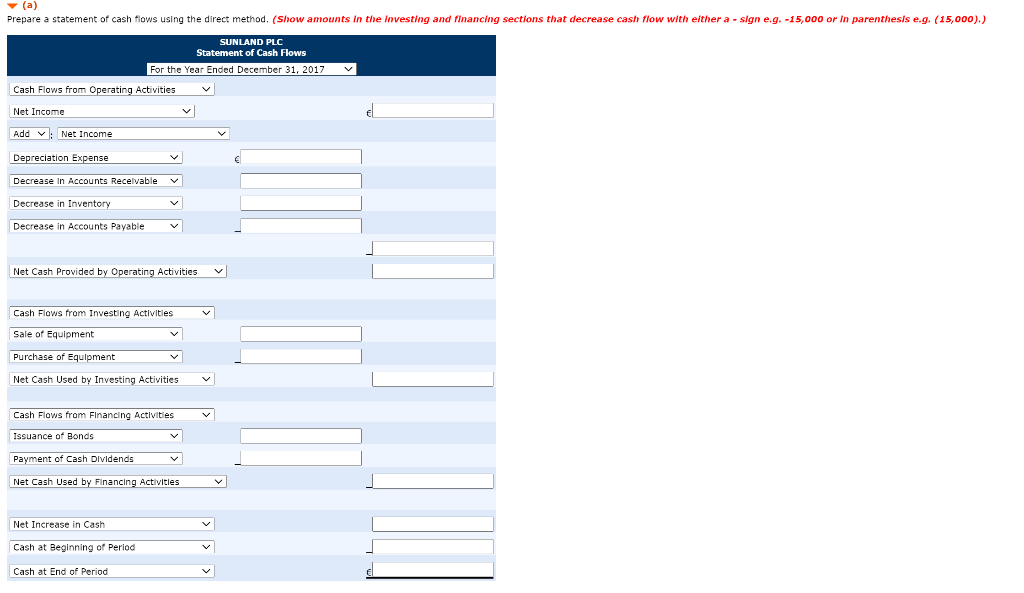

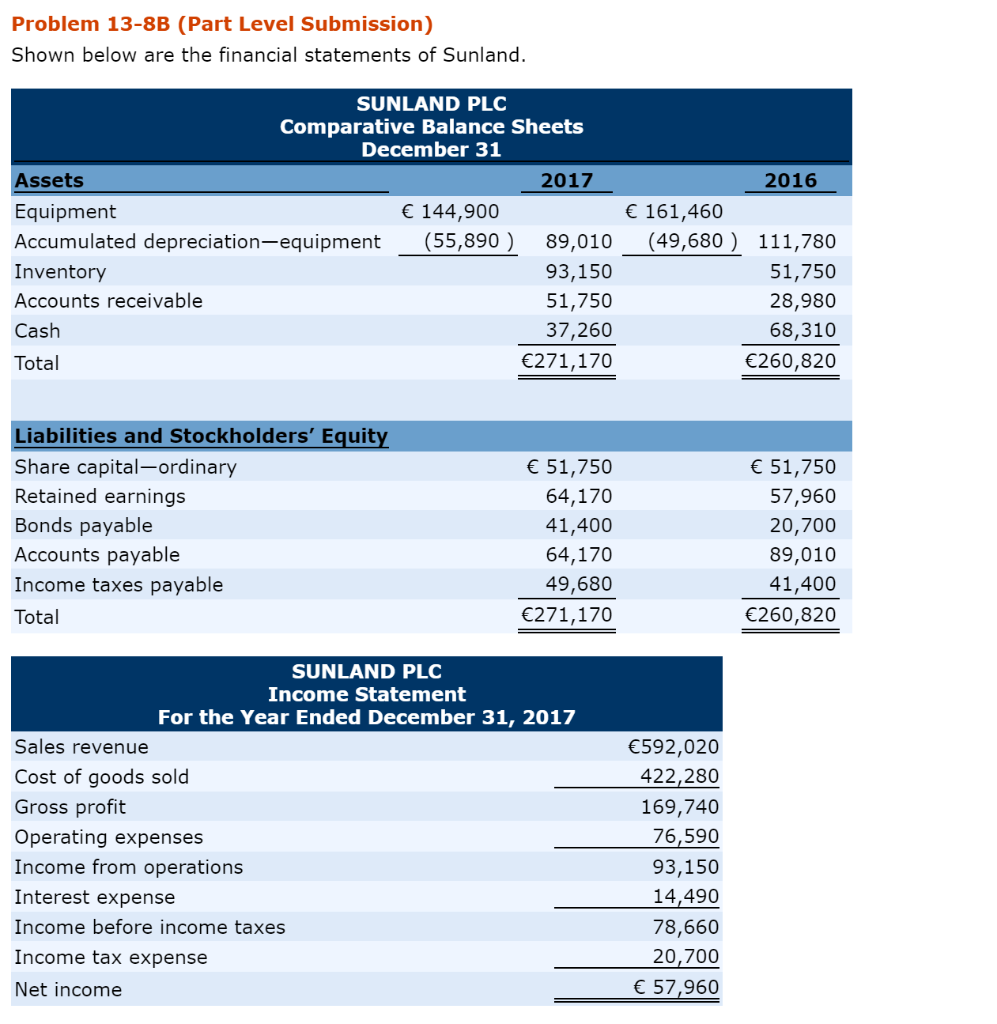

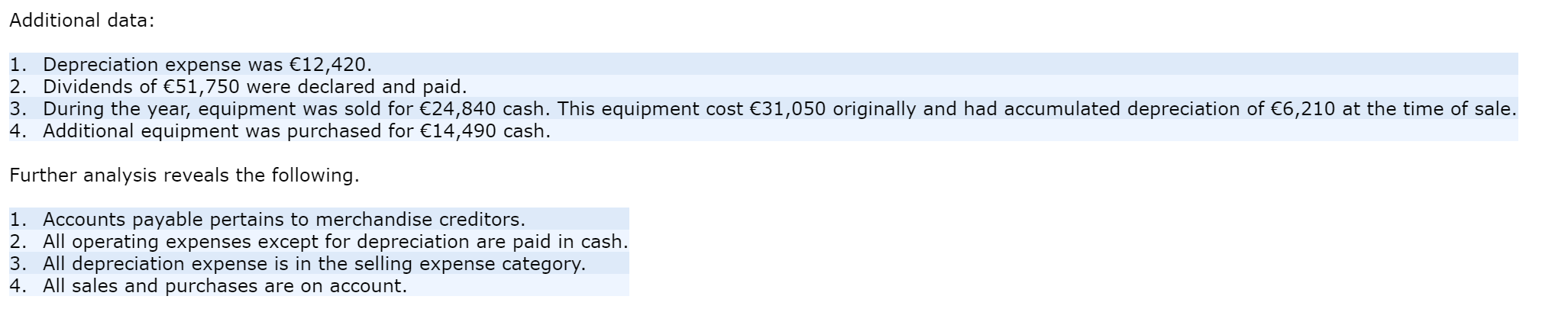

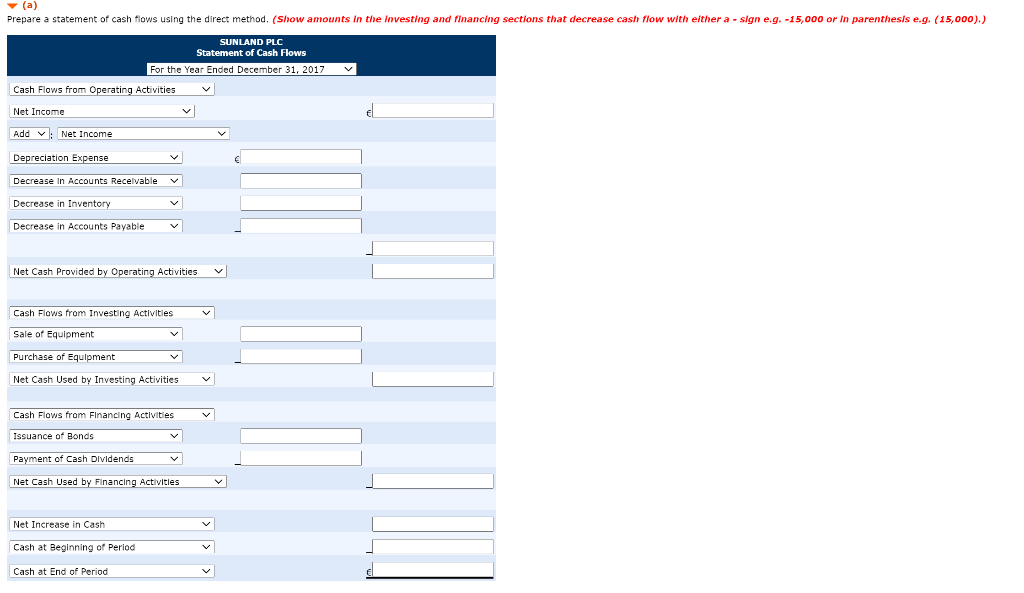

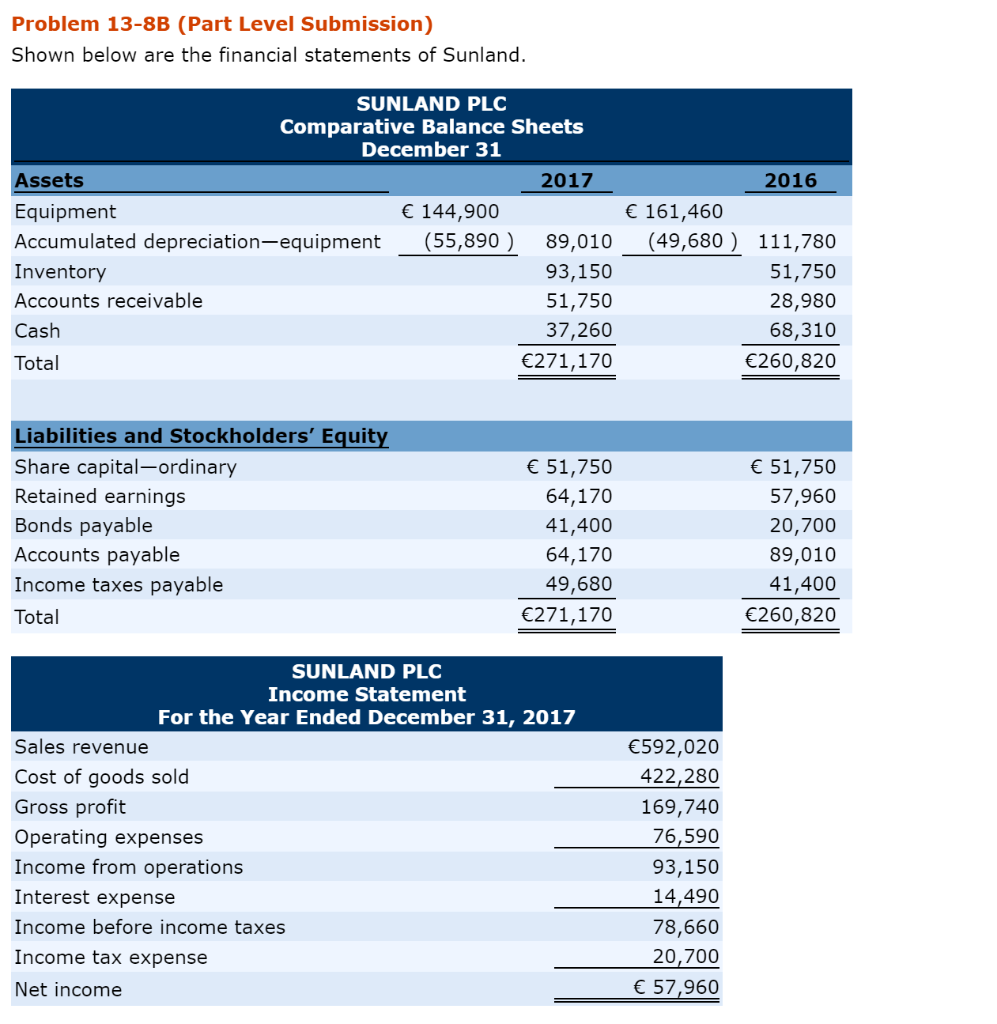

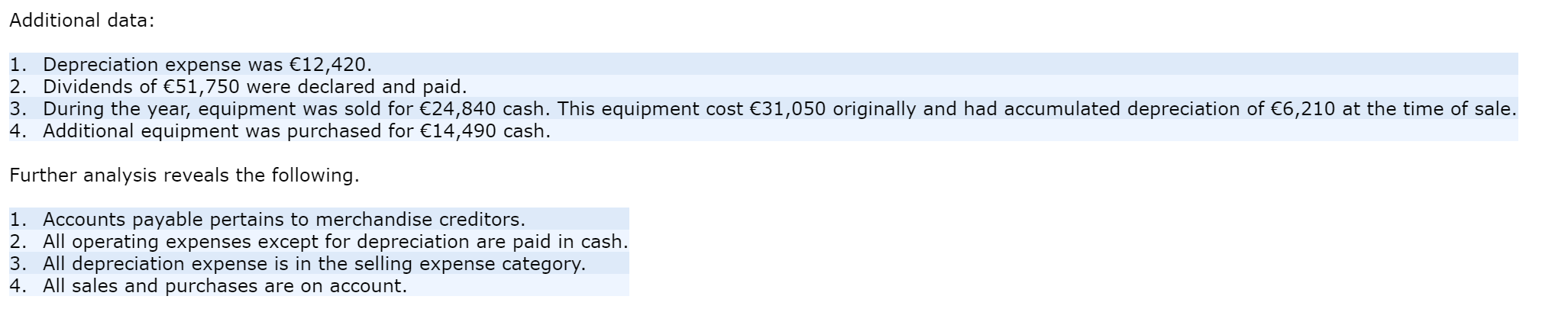

(a) Prepare a statement of cash flows using the direct method. (Show amounts in the investing and financing sections that decrease cash flow with either a sign e.g.-15,000 or in parenthesis e.g. (15,000).) SUNLAND PLC Statement of Cash Flows For the Year Ended December 31, 2017 Cash Flows from Operating Activities Net Income el Add Net Income Depreciation Expense Decrease in Accounts Recelvable Decrease in Inventory Decrease in Accounts Payable Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Equipment Purchase of Equipment Net Cash Used by Investing Activities Cash Flows from Financing Activities Issuance of Bonds Payment of Cash Dividends Net Cash Used by Financing Activities Net Increase in Cash Cash at Beginning of Period Cash at End of Period Problem 13-8B (Part Level Submission) Shown below are the financial statements of Sunland. 2016 SUNLAND PLC Comparative Balance Sheets December 31 Assets 2017 Equipment 144,900 Accumulated depreciation equipment (55,890 ) 89,010 Inventory 93,150 Accounts receivable 51,750 Cash 37,260 Total 271,170 161,460 (49,680 ) 111,780 51,750 28,980 68,310 260,820 Liabilities and Stockholders' Equity Share capital-ordinary Retained earnings Bonds payable Accounts payable Income taxes payable Total 51,750 64,170 41,400 64,170 49,680 271,170 51,750 57,960 20,700 89,010 41,400 260,820 SUNLAND PLC Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income taxes 592,020 422,280 169,740 76,590 93,150 14,490 78,660 20,700 57,960 Income tax expense Net income Additional data: 1. Depreciation expense was 12,420. 2. Dividends of 51,750 were declared and paid. 3. During the year, equipment was sold for 24,840 cash. This equipment cost 31,050 originally and had accumulated depreciation of 6,210 at the time of sale. 4. Additional equipment was purchased for 14,490 cash. Further analysis reveals the following. 1. Accounts payable pertains to merchandise creditors. 2. All operating expenses except for depreciation are paid in cash. 3. All depreciation expense is in the selling expense category. 4. All sales and purchases are on account