Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio manager (PM) purchases $500,000 face amount of a 10-year corporate bond with a 5% coupon priced at a required yield of 4.8%

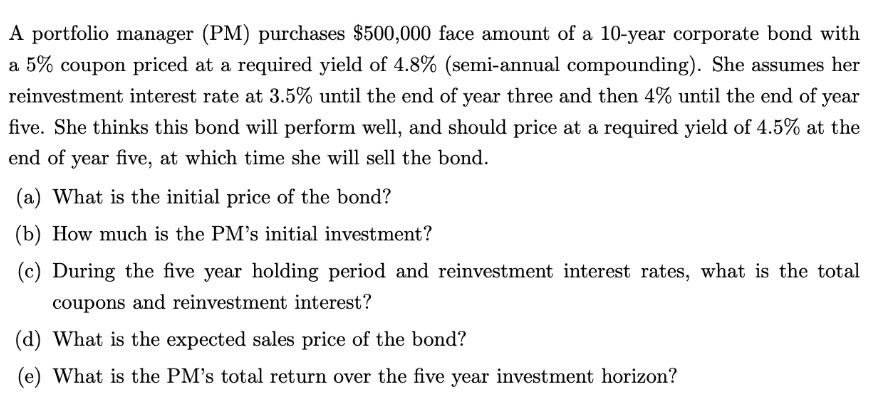

A portfolio manager (PM) purchases $500,000 face amount of a 10-year corporate bond with a 5% coupon priced at a required yield of 4.8% (semi-annual compounding). She assumes her reinvestment interest rate at 3.5% until the end of year three and then 4% until the end of year five. She thinks this bond will perform well, and should price at a required yield of 4.5% at the end of year five, at which time she will sell the bond. (a) What is the initial price of the bond? (b) How much is the PM's initial investment? (c) During the five year holding period and reinvestment interest rates, what is the total coupons and reinvestment interest? (d) What is the expected sales price of the bond? (e) What is the PM's total return over the five year investment horizon?

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The initial price of the bond is 49661320 b The PMs initial investment is 49661320 c The to...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started