a- prepare a statement of cash flow for the year 2018

b- prepare a projected statement of earnings (project income statement ) for the year ending 2019

c - interpretation if two statements and decision

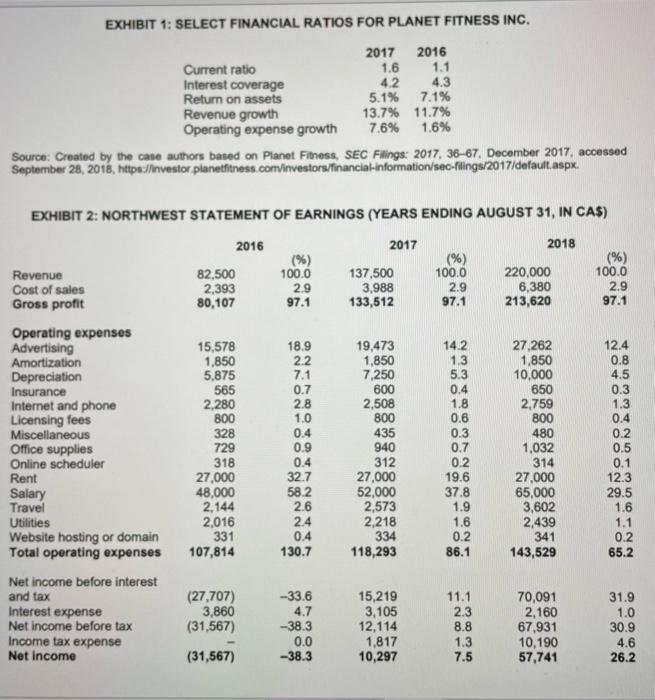

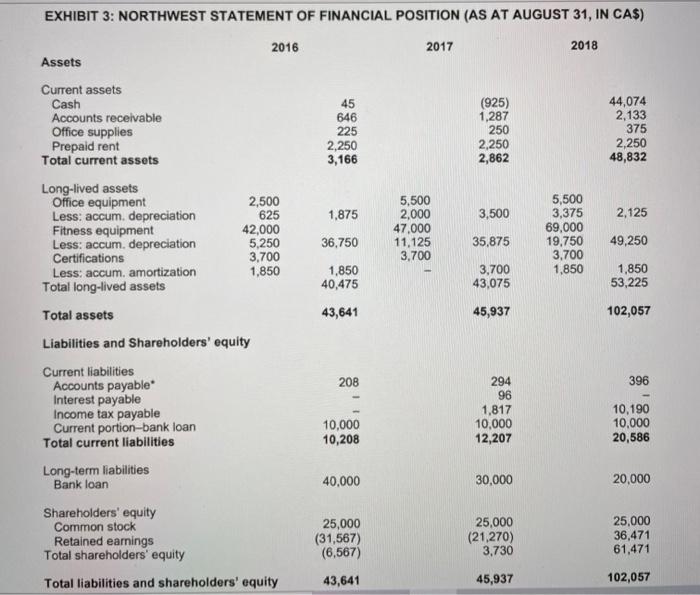

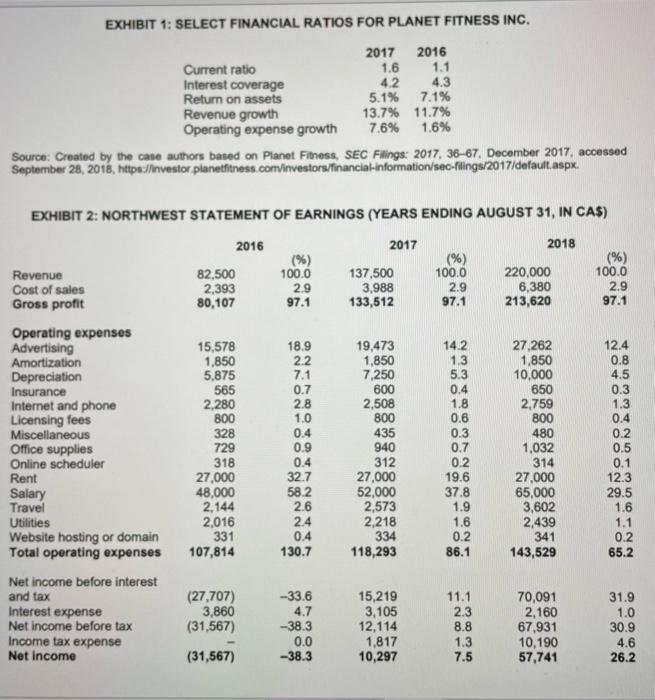

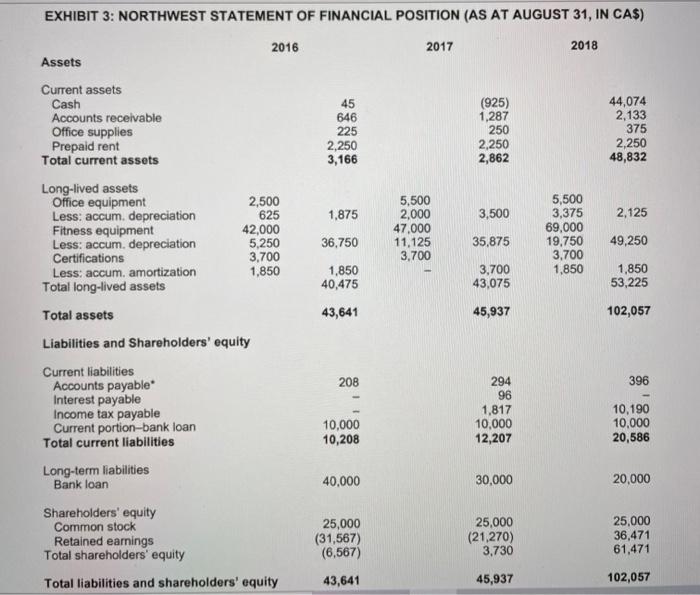

EXHIBIT 1: SELECT FINANCIAL RATIOS FOR PLANET FITNESS INC. 2017 2016 Current ratio 1.6 1.1 Interest coverage 4.2 4.3 Return on assets 5.1% 7.1% Revenue growth 13.7% 11.7% Operating expense growth 7.6% 1.6% Source: Created by the case authors based on Planet Finess, SEC Filings: 2017. 36-67. December 2017, accessed September 28, 2016, https://investor planetfitness.com/investors/financial-information/seo-filings/2017/default.aspx EXHIBIT 2: NORTHWEST STATEMENT OF EARNINGS (YEARS ENDING AUGUST 31, IN CAS) 2016 2017 2018 (%) (%) (%) Revenue 82,500 100.0 137,500 100.0 220,000 100.0 Cost of sales 2,393 2.9 3,988 2.9 6,380 2.9 Gross profit 80,107 97.1 133,512 97.1 213,620 97.1 12.4 0.8 4.5 0.3 1.3 0.4 Operating expenses Advertising Amortization Depreciation Insurance Internet and phone Licensing fees Miscellaneous Office supplies Online scheduler Rent Salary Travel Utilities Website hosting or domain Total operating expenses 15,578 1,850 5,875 565 2,280 800 328 729 318 27,000 48,000 2,144 2,016 331 107,814 18.9 2.2 7.1 0.7 2.8 1.0 0.4 0.9 0.4 32.7 58.2 2.6 2.4 0.4 130.7 19,473 1,850 7,250 600 2,508 800 435 940 312 27,000 52,000 2,573 2,218 334 118,293 14.2 1.3 5.3 0.4 1.8 0.6 0.3 0.7 0.2 19.6 37.8 1.9 1.6 27,262 1.850 10,000 650 2,759 800 480 1,032 314 27,000 65,000 3,602 2,439 341 143,529 0.2 0.5 0.1 12.3 29.5 1.6 1.1 0.2 65.2 0.2 86.1 Net income before interest and tax Interest expense Net income before tax Income tax expense Net Income (27,707) 3,860 (31,567) -33.6 4.7 -38.3 0.0 -38.3 15,219 3,105 12,114 1,817 10,297 11.1 2.3 8.8 1.3 7.5 70,091 2,160 67,931 10,190 57,741 31.9 1.0 30.9 4.6 26.2 (31,567) EXHIBIT 3: NORTHWEST STATEMENT OF FINANCIAL POSITION (AS AT AUGUST 31, IN CAS) 2016 2017 2018 Assets 45 646 225 2,250 3,166 (925) 1,287 250 2,250 2,862 44,074 2,133 375 2,250 48,832 1,875 3,500 2,125 5,500 2,000 47,000 11,125 3,700 5,500 3,375 69,000 19,750 3,700 1,850 36,750 35,875 49,250 1,850 40,475 3,700 43,075 1,850 53,225 43,641 45,937 102,057 Current assets Cash Accounts receivable Office supplies Prepaid rent Total current assets Long-lived assets Office equipment 2,500 Less: accum. depreciation 625 Fitness equipment 42,000 Less: accum. depreciation 5,250 Certifications 3,700 Less: accum, amortization 1,850 Total long-lived assets Total assets Liabilities and Shareholders' equity Current liabilities Accounts payable Interest payable Income tax payable Current portion-bank loan Total current liabilities Long-term liabilities Bank loan Shareholders' equity Common stock Retained earnings Total shareholders' equity 208 396 294 96 1,817 10,000 12,207 10,000 10,208 10,190 10,000 20,586 40,000 30,000 20,000 25,000 (31,567) (6,567) 25,000 (21,270) 3,730 25,000 36,471 61,471 Total liabilities and shareholders' equity 43,641 45,937 102,057