Question

Suppose you sell a December forward contract on gold on August 31 at a forward price of $1750/oz, and then you buy a December

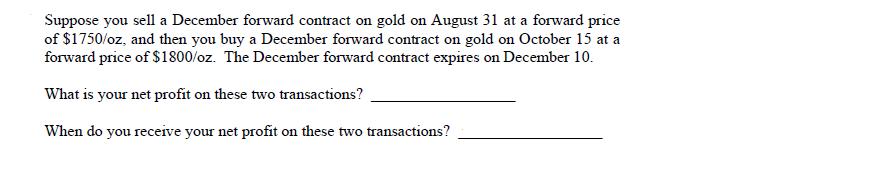

Suppose you sell a December forward contract on gold on August 31 at a forward price of $1750/oz, and then you buy a December forward contract on gold on October 15 at a forward price of $1800/oz. The December forward contract expires on December 10. What is your net profit on these two transactions? When do you receive your net profit on these two transactions?

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net profit from these two forward contract transactions we need to consider the cha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing An International Approach

Authors: Wally J. Smieliauskas, Kathryn Bewley

6th edition

978-0070968295, 9781259087462, 978-0071051415

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App