Question

(a) Prepare a schedule of expected cash collections for July, August, and September. (6 marks) (b) Prepare a cash budget by month for July, August,

(a) Prepare a schedule of expected cash collections for July, August, and September. (6 marks)

(b) Prepare a cash budget by month for July, August, and September. (9 marks)

(c) A sales manager may have more motivation to present a low, conservative sales forecast in order to make the sales managers operation appear to be much more effective when the sales staff meets or exceeds the estimates. What possible harms could be caused to a company if a sales manager produces numbers that will not be hard to beat for the sales staff and what can be done about it?

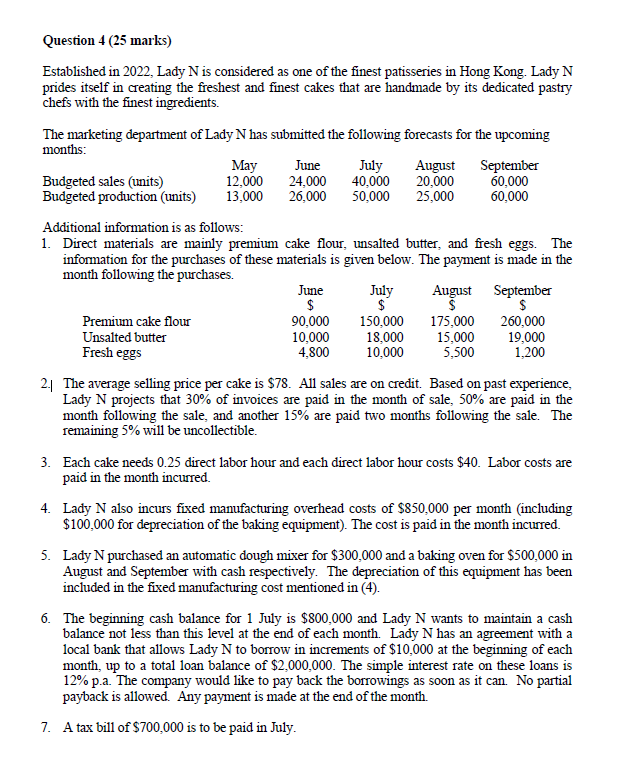

Question 4 (25 marks) Established in 2022, Lady N is considered as one of the finest patisseries in Hong Kong. Lady N prides itself in creating the freshest and finest cakes that are handmade by its dedicated pastry chefs with the finest ingredients. The marketing department of Lady N has submitted the following forecasts for the upcoming months: May June July August September Budgeted sales (units) 12,000 24,000 40.000 20,000 60.000 Budgeted production (units) 13,000 26,000 50,000 25,000 60,000 Additional information is as follows: 1. Direct materials are mainly premium cake flour, unsalted butter, and fresh eggs. The information for the purchases of these materials is given below. The payment is made in the month following the purchases. June July August September $ $ $ $ Premium cake flour 90,000 150,000 175.000 260,000 Unsalted butter 10,000 18,000 15,000 19,000 Fresh eggs 4,800 10,000 5,500 1,200 2. The average selling price per cake is $78. All sales are on credit. Based on past experience, Lady N projects that 30% of invoices are paid in the month of sale, 50% are paid in the month following the sale, and another 15% are paid two months following the sale. The remaining 5% will be uncollectible. 3. Each cake needs 0.25 direct labor hour and each direct labor hour costs $40. Labor costs are paid in the month incurred. 4. Lady N also incurs fixed manufacturing overhead costs of $850,000 per month (including $100,000 for depreciation of the baking equipment). The cost is paid in the month incurred. 5. Lady N purchased an automatic dough mixer for $300,000 and a baking oven for $500,000 in August and September with cash respectively. The depreciation of this equipment has been included in the fixed manufacturing cost mentioned in (4). 6. The beginning cash balance for 1 July is $800,000 and Lady N wants to maintain a cash balance not less than this level at the end of each month. Lady N has an agreement with a local bank that allows Lady N to borrow in increments of $10,000 at the beginning of each month, up to a total loan balance of $2,000,000. The simple interest rate on these loans is 12% p.a. The company would like to pay back the borrowings as soon as it can. No partial payback is allowed. Any payment is made at the end of the month. 7. A tax bill of $700,000 is to be paid in JulyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started