Question

(a) Prepare a standard cost card for the colander using absorption costing principles. (b) Calculate the operating incomes for April and May using absorption costing

(a) Prepare a standard cost card for the colander using absorption costing principles.

(b) Calculate the operating incomes for April and May using absorption costing principles, showing clearly the adjustments for any over or under absorption. Assume standard costs are used for inventory valuation, and any difference between applied and actual fixed production overheads are closed off to the cost of goods sold at month-end.

(c) Using your answer in part (b) as a starting point, calculate (without preparing a full income statement) the operating incomes for April and May using variable costing principles.

(d) Explain the difference in reported profits between part (b) and part (c).

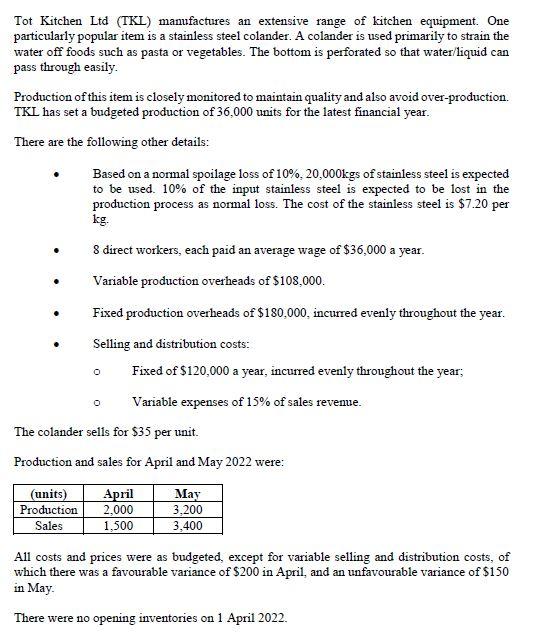

Tot Kitchen Ltd (TKL) manufactures an extensive range of kitchen equipment. One particularly popular item is a stainless steel colander. A colander is used primarily to strain the water off foods such as pasta or vegetables. The bottom is perforated so that water/liquid can pass through easily. Production of this item is closely monitored to maintain quality and also avoid over-production. TKL has set a budgeted production of 36,000 units for the latest financial year. There are the following other details: Based on a normal spoilage loss of 10%, 20,000kgs of stainless steel is expected to be used. 10% of the input stainless steel is expected to be lost in the production process as normal loss. The cost of the stainless steel is $7.20 per kg. 8 direct workers, each paid an average wage of $36,000 a year. Variable production overheads of $108,000. o Fixed production overheads of $180,000, incurred evenly throughout the year. Selling and distribution costs: Fixed of $120,000 a year, incurred evenly throughout the year; o Variable expenses of 15% of sales revenue. The colander sells for $35 per unit. Production and sales for April and May 2022 were: (units) Production Sales April 2,000 1,500 May 3,200 3,400 All costs and prices were as budgeted, except for variable selling and distribution costs, of which there was a favourable variance of $200 in April, and an unfavourable variance of $150 in May. There were no opening inventories on 1 April 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started