Question

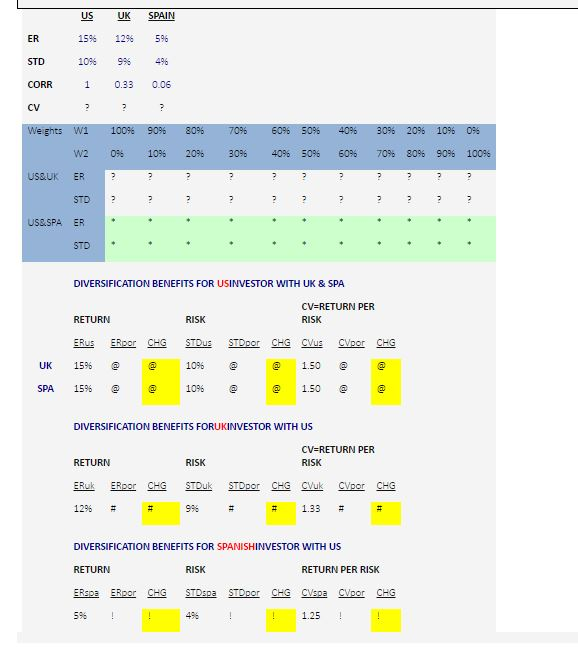

A portfolio manager is considering the benefits of increasing her diversification by investing overseas. She can purchase shares in individual country funds with the expected

A portfolio manager is considering the benefits of increasing her diversification by investing overseas. She can purchase shares in individual country funds with the expected return (ER), standard deviation (STD) and correlations (CORR) characteristic provided above.

1. What are the expected returns and standard deviations of returns of US&UK portfolios with different mixes such as 100% invested in US, 0% in UK; 90% invested in US, 10% in UK; 80% invested in US, 20% in UK;; 10% invested in US, 90% in UK; 0% invested in US, 100% in UK? Replace ?s with the right info at the above table with the help of Excel formulas.

2. What are the expected returns and standard deviations of returns of US & Spain portfolios with different mixes such as 100% invested in US, 0% in Spain; 90% invested in US, 10% in Spain; 80% invested in US, 20% in Spain;; 10% invested in US, 90% in Spain; 0% invested in US, 100% in Spain? Replace *s with the right info at the above table with the help of Excel formulas.

3. Plot these two sets of risk-return combinations as in the case at the back (one for US&UK and another for US & Spain portfolio).

4. Which combination leads to a better risk and return (the most efficient) choice from a US investor perspective [answer by calculating the changes (CHG) in ER (return improvement), STD (risk reduction) and CV (coefficient of variation return per unit of risk) and by replacing @s]. From UK investor perspective (replace #s)? From Spanish investor perspective (replace !s). Explain your answers.

5. What is the beta of the British market from a U.S. perspective? What is the beta of the Spanish market from a U.S. perspective?

6. Assume that the British pound is expected to appreciate by %5 against dollar by the end of the year. What would the expected percentage dollar return be if the US investor invested in the most efficient US & UK portfolio?

7. Assume that euro is expected to depreciate by %3 against dollar by the end of the year. What would the expected percentage dollar return be if the US investor invested in the most efficient US & Spanish portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started