Question

Note: For the exercises and problems in this chapter, use the following tax rates: FICAEmployer and employee, 8% of the first $100,000 of earnings per

Note: For the exercises and problems in this chapter, use the following tax rates:

FICA–Employer and employee, 8% of the first $100,000 of earnings per employee per calendar year.

State unemployment–4% of the first $8,000 of earnings per employee per calendar year.

Federal unemployment–1% of the first $8,000 of earnings per employee per calendar year.

Federal income tax withholding–10% of each employee’s gross earnings, unless otherwise stated.

Payroll distribution

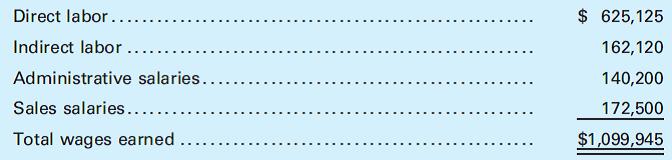

The total wages and salaries earned by all employees of Rivers Manufacturing Co. during March, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows:

a. Prepare a journal entry to distribute the wages earned during March.

b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of $3,000 have exceeded $8,000 in earnings prior to the period?

Direct labor..... $ 625,125 Indirect labor ... 162,120 Administrative salaries.... 140,200 Sales salaries.... 172,500 Total wages earned $1,099,945

Step by Step Solution

There are 3 Steps involved in it

Step: 1

We allocate the direct labour to work in Process ard the indirect laboor to factory ovc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started