Question

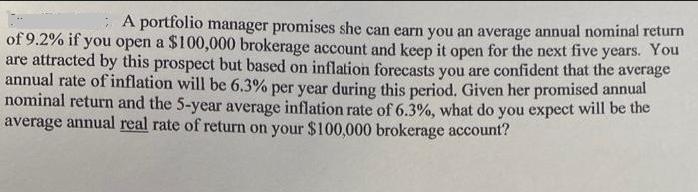

; A portfolio manager promises she can earn you an average annual nominal return of 9.2% if you open a $100,000 brokerage account and

; A portfolio manager promises she can earn you an average annual nominal return of 9.2% if you open a $100,000 brokerage account and keep it open for the next five years. You are attracted by this prospect but based on inflation forecasts you are confident that the average annual rate of inflation will be 6.3% per year during this period. Given her promised annual nominal return and the 5-year average inflation rate of 6.3%, what do you expect will be the average annual real rate of return on your $100,000 brokerage account?

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the average annual real rate of return we need to adjust ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Financial Management

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao

13th edition

1285198840, 978-1285198842

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App