Muggie pvt overall equity beta is 1 35, and it is estimated that the equivalent equity beta for production of computer storage device is

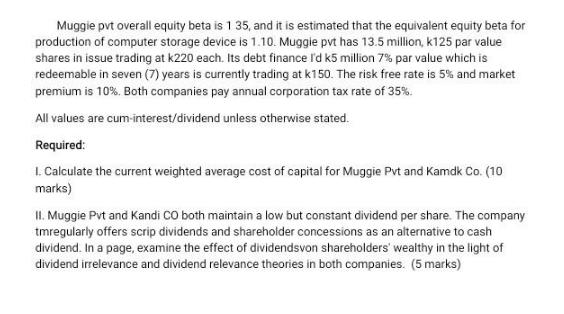

Muggie pvt overall equity beta is 1 35, and it is estimated that the equivalent equity beta for production of computer storage device is 1.10. Muggie pvt has 13.5 million, k125 par value shares in issue trading at k220 each. Its debt finance I'd k5 million 7% par value which is redeemable in seven (7) years is currently trading at k150. The risk free rate is 5% and market premium is 10%. Both companies pay annual corporation tax rate of 35%. All values are cum-interest/dividend unless otherwise stated. Required: 1. Calculate the current weighted average cost of capital for Muggie Pvt and Kamdk Co. (10 marks) II. Muggie Pvt and Kandi CO both maintain a low but constant dividend per share. The company tmregularly offers scrip dividends and shareholder concessions as an alternative to cash dividend. In a page, examine the effect of dividendsvon shareholders' wealthy in the light of dividend irrelevance and dividend relevance theories in both companies. (5 marks)

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the Weighted Average Cost of Capital WACC for Muggie Pvt and Kamdk Co To calculate WACC well use the following formula WACC EVRe DVRd1 Tax ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started