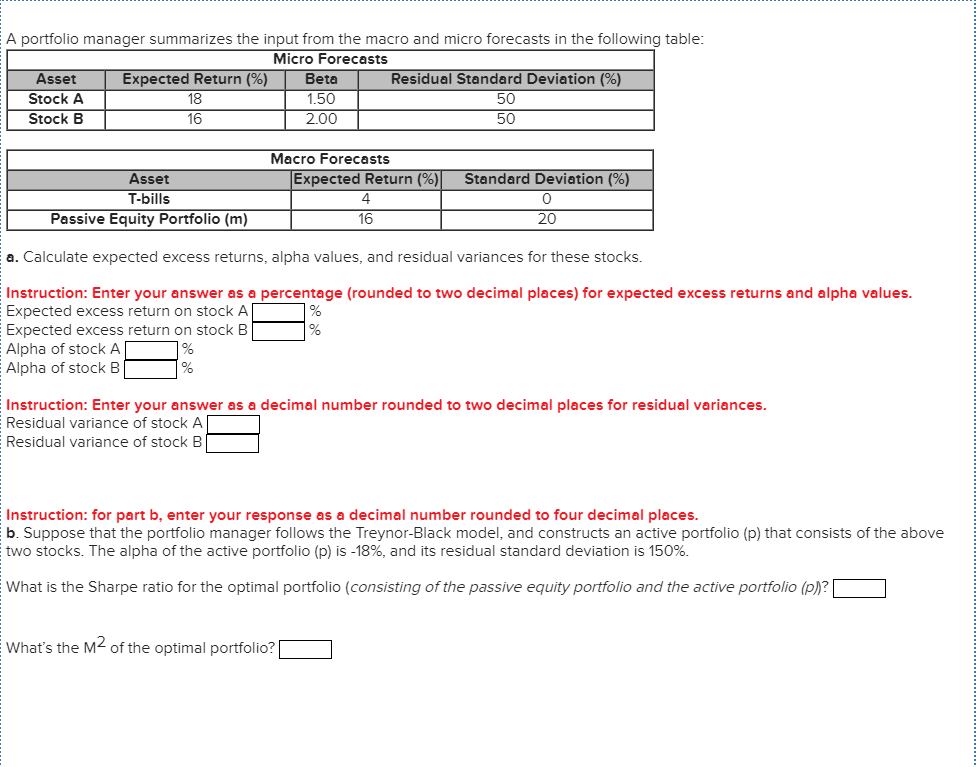

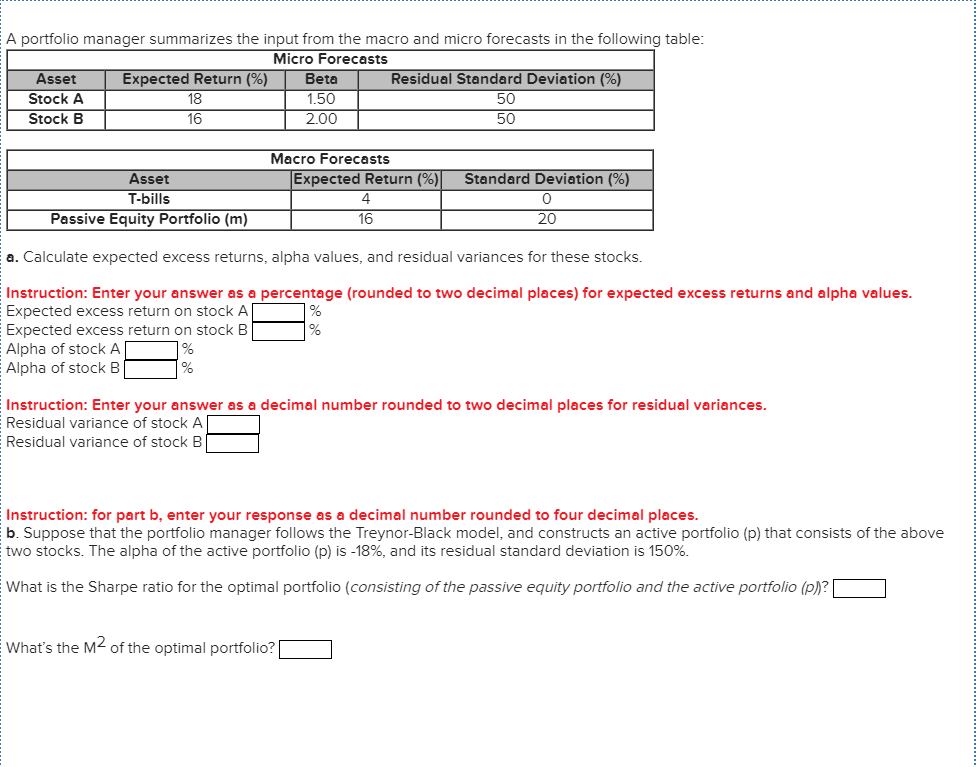

A portfolio manager summarizes the input from the macro and micro forecasts in the following table: Micro Forecasts Beta Expected Return (%) 18 Residual Standard Deviation (% Asset Stock A 1.50 50 Stock B 16 2.00 50 Macro Forecasts Expected Return (%) Standard Deviation (% Asset T-bills 0 Passive Equity Portfolio (m) 16 20 a. Calculate expected excess returns, alpha values, and residual variances for these stocks. Instruction: Enter your answer as a percentage (rounded to two decimal places) for expected excess returns and alpha values. Expected excess return on stock A % Expected excess return on stock B Alpha of stock A Alpha of stock B % Instruction: Enter your answer as a decimal number rounded to two decimal places for residual variances. Residual variance of stock A Residual variance of stock B Instruction: for part b, enter your response as a decimal number rounded to four decimal places. b. Suppose that the portfolio manager follows the Treynor-Black model, and constructs an active portfolio (p) that consists of the above two stocks. The alpha of the active portfolio (p) is -18%, and its residual standard deviation is 150% What is the Sharpe ratio for the optimal portfolio (consisting of the passive equity portfolio and the active portfolio (p)? | What's the M2 of the optimal portfolio? A portfolio manager summarizes the input from the macro and micro forecasts in the following table: Micro Forecasts Beta Expected Return (%) 18 Residual Standard Deviation (% Asset Stock A 1.50 50 Stock B 16 2.00 50 Macro Forecasts Expected Return (%) Standard Deviation (% Asset T-bills 0 Passive Equity Portfolio (m) 16 20 a. Calculate expected excess returns, alpha values, and residual variances for these stocks. Instruction: Enter your answer as a percentage (rounded to two decimal places) for expected excess returns and alpha values. Expected excess return on stock A % Expected excess return on stock B Alpha of stock A Alpha of stock B % Instruction: Enter your answer as a decimal number rounded to two decimal places for residual variances. Residual variance of stock A Residual variance of stock B Instruction: for part b, enter your response as a decimal number rounded to four decimal places. b. Suppose that the portfolio manager follows the Treynor-Black model, and constructs an active portfolio (p) that consists of the above two stocks. The alpha of the active portfolio (p) is -18%, and its residual standard deviation is 150% What is the Sharpe ratio for the optimal portfolio (consisting of the passive equity portfolio and the active portfolio (p)? | What's the M2 of the optimal portfolio