Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paul and his wife Gail jointly own (50% each) a piece of vacant land north of Toronto. This land was purchased on January 1,

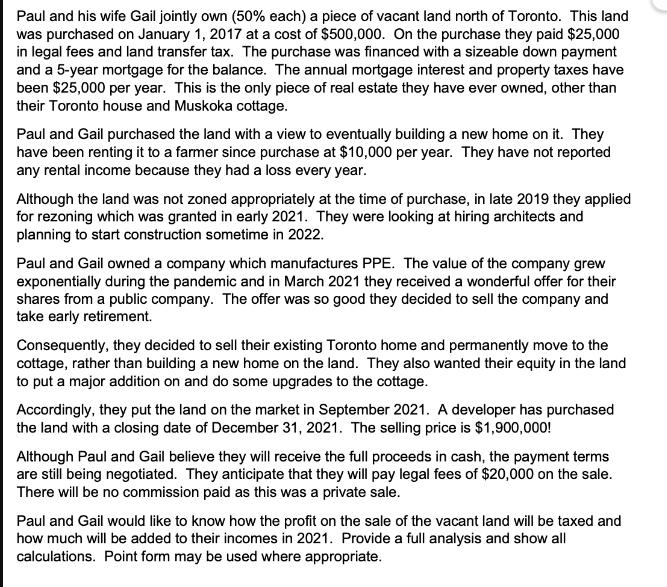

Paul and his wife Gail jointly own (50% each) a piece of vacant land north of Toronto. This land was purchased on January 1, 2017 at a cost of $500,000. On the purchase they paid $25,000 in legal fees and land transfer tax. The purchase was financed with a sizeable down payment and a 5-year mortgage for the balance. The annual mortgage interest and property taxes have been $25,000 per year. This is the only piece of real estate they have ever owned, other than their Toronto house and Muskoka cottage. Paul and Gail purchased the land with a view to eventually building a new home on it. They have been renting it to a farmer since purchase at $10,000 per year. They have not reported any rental income because they had a loss every year. Although the land was not zoned appropriately at the time of purchase, in late 2019 they applied for rezoning which was granted in early 2021. They were looking at hiring architects and planning to start construction sometime in 2022. Paul and Gail owned a company which manufactures PPE. The value of the company grew exponentially during the pandemic and in March 2021 they received a wonderful offer for their shares from a public company. The offer was so good they decided to sell the company and take early retirement. Consequently, they decided to sell their existing Toronto home and permanently move to the cottage, rather than building a new home on the land. They also wanted their equity in the land to put a major addition on and do some upgrades to the cottage. Accordingly, they put the land on the market in September 2021. A developer has purchased the land with a closing date of December 31, 2021. The selling price is $1,900,000! Although Paul and Gail believe they will receive the full proceeds in cash, the payment terms are still being negotiated. They anticipate that they will pay legal fees of $20,000 on the sale. There will be no commission paid as this was a private sale. Paul and Gail would like to know how the profit on the sale of the vacant land will be taxed and how much will be added to their incomes in 2021. Provide a full analysis and show all calculations. Point form may be used where appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the tax implications of the sale of the vacant land for Paul and Gail we need to consid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started