Question

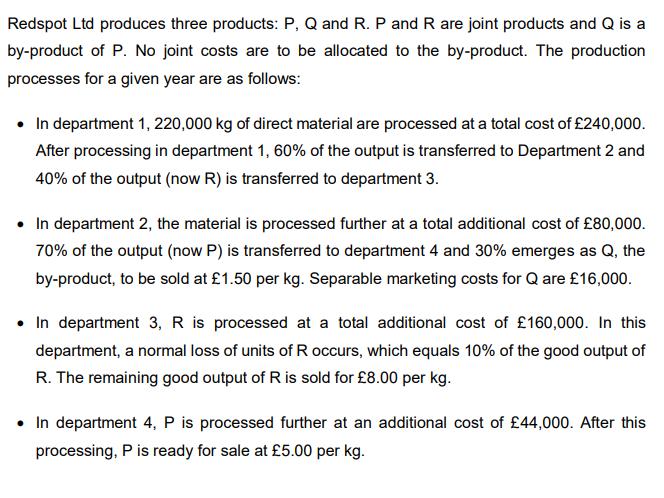

a) Plot the current production processes. Indicate the quantities, the selling prices and all the costs incurred in each stage of the production process for

a) Plot the current production processes. Indicate the quantities, the selling prices and all the costs incurred in each stage of the production process for manufacturing and selling P, Q and R. Also, indicate the joint costs, the split-off point and the separable costs.

b) Prepare a schedule showing the allocation of the joint costs between P and R using the estimated NRV method. Show all your workings to compute the estimated NRV of each product. When allocating the joint costs, the estimated NRV of Q should be treated as an addition to the sales value of P. Round the weighting percentages to the closest integer. How much of the joint costs will be allocated respectively to P and to R?

c) Ignore your answer to requirement b). Assume that £120,000 of joint costs were allocated to P. Assume also that there were 84,000 kg of P and 40,000 kg of Q available to sell. Prepare an income statement which identifies the gross margin (use the cost of goods sold format) for P. Use the separable costs and selling prices provided in the original data for P and Q and the following additional information:

- During the year, sales of P were 80% of the kilograms available for sale. There was no opening stock.

- The estimated NRV of Q available for sale is to be deducted from the cost of producing P. The closing stock of P is to be based on the net costs of production.

What is the gross margin percentage generated by P? Round your answer to the closest integer.

d) Together with the estimated NRV method, what are the other two methods that could be used to allocate the joint costs among the three products? Critically examine the differences among these methods and discuss the feasibility of using them in the case of Redspot Ltd. Word limit: 400 words.

Redspot Ltd produces three products: P, Q and R. P and R are joint products and Q is a by-product of P. No joint costs are to be allocated to the by-product. The production processes for a given year are as follows: In department 1, 220,000 kg of direct material are processed at a total cost of 240,000. After processing in department 1, 60% of the output is transferred to Department 2 and 40% of the output (now R) is transferred to department 3. In department 2, the material is processed further at a total additional cost of 80,000. 70% of the output (now P) is transferred to department 4 and 30% emerges as Q, the by-product, to be sold at 1.50 per kg. Separable marketing costs for Q are 16,000. In department 3, R is processed at a total additional cost of 160,000. In this department, a normal loss of units of R occurs, which equals 10% of the good output of R. The remaining good output of Ris sold for 8.00 per kg. In department 4, P is processed further at an additional cost of 44,000. After this processing, P is ready for sale at 5.00 per kg.

Step by Step Solution

3.55 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Stepbystep exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started