Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Prepare Journal Entries for items related to the first year's Income Statement and first year's ending Balance Sheet. The entries should be in standard

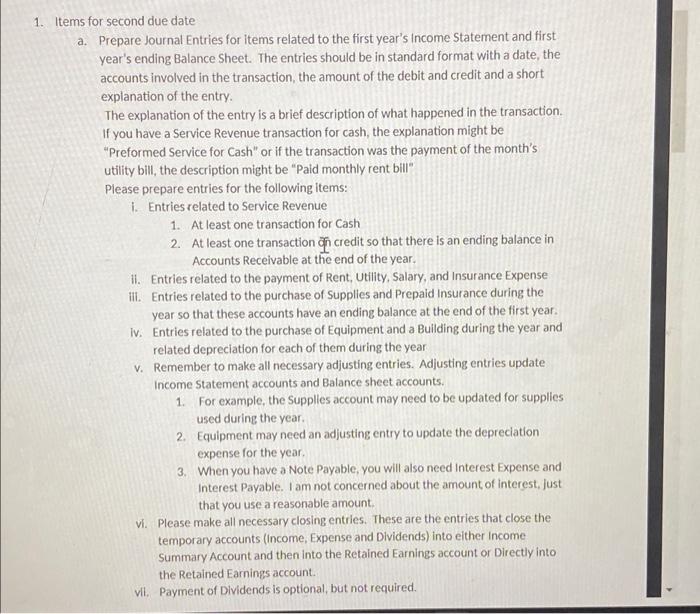

a. Prepare Journal Entries for items related to the first year's Income Statement and first year's ending Balance Sheet. The entries should be in standard format with a date, the accounts involved in the transaction, the amount of the debit and credit and a short explanation of the entry. The explanation of the entry is a brief description of what happened in the transaction. If you have a Service Revenue transaction for cash, the explanation might be "Preformed Service for Cash" or if the transaction was the payment of the month's utility bill, the description might be "Paid monthly rent bill" Please prepare entries for the following items: i. Entries related to Service Revenue 1. At least one transaction for Cash 2. At least one transaction on credit so that there is an ending balance in Accounts Receivable at the end of the year. iii. ii. Entries related to the payment of Rent, Utility, Salary, and Insurance Expense Entries related to the purchase of Supplies and Prepaid Insurance during the year so that these accounts have an ending balance at the end of the first year. iv. Entries related to the purchase of Equipment and a Building during the year and related depreciation for each of them during the year v. Remember to make all necessary adjusting entries. Adjusting entries update Income Statement accounts and Balance sheet accounts. 1. For example, the Supplies account may need to be updated for supplies used during the year. 2. Equipment may need an adjusting entry to update the depreciation expense for the year. 3. When you have a Note Payable, you will also need Interest Expense and Interest Payable. I am not concerned about the amount of interest, just that you use a reasonable amount. vi. Please make all necessary closing entries. These are the entries that close the temporary accounts (Income, Expense and Dividends) into either Income Summary Account and then into the Retained Earnings account or Directly into the Retained Earnings account. vii. Payment of Dividends is optional, but not required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started