Question

A portfolio analyst has been asked to allocate investment funds among three different stocks. The relevant data for the stocks is shown in the

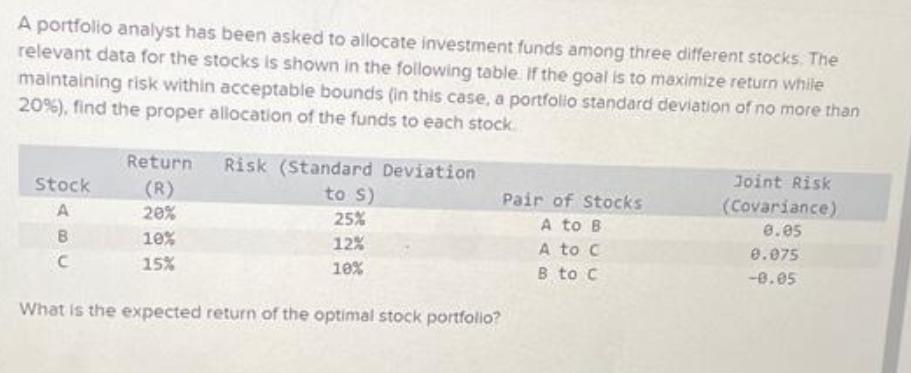

A portfolio analyst has been asked to allocate investment funds among three different stocks. The relevant data for the stocks is shown in the following table. If the goal is to maximize return while maintaining risk within acceptable bounds (in this case, a portfolio standard deviation of no more than 20%), find the proper allocation of the funds to each stock Stock A B C Return (R) 20% 10% 15% Risk (Standard Deviation to S) 25% 12% 10% What is the expected return of the optimal stock portfolio? Pair of Stocks A to B A to C B to C Joint Risk (Covariance) 0.05 0.075 -0.05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To solve this problem we need to find the optimal allocation of funds among the three stocks that maximizes return while maintaining risk wit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Quantitative Methods For Business

Authors: David Anderson, Dennis Sweeney, Thomas Williams, Jeffrey Cam

11th Edition

978-0324651812, 324651813, 978-0324651751

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App