Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a CPA working in the tax group of your firm. Zhihong (Zhi) has been a client of the firm for a number

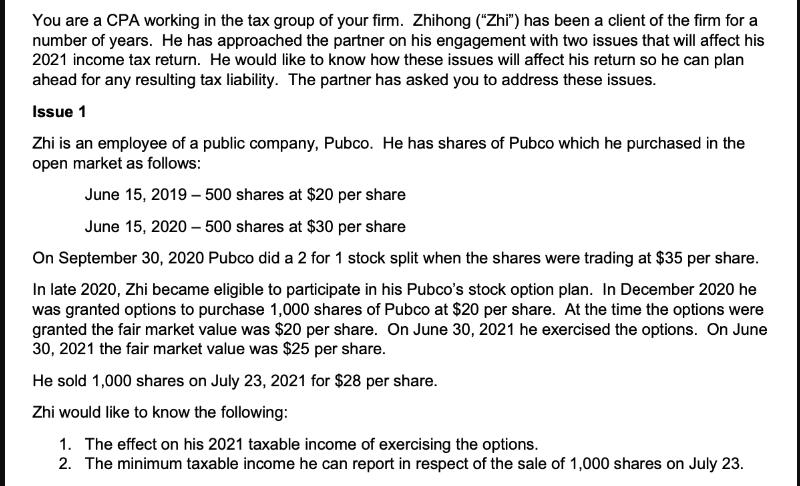

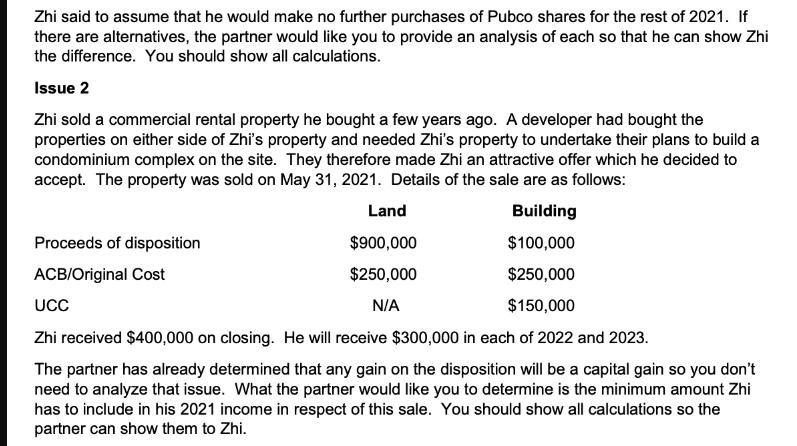

You are a CPA working in the tax group of your firm. Zhihong ("Zhi") has been a client of the firm for a number of years. He has approached the partner on his engagement with two issues that will affect his 2021 income tax return. He would like to know how these issues will affect his return so he can plan ahead for any resulting tax liability. The partner has asked you to address these issues. Issue 1 Zhi is an employee of a public company, Pubco. He has shares of Pubco which he purchased in the open market as follows: June 15, 2019-500 shares at $20 per share June 15, 2020 - 500 shares at $30 per share On September 30, 2020 Pubco did a 2 for 1 stock split when the shares were trading at $35 per share. In late 2020, Zhi became eligible to participate in his Pubco's stock option plan. In December 2020 he was granted options to purchase 1,000 shares of Pubco at $20 per share. At the time the options were granted the fair market value was $20 per share. On June 30, 2021 he exercised the options. On June 30, 2021 the fair market value was $25 per share. He sold 1,000 shares on July 23, 2021 for $28 per share. Zhi would like to know the following: 1. The effect on his 2021 taxable income of exercising the options. 2. The minimum taxable income he can report in respect of the sale of 1,000 shares on July 23. Zhi said to assume that he would make no further purchases of Pubco shares for the rest of 2021. If there are alternatives, the partner would like you to provide an analysis of each so that he can show Zhi the difference. You should show all calculations. Issue 2 Zhi sold a commercial rental property he bought a few years ago. A developer had bought the properties on either side of Zhi's property and needed Zhi's property to undertake their plans to build a condominium complex on the site. They therefore made Zhi an attractive offer which he decided to accept. The property was sold on May 31, 2021. Details of the sale are as follows: Building $100,000 $250,000 $150,000 Proceeds of disposition ACB/Original Cost Land $900,000 $250,000 N/A UCC Zhi received $400,000 on closing. He will receive $300,000 in each of 2022 and 2023. The partner has already determined that any gain on the disposition will be a capital gain so you don't need to analyze that issue. What the partner would like you to determine is the minimum amount Zhi has to include in his 2021 income in respect of this sale. You should show all calculations so the partner can show them to Zhi.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Issue 1 Taxable Income Effect of Exercising Stock Options Zhi exercised stock options on June 30 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started