Answered step by step

Verified Expert Solution

Question

1 Approved Answer

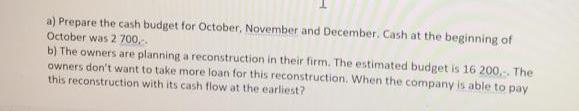

a) Prepare the cash budget for October, November and December. Cash at the beginning of October was 2 700... b) The owners are planning

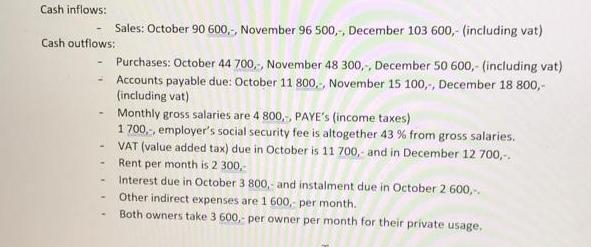

a) Prepare the cash budget for October, November and December. Cash at the beginning of October was 2 700... b) The owners are planning a reconstruction in their firm. The estimated budget is 16 200... The owners don't want to take more loan for this reconstruction. When the company is able to pay this reconstruction with its cash flow at the earliest? Cash inflows: Cash outflows: - Sales: October 90 600,-, November 96 500,-, December 103 600,- (including vat) Purchases: October 44 700,-, November 48 300,-, December 50 600,- (including vat) Accounts payable due: October 11 800,-, November 15 100,-, December 18 800,- (including vat) Monthly gross salaries are 4 800,-, PAYE's (income taxes) 1 700,-, employer's social security fee is altogether 43 % from gross salaries. VAT (value added tax) due in October is 11 700,- and in December 12 700,-. Rent per month is 2 300,- Interest due in October 3 800,- and instalment due in October 2 600,-. - Other indirect expenses are 1 600,- per month. Both owners take 3 600,- per owner per month for their private usage,

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To prepare the cash budget for October November and December we need to calculate the cash inflows and outflows for each month and determine the end...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started