Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company ABC is privately held and has a lot of debt outstanding from the recent transaction where a group of company executives took ABC

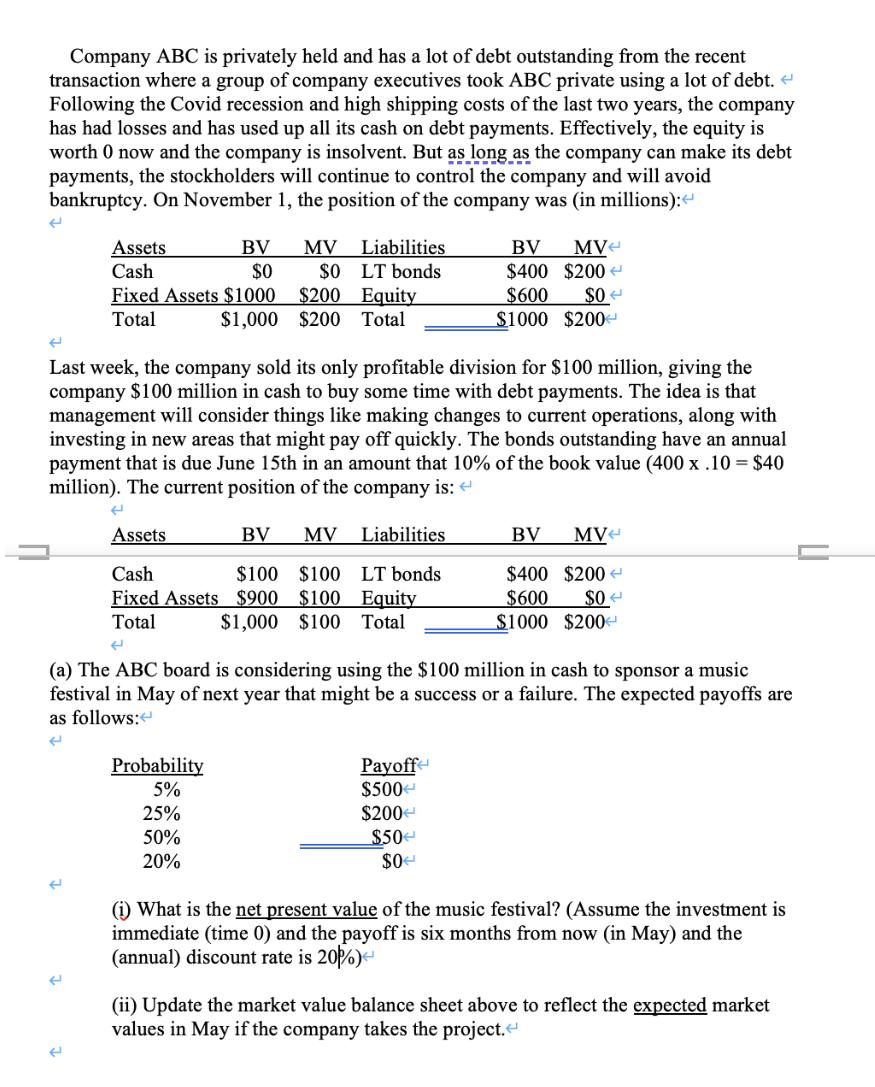

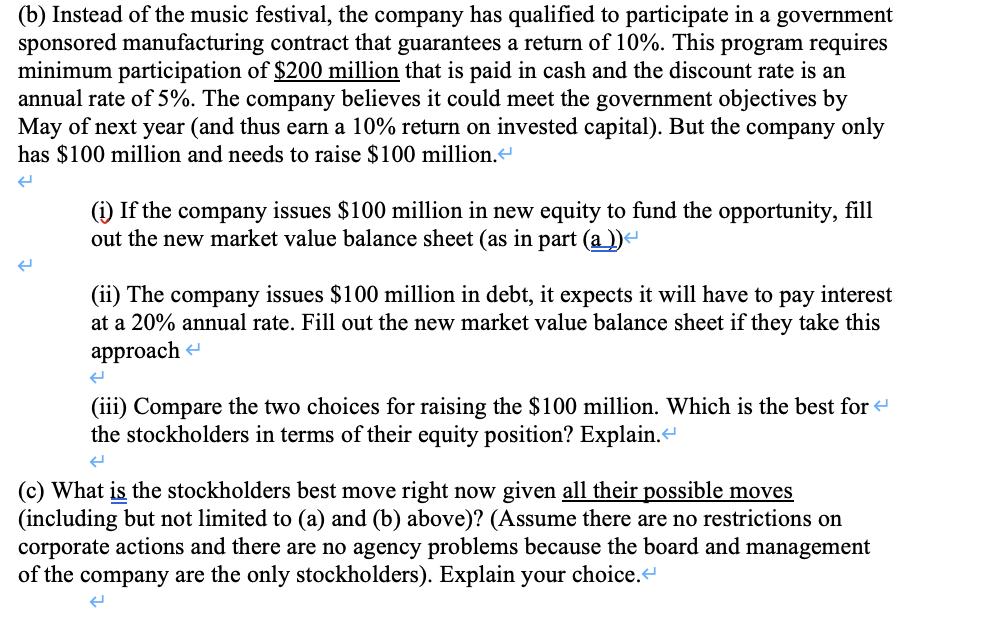

Company ABC is privately held and has a lot of debt outstanding from the recent transaction where a group of company executives took ABC private using a lot of debt. Following the Covid recession and high shipping costs of the last two years, the company has had losses and has used up all its cash on debt payments. Effectively, the equity is worth 0 now and the company is insolvent. But as long as the company can make its debt payments, the stockholders will continue to control the company and will avoid bankruptcy. On November 1, the position of the company was (in millions): < ( BV Assets Cash $0 Fixed Assets $1000 Total $1,000 E MV Liabilities $0 LT bonds Probability 5% $200 Equity $200 Total Last week, the company sold its only profitable division for $100 million, giving the company $100 million in cash to buy some time with debt payments. The idea is that management will consider things like making changes to current operations, along with investing in new areas that might pay off quickly. The bonds outstanding have an annual payment that is due June in an amount that 10% of the book value (400 x .10 = $40 of the company is: < million). The current position 25% 50% 20% Liabilities LT bonds Equity $1,000 $100 Total BV MV $400 $200 $600 $1000 Assets BV MV Cash $100 $100 Fixed Assets $900 $100 Total ( (a) The ABC board is considering using the $100 million in cash to sponsor a music festival in May of next year that might be a success or a failure. The expected payoffs are as follows: SO $200 Payoff $500 $200 < $50 $0 BV MV4 $400 $200 $600 $O $1000 $200 (i) What is the net present value of the music festival? (Assume the investment is immediate (time 0) and the payoff is six months from now (in May) and the (annual) discount rate is 20%) < (ii) Update the market value balance sheet above to reflect the expected market values in May if the company takes the project. (b) Instead of the music festival, the company has qualified to participate in a government sponsored manufacturing contract that guarantees a return of 10%. This program requires minimum participation of $200 million that is paid in cash and the discount rate is an annual rate of 5%. The company believes it could meet the government objectives by May of next year (and thus earn a 10% return on invested capital). But the company only has $100 million and needs to raise $100 million. < ( (i) If the company issues $100 million in new equity to fund the opportunity, fill out the new market value balance sheet (as in part (a)) < (ii) The company issues $100 million in debt, it expects it will have to pay interest at a 20% annual rate. Fill out the new market value balance sheet if they take this approach (iii) Compare the two choices for raising the $100 million. Which is the best for the stockholders in terms of their equity position? Explain. < (c) What is the stockholders best move right now given all their possible moves (including but not limited to (a) and (b) above)? (Assume there are no restrictions on corporate actions and there are no agency problems because the board and management of the company are the only stockholders). Explain your choice.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer a i The Net Present Value of the music festival is 575 million NPV 500005 200025 50050 0020 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started