Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Post events 1-14 to the accompanying transaction record. Show any necessary calculations in a matching row under the transaction record. B. Post adjusting entries

A. Post events 1-14 to the accompanying transaction record. Show any necessary calculations in a matching row under the transaction record. B. Post adjusting entries for events indicated by a * to the accompanying transaction record. Show any necessary calculations in a matching row under the transaction record.

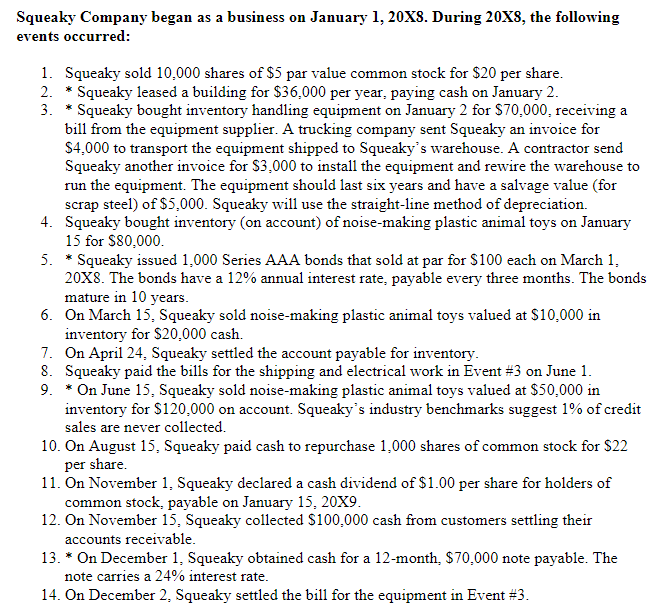

Squeaky Company began as a business on January 1,20X8. During 20X8, the following vents occurred: 1. Squeaky sold 10,000 shares of $5 par value common stock for $20 per share. 2. * Squeaky leased a building for $36,000 per year, paying cash on January 2. 3. * Squeaky bought inventory handling equipment on January 2 for $70,000, receiving a bill from the equipment supplier. A trucking company sent Squeaky an invoice for $4,000 to transport the equipment shipped to Squeaky's warehouse. A contractor send Squeaky another invoice for $3,000 to install the equipment and rewire the warehouse to run the equipment. The equipment should last six years and have a salvage value (for scrap steel) of $5,000. Squeaky will use the straight-line method of depreciation. 4. Squeaky bought inventory (on account) of noise-making plastic animal toys on January 15 for $80,000. 5. * Squeaky issued 1,000 Series AAA bonds that sold at par for $100 each on March 1 , 20X8. The bonds have a 12% annual interest rate, payable every three months. The bonds mature in 10 years. 6. On March 15, Squeaky sold noise-making plastic animal toys valued at $10,000 in inventory for $20,000 cash. 7. On April 24, Squeaky settled the account payable for inventory. 8. Squeaky paid the bills for the shipping and electrical work in Event \#3 on June 1. 9. * On June 15, Squeaky sold noise-making plastic animal toys valued at $50,000 in inventory for $120,000 on account. Squeaky's industry benchmarks suggest 1% of credit sales are never collected. 10. On August 15, Squeaky paid cash to repurchase 1,000 shares of common stock for $22 per share. 11. On November 1, Squeaky declared a cash dividend of $1.00 per share for holders of common stock, payable on January 15,20X9. 12. On November 15 , Squeaky collected $100,000 cash from customers settling their accounts receivable. 13. * On December 1 , Squeaky obtained cash for a 12 -month, $70,000 note payable. The note carries a 24% interest rate. 14. On December 2, Squeaky settled the bill for the equipment in Event #3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started