a. prepare a statement of changes in net assets in liquidation for the three months ending oct 31 2020

b. prepare a statement of net assets in liquidation as of october 31 2020

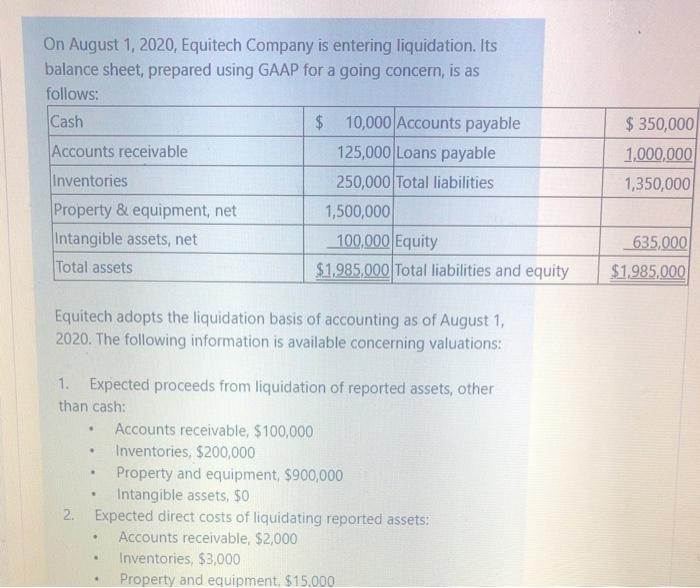

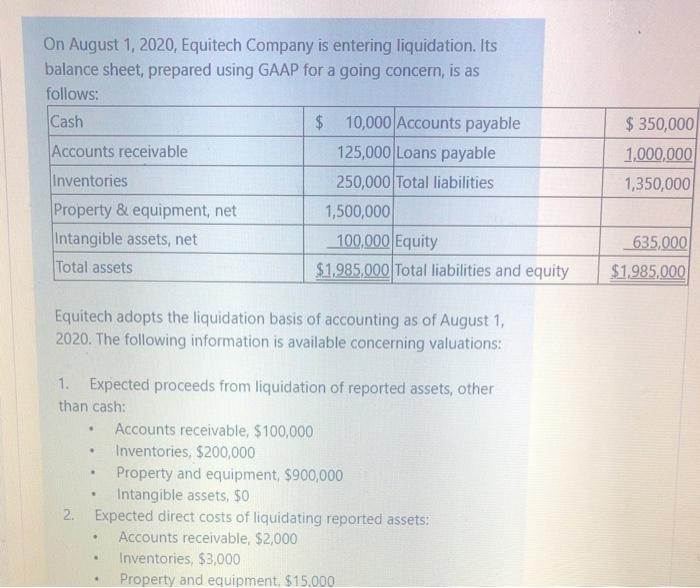

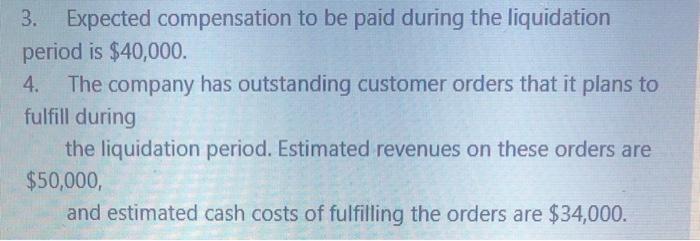

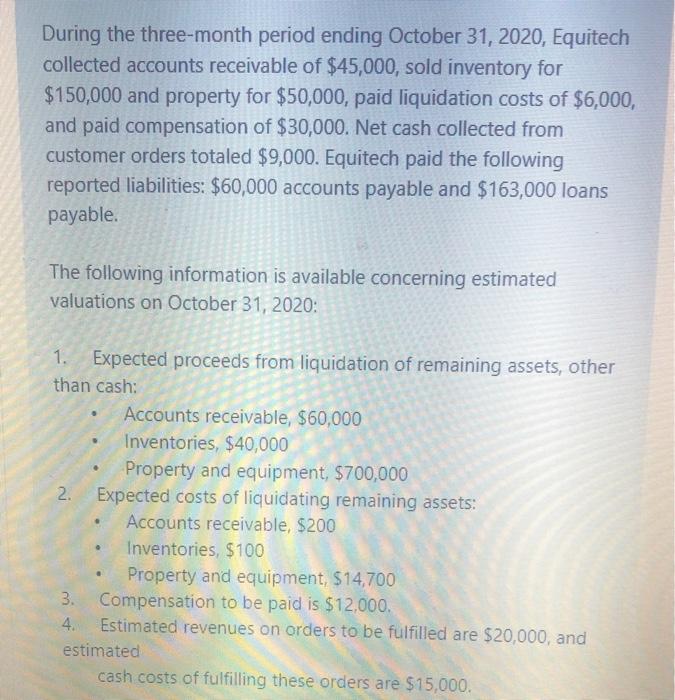

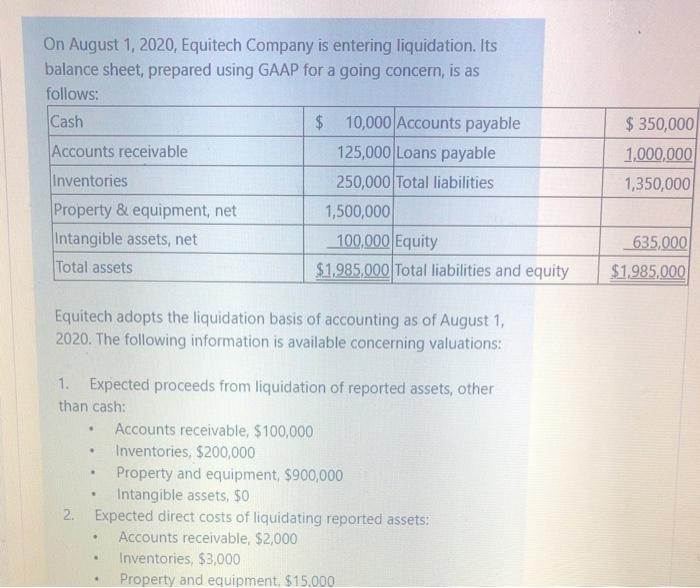

On August 1, 2020, Equitech Company is entering liquidation. Its balance sheet, prepared using GAAP for a going concern, is as follows: Cash $ 10,000 Accounts payable Accounts receivable 125,000 Loans payable Inventories 250,000 Total liabilities Property & equipment, net 1,500,000 Intangible assets, net 100.000 Equity Total assets $1,985,000 Total liabilities and equity $ 350,000 1,000,000 1,350,000 635,000 $1,985,000 Equitech adopts the liquidation basis of accounting as of August 1, 2020. The following information is available concerning valuations: . . 1. Expected proceeds from liquidation of reported assets, other than cash: Accounts receivable, $100,000 Inventories, $200,000 Property and equipment, $900,000 Intangible assets, $0 2. Expected direct costs of liquidating reported assets: Accounts receivable, $2,000 Inventories, $3,000 Property and equipment. $15.000 . 3. Expected compensation to be paid during the liquidation period is $40,000. 4. The company has outstanding customer orders that it plans to fulfill during the liquidation period. Estimated revenues on these orders are $50,000, and estimated cash costs of fulfilling the orders are $34,000. During the three-month period ending October 31, 2020, Equitech collected accounts receivable of $45,000, sold inventory for $150,000 and property for $50,000, paid liquidation costs of $6,000, and paid compensation of $30,000. Net cash collected from customer orders totaled $9,000. Equitech paid the following reported liabilities: $60,000 accounts payable and $163,000 loans payable. The following information is available concerning estimated valuations on October 31, 2020: . 1. Expected proceeds from liquidation of remaining assets, other than cash: Accounts receivable, $60,000 Inventories, $40,000 Property and equipment, $700,000 2. Expected costs of liquidating remaining assets: Accounts receivable, $200 Inventories, $100 Property and equipment, $14,700 3. Compensation to be paid is $12,000. 4 Estimated revenues on orders to be fulfilled are $20,000, and estimated cash costs of fulfilling these orders are $15,000. . . a. Required Prepare a statement of changes in net assets in liquidation for the three months ending October 31, 2020. b. Prepare a statement of net assets in liquidation as of October 31, 2020. On August 1, 2020, Equitech Company is entering liquidation. Its balance sheet, prepared using GAAP for a going concern, is as follows: Cash $ 10,000 Accounts payable Accounts receivable 125,000 Loans payable Inventories 250,000 Total liabilities Property & equipment, net 1,500,000 Intangible assets, net 100.000 Equity Total assets $1,985,000 Total liabilities and equity $ 350,000 1,000,000 1,350,000 635,000 $1,985,000 Equitech adopts the liquidation basis of accounting as of August 1, 2020. The following information is available concerning valuations: . . 1. Expected proceeds from liquidation of reported assets, other than cash: Accounts receivable, $100,000 Inventories, $200,000 Property and equipment, $900,000 Intangible assets, $0 2. Expected direct costs of liquidating reported assets: Accounts receivable, $2,000 Inventories, $3,000 Property and equipment. $15.000 . 3. Expected compensation to be paid during the liquidation period is $40,000. 4. The company has outstanding customer orders that it plans to fulfill during the liquidation period. Estimated revenues on these orders are $50,000, and estimated cash costs of fulfilling the orders are $34,000. During the three-month period ending October 31, 2020, Equitech collected accounts receivable of $45,000, sold inventory for $150,000 and property for $50,000, paid liquidation costs of $6,000, and paid compensation of $30,000. Net cash collected from customer orders totaled $9,000. Equitech paid the following reported liabilities: $60,000 accounts payable and $163,000 loans payable. The following information is available concerning estimated valuations on October 31, 2020: . 1. Expected proceeds from liquidation of remaining assets, other than cash: Accounts receivable, $60,000 Inventories, $40,000 Property and equipment, $700,000 2. Expected costs of liquidating remaining assets: Accounts receivable, $200 Inventories, $100 Property and equipment, $14,700 3. Compensation to be paid is $12,000. 4 Estimated revenues on orders to be fulfilled are $20,000, and estimated cash costs of fulfilling these orders are $15,000. . . a. Required Prepare a statement of changes in net assets in liquidation for the three months ending October 31, 2020. b. Prepare a statement of net assets in liquidation as of October 31, 2020