Answered step by step

Verified Expert Solution

Question

1 Approved Answer

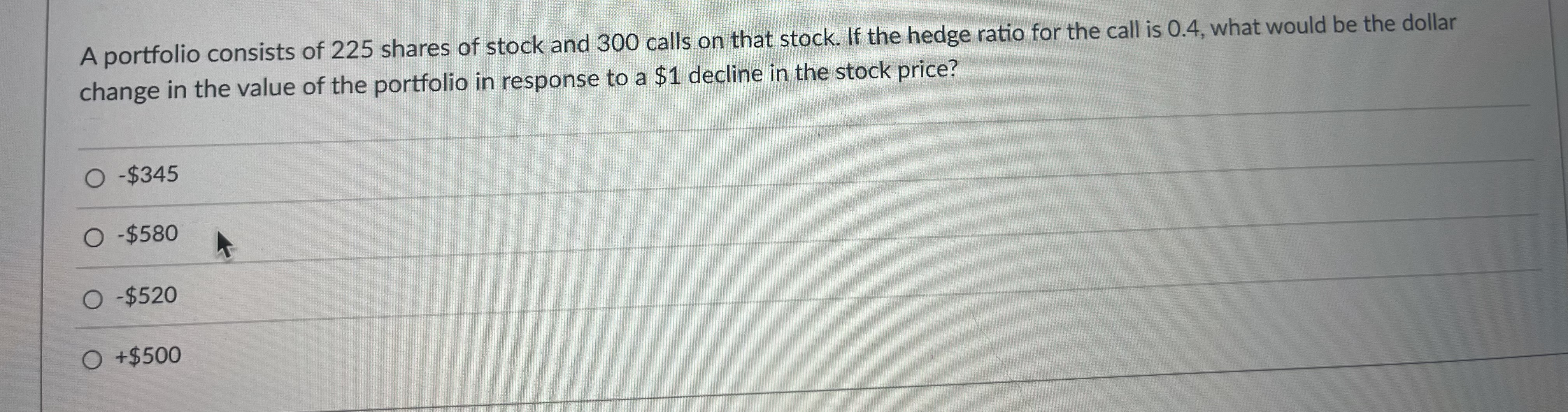

A portfolio consists of 225 shares of stock and 300 calls on that stock. If the hedge ratio for the call is 0.4 , what

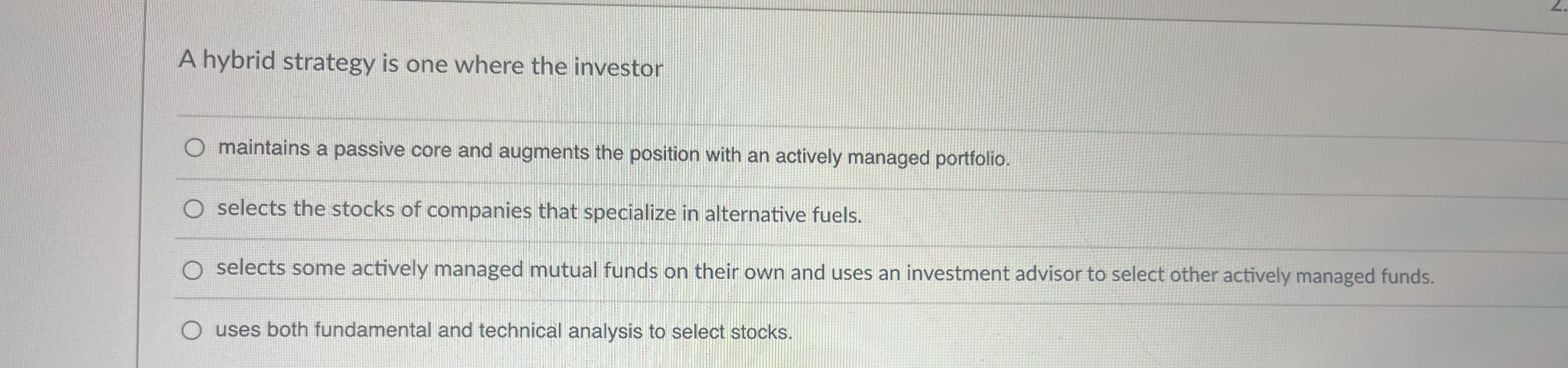

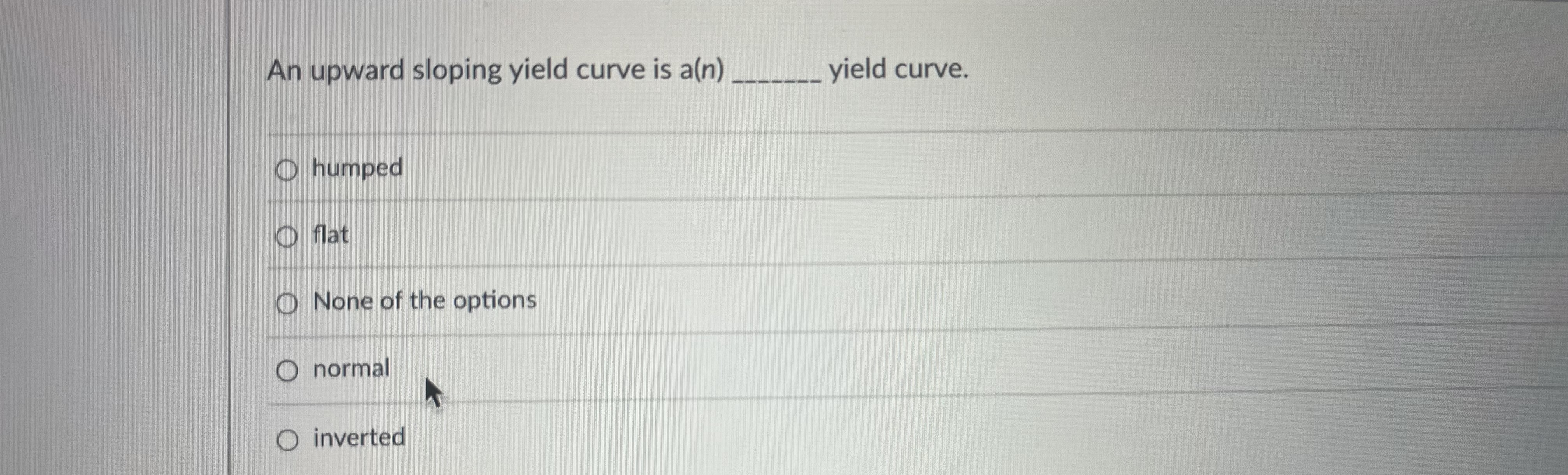

A portfolio consists of 225 shares of stock and 300 calls on that stock. If the hedge ratio for the call is 0.4 , what would be the dollar change in the value of the portfolio in response to a $1 decline in the stock price? $345 $580 $520 +$500 A hybrid strategy is one where the investor maintains a passive core and augments the position with an actively managed portfolio. selects the stocks of companies that specialize in alternative fuels. selects some actively managed mutual funds on their own and uses an investment advisor to select other actively managed funds. uses both fundamental and technical analysis to select stocks. An upward sloping yield curve is a(n) yield curve. humped flat None of the options normal inverted

A portfolio consists of 225 shares of stock and 300 calls on that stock. If the hedge ratio for the call is 0.4 , what would be the dollar change in the value of the portfolio in response to a $1 decline in the stock price? $345 $580 $520 +$500 A hybrid strategy is one where the investor maintains a passive core and augments the position with an actively managed portfolio. selects the stocks of companies that specialize in alternative fuels. selects some actively managed mutual funds on their own and uses an investment advisor to select other actively managed funds. uses both fundamental and technical analysis to select stocks. An upward sloping yield curve is a(n) yield curve. humped flat None of the options normal inverted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started