Answered step by step

Verified Expert Solution

Question

1 Approved Answer

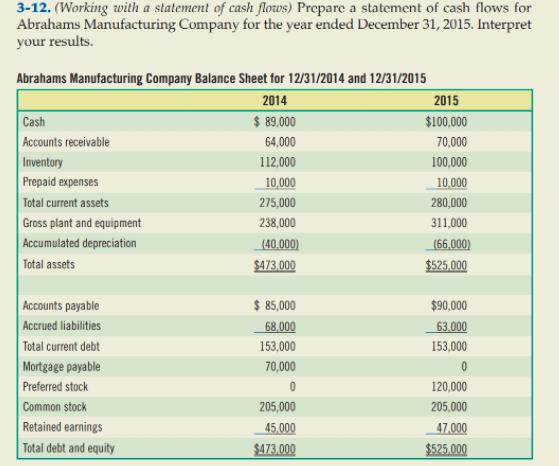

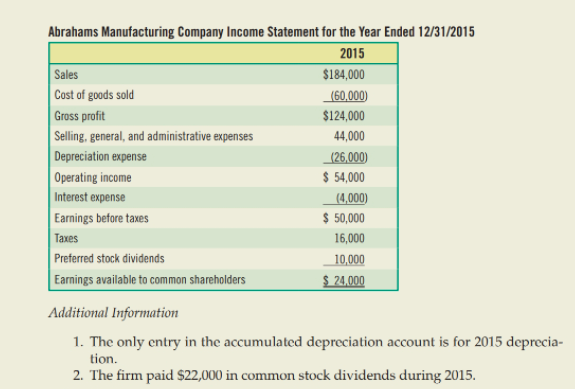

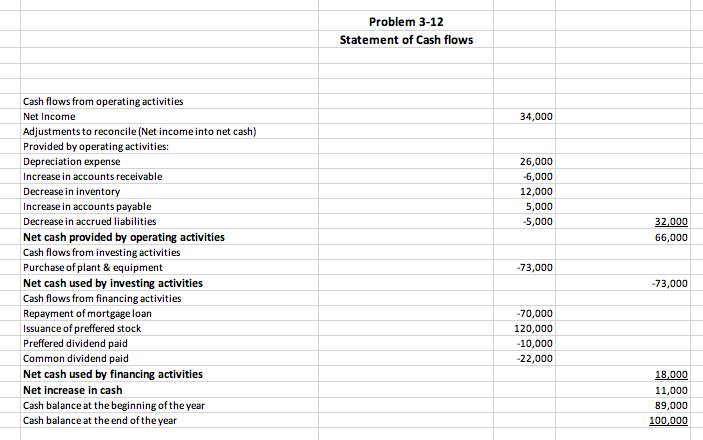

A. Prepare a statement of cash flows for Abrahams Manufacturing Company for the year ended December 31, 2015. Interpret your results. B. Your interpretation of

A. Prepare a statement of cash flows for Abrahams Manufacturing Company for the year ended December 31, 2015. Interpret your results.

B. Your interpretation of your cash flow statement should describe the operating, investing and financing activities of Abrahams Manufacturing.

I did some work below all the way in the end but I do not know if it is right and I also need the interpretation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started