Question

A portfolio manager believes she has identified an underpriced stock. The stock is expected to yield an alpha of 0.01 and have a beta

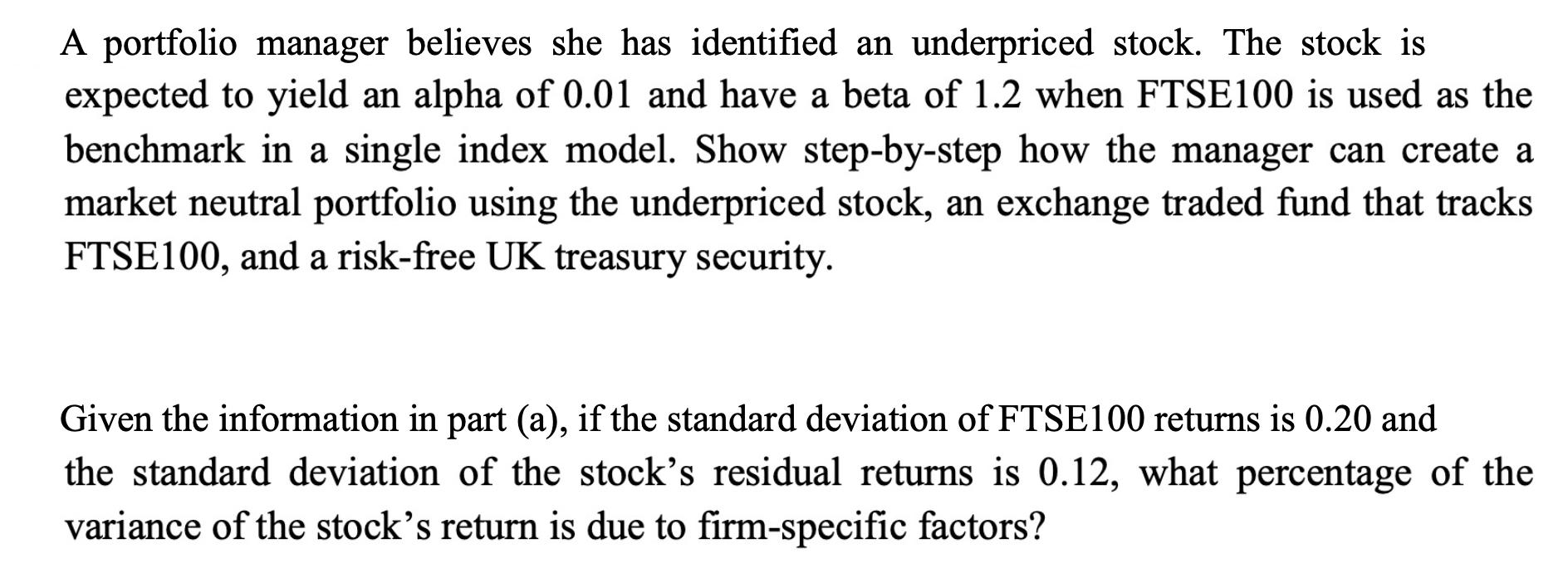

A portfolio manager believes she has identified an underpriced stock. The stock is expected to yield an alpha of 0.01 and have a beta of 1.2 when FTSE100 is used as the benchmark in a single index model. Show step-by-step how the manager can create a market neutral portfolio using the underpriced stock, an exchange traded fund that tracks FTSE100, and a risk-free UK treasury security. Given the information in part (a), if the standard deviation of FTSE100 returns is 0.20 and the standard deviation of the stock's residual returns is 0.12, what percentage of the variance of the stock's return is due to firm-specific factors?

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To make a market unbiased portfolio utilizing the undervalued stock a trade exchanged store ETF that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App