Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio of investments of available-for-sale securities held by Dow Inc. is as follows. Cost Fair Value Dece. 31, Year 1 Eastern Corp. bonds

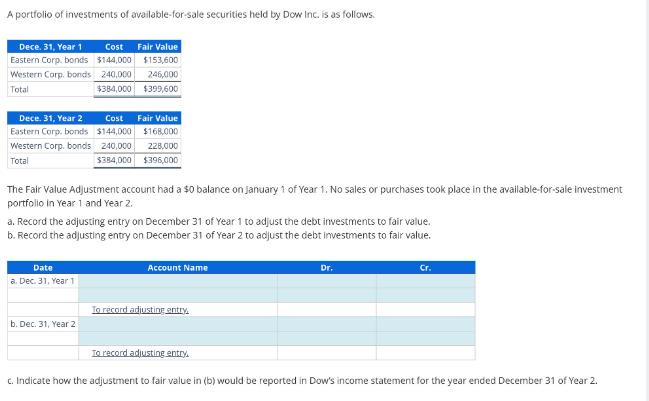

A portfolio of investments of available-for-sale securities held by Dow Inc. is as follows. Cost Fair Value Dece. 31, Year 1 Eastern Corp. bonds $144,000 $153,600 Western Corp. bonds 240,000 246,000 Total $384,000 $399,600 Dece. 31, Year 2 Eastern Corp. bonds $144,000 Western Corp. bonds 240,000 Total Cost Fair Value The Fair Value Adjustment account had a $0 balance on January 1 of Year 1. No sales or purchases took place in the available-for-sale investment portfolio in Year 1 and Year 2. Date a. Dec. 31, Year 1 $168,000 228,000 $384,000 $396,000 a. Record the adjusting entry on December 31 of Year 1 to adjust the debt investments to fair value. b. Record the adjusting entry on December 31 of Year 2 to adjust the debt investments to fair value. b. Dec. 31, Year 2 Account Name To record adjusting entry. Dr. Cr. To record adjusting entry. c. Indicate how the adjustment to fair value in (b) would be reported in Dow's income statement for the year ended December 31 of Year 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image shows a table of a portfolio of investments of availableforsale securities held by Dow Inc Specifically it lists two types of investments Eastern Corp bonds and Western Corp bonds with their ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started