Question

A popular restaurant in Indianapolis does a brisk business, filling virtually all of its seats from 6 p.m. until 9 p.m. Tuesday through Sunday. Its

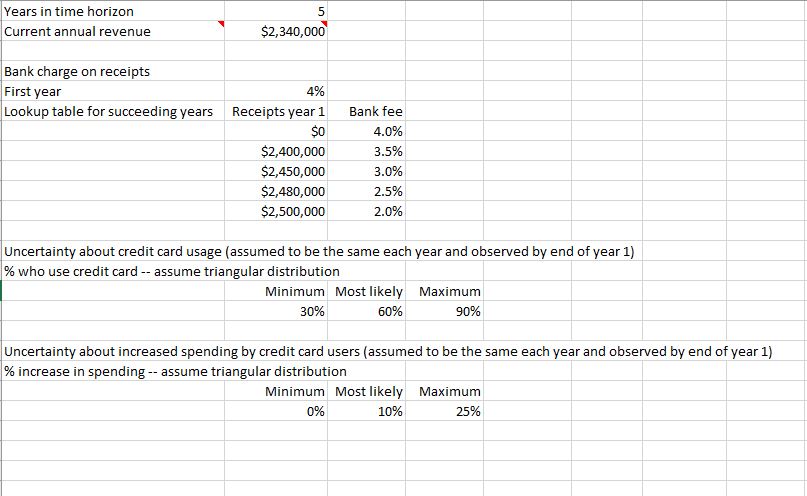

A popular restaurant in Indianapolis does a brisk business, filling virtually all of its seats from 6 p.m. until 9 p.m. Tuesday through Sunday. Its current annual revenue is $2.34 million. However, it does not currently accept credit cards, and it is thinking of doing so. If it does, the bank will charge 4% on all receipts during the first year. (To keep it simple, you can ignore taxes and tips and focus only on the receipts from food and liquor.) Depending on receipts in year 1, the bank might then reduce its fee in succeeding years, as indicated in the file P16_63.xlsx. (This would be a one-time reduction, at the end of year 1 only.) This file also contains parameters of the two uncertain quantities, credit card usage (percentage of customers who will pay with credit cards) and increased spending (percentage increase in spending by credit card users, presumably on liquor but maybe also on more expensive food). The restaurant wants to simulate a five-year horizon. Its base case is not to accept credit cards at all, in which case it expects to earn $2.34 million in revenue each year. It wants to use simulation to explore other options, where it will accept credit cards in year 1 and then continue them in years 2-5 if the bank fee is less than or equal to some cutoff value. For example, one possibility is to accept credit cards in year 1 and then discontinue them only if the bank fee is less than or equal to 3%. You should explore the cutoffs 2% to 4% in increments of 0.5%. Which policy provides with the largest mean increase in revenue over the five-year horizon, relative to never using credit cards?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started