Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Prepare Adjusting Journal Entries and Multi-Step Income Statement. b. Prepare a Classified Balance Sheet and Statement of Cash Flows. Income Statement Balance Sheet and

a. Prepare Adjusting Journal Entries and Multi-Step Income Statement.

b. Prepare a Classified Balance Sheet and Statement of Cash Flows.

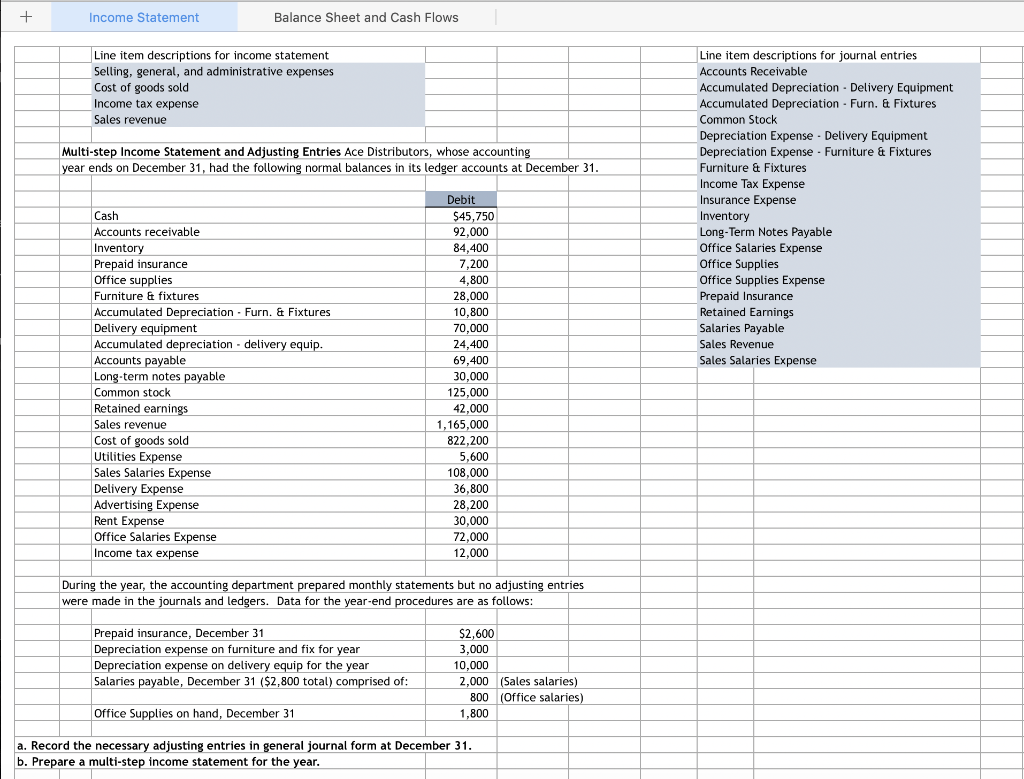

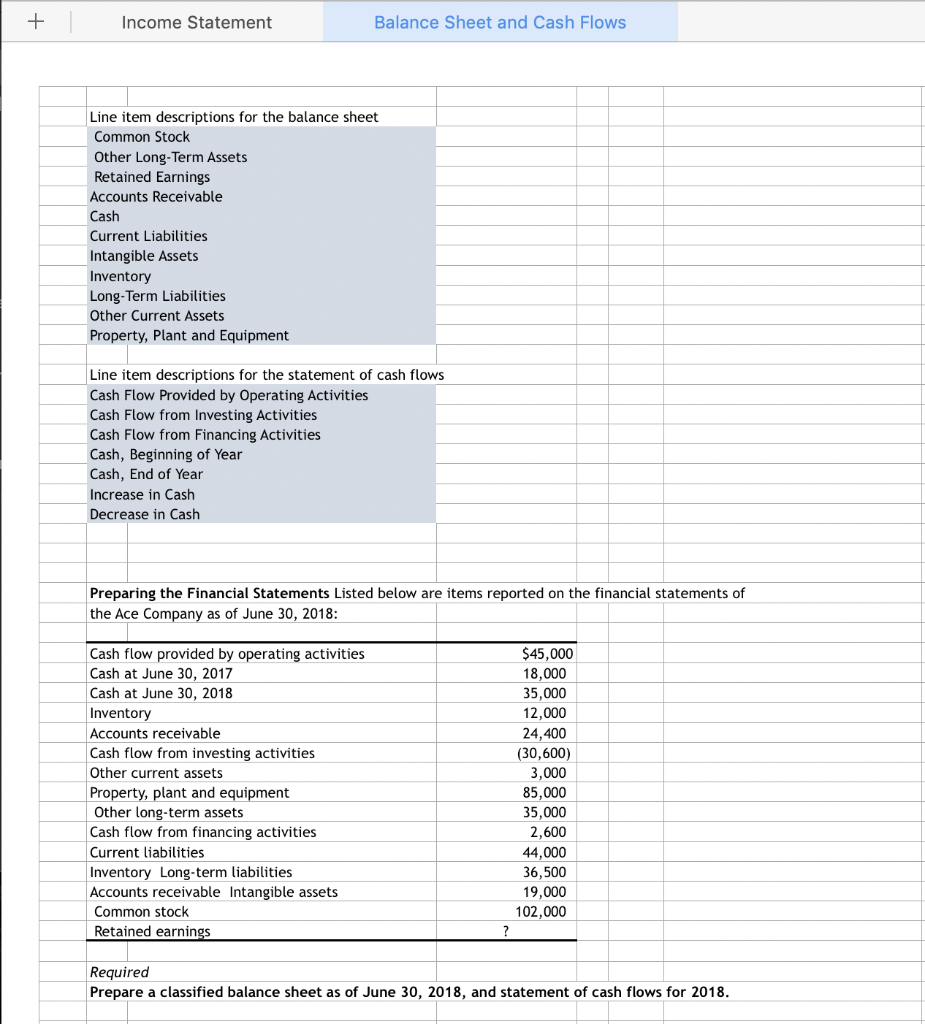

Income Statement Balance Sheet and Cash Flows Line item descriptions for income statement Selling, general, and administrative expenses Cost of goods sold Income tax expense Sales revenue Line item descriptions for journal entries Accounts Receivable Accumulated Depreciation Delivery Equipment Accumulated Depreciation Furn. & Fixtures Common Stock Depreciation Expense Delivery Equipment Depreciation Expense Furniture & Fixtures Furniture & Fixtures Income Tax Expense Insurance Expense Inventory Long-Term Notes Payable Office Salaries Expense Office Supplies Office Supplies Expense Prepaid Insurance Retained Earnings Salaries Payable Sales Revenue Sales Salaries Expense Multi-step Income Statement and Adjusting Entries Ace Distributors, whose accounting ar ends on December 31, had the following normal balances in its ledger accounts at December 31 Debit Cash Accounts receivable In Prepaid insurance Office supplies Furniture &fixtures Accumulated Delive Accumulated depreciation deliv Accounts payable Lons-term notes Common stock Retained earnin Sales revenue Cost of goods sold Utilities Expense Sales Salaries Expense Delivery Expense Advertising Expense Rent Expense Office Salaries Expense Income tax expense $45,750 92,000 84.400 7,200 4,800 28,000 10,800 70,000 24,400 69,400 30,000 125,000 42,000 iation Furn. & Fixtures Ul 1,165,000 822,200 5,600 108,000 36,800 28,200 30,000 72,000 12,000 During the year, the accounting department were made in the journals and ledgers. Data for the year-end procedures are as follows ared monthly statements but no adjusting entries Prepaid insurance, December 31 Depreciation expense on furniture and fix for year Depreciation expense on delivery equip for the year Salaries payable, December 31 ($2,800 total) comprised of: $2,600 3,000 10,000 2,000 (Sales salaries) 800 (Office salaries) 1,800 Office Supplies on hand, December 31 a. Record the necessary adjusting entries in general journal form at Deb31 b. Prepare a multi-step income statement for the year Income Statement Balance Sheet and Cash Flows Line item descriptions for the balance sheet Common Stock Other Long-Term Assets Retained Earnings Accounts Receivable Cash Current Liabilities Intangible Assets Inventory Long-Term Liabilities Other Current Assets Property, Plant and Equipment Line item descriptions for the statement of cash flows Cash Flow Provided by Operating Activities Cash Flow from Investing Activities Cash Flow from Financing Activities Cash, Beginning of Year Cash, End of Year Increase in Cash Decrease in Cash Preparing the Financial Statements Listed below are items reported on the financial statements of the Ace Company as of June 30, 2018: Cash flow provided by operating activities Cash at June 30, 2017 Cash at June 30, 2018 Inventory Accounts receivable Cash flow from investing activities Other current assets Property, plant and equipment Other long-term assets Cash flow from financing activities Current liabilities Inventory Long-term iabilities Accounts receivable Intangible assets Common stock Retained earnings 45,000 18,000 35,000 12,000 24,400 (30,600) 3,000 85,000 35,000 2,600 4,000 36,500 19,000 102,000 Required Prepare a classified balance sheet as of June 30, 2018, and statement of cash flows for 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started