Answered step by step

Verified Expert Solution

Question

1 Approved Answer

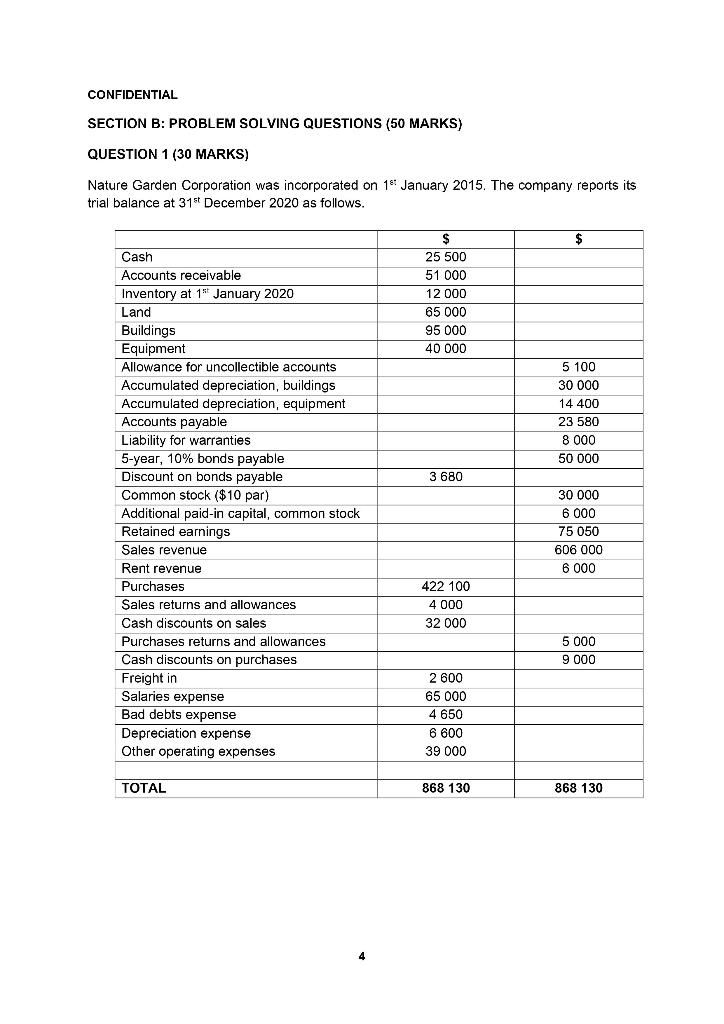

a) Prepare journal entries for the transactions listed in item 2 (a-f), additional information. CONFIDENTIAL SECTION B: PROBLEM SOLVING QUESTIONS (50 MARKS) QUESTION 1 (30

a) Prepare journal entries for the transactions listed in item 2 (a-f), additional information.

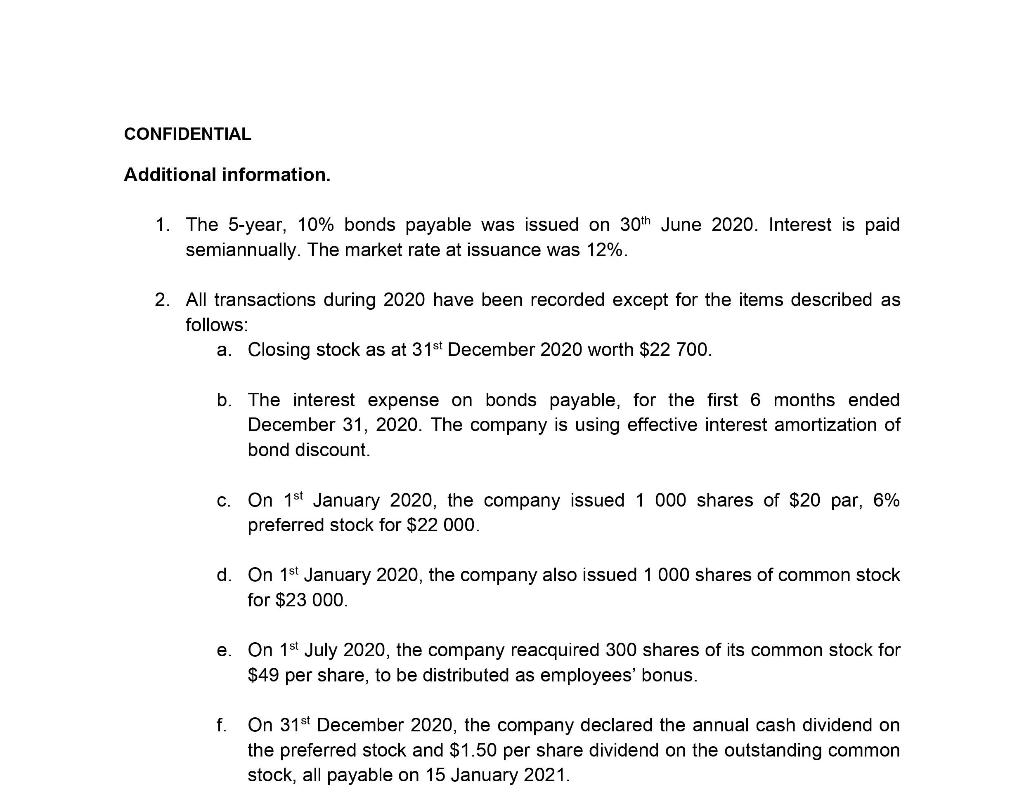

CONFIDENTIAL SECTION B: PROBLEM SOLVING QUESTIONS (50 MARKS) QUESTION 1 (30 MARKS) Nature Garden Corporation was incorporated on 18 January 2015. The company reports its trial balance at 31st December 2020 as follows. $ $ 25 500 51 000 12 000 65 000 95 000 40 000 5 100 30 000 14 400 23 580 8 000 50 000 3 680 Cash Accounts receivable Inventory at 1" January 2020 Land Buildings Equipment Allowance for uncollectible accounts Accumulated depreciation, buildings Accumulated depreciation, equipment Accounts payable Liability for warranties 5-year, 10% bonds payable Discount on bonds payable Common stock ($10 par) Additional paid-in capital, common stock Retained earnings Sales revenue Rent revenue Purchases Sales returns and allowances Cash discounts on sales Purchases returns and allowances Cash discounts on purchases Freight in Salaries expense Bad debts expense Depreciation expense Other operating expenses 30 000 6 000 75 050 606 000 6 000 422 100 4 000 32 000 5 000 9000 2 600 65 000 4 650 6 600 39 000 TOTAL 868 130 868 130 4 CONFIDENTIAL Additional information. 1. The 5-year, 10% bonds payable was issued on 30th June 2020. Interest is paid semiannually. The market rate at issuance was 12%. 2. All transactions during 2020 have been recorded except for the items described as follows: a. Closing stock as at 31st December 2020 worth $22 700. b. The interest expense on bonds payable, for the first 6 months ended December 31, 2020. The company is using effective interest amortization of bond discount. c. On 1st January 2020, the company issued 1 000 shares of $20 par, 6% preferred stock for $22 000. d. On 1st January 2020, the company also issued 1 000 shares of common stock for $23 000. e. On 1st July 2020, the company reacquired 300 shares of its common stock for $49 per share, to be distributed as employees' bonus. f. On 31st December 2020, the company declared the annual cash dividend on the preferred stock and $1.50 per share dividend on the outstanding common stock, all payable on 15 January 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started