Question

A portfolio generates an annual return of 13%, a beta of 1.7, and a standard deviation of 17%. The market index return is 14% and

A portfolio generates an annual return of 13%, a beta of 1.7, and a standard deviation of 17%. The market index return is 14% and has a variance of 4.41%. The risk-free rate is 5%. What is the M2 measure of the portfolio? What is Jensen's alpha of the portfolio?

True or False A market-timing strategy will increase the weight or asset allocation in treasury bonds when one forecasts that the stock market will be negative.

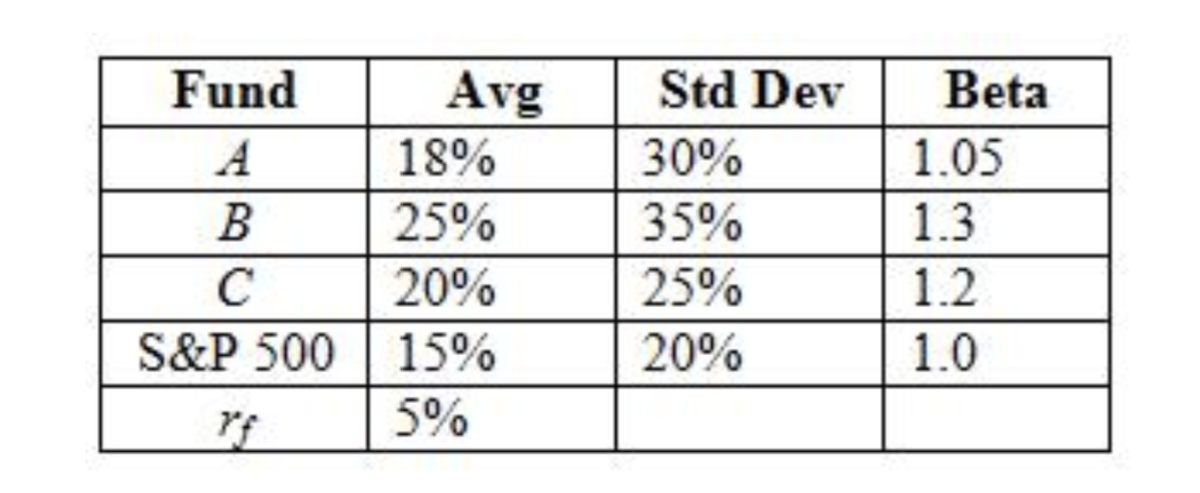

The risk-free rate, average returns, standard deviations, and betas for three funds and the S&P 500 are given below.

What is the Treynor measure for portfolio B? What is the M2 measure for portfolio C?

What is the Treynor measure for portfolio B? What is the M2 measure for portfolio C?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started