Answered step by step

Verified Expert Solution

Question

1 Approved Answer

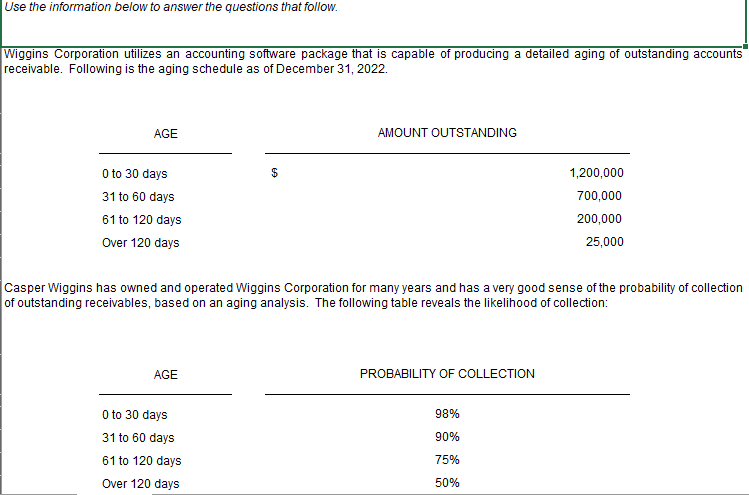

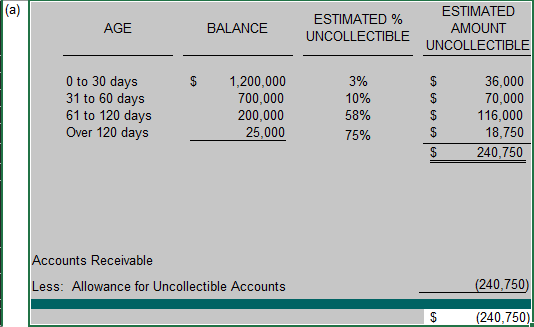

(a) Prepare an aging analysis, and show how accounts receivable and the related allowance for uncollectibles should appear on the balance sheet at December 31.

| (a) | Prepare an aging analysis, and show how accounts receivable and the related allowance for uncollectibles should appear on the balance sheet at December 31. (5 points) | ||||

| (b) | Prepare the necessary journal entry to update the allowance for uncollectibles, assuming the balance prior to preparing the aging was a $15,000 credit. (2.5 points) | ||||

| (c) | Prepare the necessary journal entry to update the allowance for uncollectibles, assuming the balance prior to preparing the aging was a $5,000 debit. (2.5 points) | ||||

| (d) | Assume one of Wiggins customers has filed for banruptcy protection. Prepare the journal entry to write off the account, $21,000. (2.5 points) | ||||

| (e) | Explain why the actual write-off will not result in a reduction of Wang Corporation's income. (2.5 points) | ||||

| (f) | Wiggins accepts credit card payments from customers. Charges on USExpress cards were $3,000. This card is not a bank (debit) card, and settlement does not occur until approximately two weeks following the date of the transaction. USExpress charges a 4% fee, and this amount is recorded on the day of sale. Prepare the journal entry for the credit card sales. (3.5 points) | ||||

| (g) | Prepare the journal entry for the eventual collection of the USExpress charges. (2.5 points) | ||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started