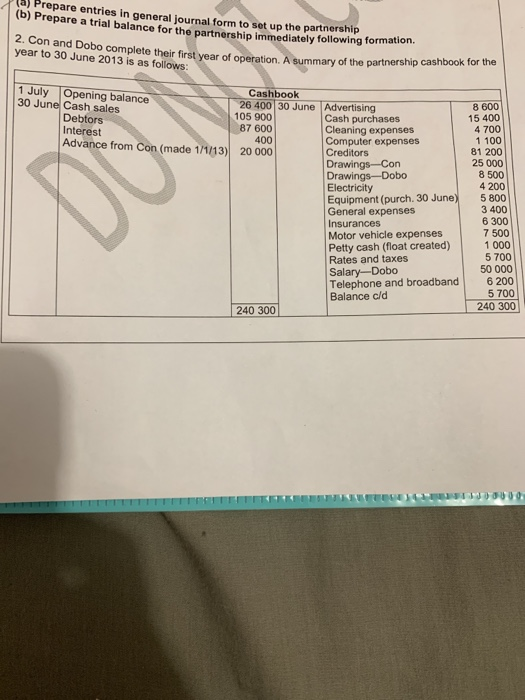

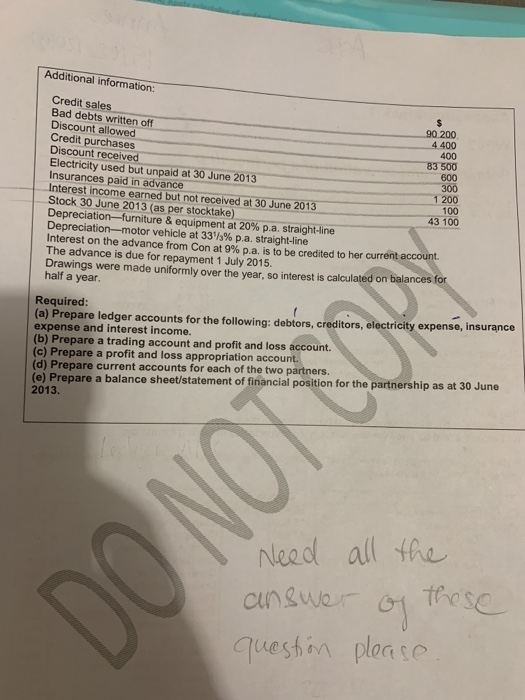

(a) Prepare entries in general journal form to set up the partnership (b) Prepare a trial balance for the partnership immediately following 2. Con and Dobo complete their first year of year to 30 June 2013 is as follows operation. A summary of the partnership cashbook for the 1 July Opening balance 30 June Cash sales Cashboolk 26 400 30 June Advertising 05 900 87 600 8 600 15 400 Debtors Interest Advance from Con (made 1/1/13) 20 000 Cash purchases Cleaning expenses Computer expenses 4 700 1 100 81 200 25 000 8 500 4 200 Equipment (purch. 30 June) General expenses Insurances 5 800 3 400 6 300 7 500 Motor vehicle expenses Petty cash (float created 1000 Rates and taxes Salary-Dobo 5 700 50 000 Telephone and broadband 6 200 Balance c/d 5 700 240 300 240 300 Additional information: Credit sales Bad debts written off Discount allowed Credit purchases Discount received Electricity used but unpaid at 30 June 2013 Insurances paid in advance Interest income earned but not received at 30 June 2013 Stock 30 June 2013 (as per stocktake) Depreciation-furni Depreciation-motor vehicle at 331/3% pa, straight-line Interest on the advance from Con at 9% pa, is to be credited to her current The advance is due for repayment 1 July 2015. Drawings were made uniformly over the year, so interest is calculated on balances for half a year, 90 200 4 400 400 83 500 600 300 1 200 100 43 100 ture & equipment at 20% pa straight-line Required: (a) Prepare ledger accounts for the following: debiors, creditors, electricity expense, insurance expense and interest income. (b) Prepare a trading account and profit and loss account. (c) Prepare a profit and loss appropriation account. (d) Prepare current accounts for each of the two partners (e) Prepare a balance sheet/statement of financial position for the partnership as at 30 June 2013. nleed all the cnswe qweshen plonso nes (a) Prepare entries in general journal form to set up the partnership (b) Prepare a trial balance for the partnership immediately following 2. Con and Dobo complete their first year of year to 30 June 2013 is as follows operation. A summary of the partnership cashbook for the 1 July Opening balance 30 June Cash sales Cashboolk 26 400 30 June Advertising 05 900 87 600 8 600 15 400 Debtors Interest Advance from Con (made 1/1/13) 20 000 Cash purchases Cleaning expenses Computer expenses 4 700 1 100 81 200 25 000 8 500 4 200 Equipment (purch. 30 June) General expenses Insurances 5 800 3 400 6 300 7 500 Motor vehicle expenses Petty cash (float created 1000 Rates and taxes Salary-Dobo 5 700 50 000 Telephone and broadband 6 200 Balance c/d 5 700 240 300 240 300 Additional information: Credit sales Bad debts written off Discount allowed Credit purchases Discount received Electricity used but unpaid at 30 June 2013 Insurances paid in advance Interest income earned but not received at 30 June 2013 Stock 30 June 2013 (as per stocktake) Depreciation-furni Depreciation-motor vehicle at 331/3% pa, straight-line Interest on the advance from Con at 9% pa, is to be credited to her current The advance is due for repayment 1 July 2015. Drawings were made uniformly over the year, so interest is calculated on balances for half a year, 90 200 4 400 400 83 500 600 300 1 200 100 43 100 ture & equipment at 20% pa straight-line Required: (a) Prepare ledger accounts for the following: debiors, creditors, electricity expense, insurance expense and interest income. (b) Prepare a trading account and profit and loss account. (c) Prepare a profit and loss appropriation account. (d) Prepare current accounts for each of the two partners (e) Prepare a balance sheet/statement of financial position for the partnership as at 30 June 2013. nleed all the cnswe qweshen plonso nes