Question

A portfolio consists of a number of European call contracts, all on the same asset and with the same expiration. The strike prices for

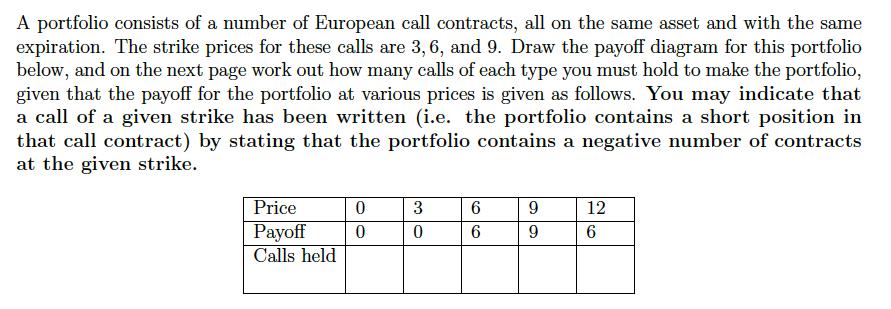

A portfolio consists of a number of European call contracts, all on the same asset and with the same expiration. The strike prices for these calls are 3, 6, and 9. Draw the payoff diagram for this portfolio below, and on the next page work out how many calls of each type you must hold to make the portfolio, given that the payoff for the portfolio at various prices is given as follows. You may indicate that a call of a given strike has been written (i.e. the portfolio contains a short position in that call contract) by stating that the portfolio contains a negative number of contracts at the given strike. Price Payoff Calls held 0 0 3 0 6 6 9 9 12 6

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To draw the payoff diagram for the portfolio we need to determine the number of calls of each type w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investments Valuation and Management

Authors: Bradford D. Jordan, Thomas W. Miller

5th edition

978-007728329, 9780073382357, 0077283295, 73382353, 978-0077283292

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App