Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio manager is considering an investment in a 4-year, 6% annual coupon payment bond corporate bond that is currently trading at 101 per

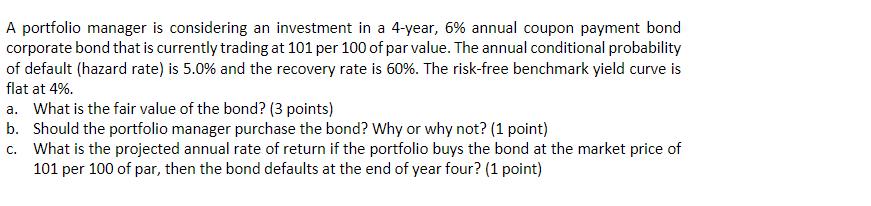

A portfolio manager is considering an investment in a 4-year, 6% annual coupon payment bond corporate bond that is currently trading at 101 per 100 of par value. The annual conditional probability of default (hazard rate) is 5.0% and the recovery rate is 60%. The risk-free benchmark yield curve is flat at 4%. a. What is the fair value of the bond? (3 points) b. Should the portfolio manager purchase the bond? Why or why not? (1 point) c. What is the projected annual rate of return if the portfolio buys the bond at the market price of 101 per 100 of par, then the bond defaults at the end of year four? (1 point)

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the fair value of the bond we need to discount the expected cash flows coupon payments and the final payment at maturity or recovery after default at the riskfree rate The formula to calculate the fair value of a bond is Fair Value C 1 1 rn r F 1 rn Where C is the annual coupon payment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started