Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Prepare the journal entries to record the above bad debts and provision for doubtful debts for the financial years ended 31 December 2018, 31

(a) Prepare the journal entries to record the above bad debts and provision for doubtful debts for the financial years ended 31 December 2018, 31 December 2019 and 31 December 2020 (narrations are not required). (12 marks) (b) Show the extract of the Statement of Profit or Loss for the financial year ended 31 December 2018, 31 December 2019 and 31 December 2020 and Statement of Financial Position as at 31 December 2018, 31 December 2019 and 31 December 2020. (6 marks)

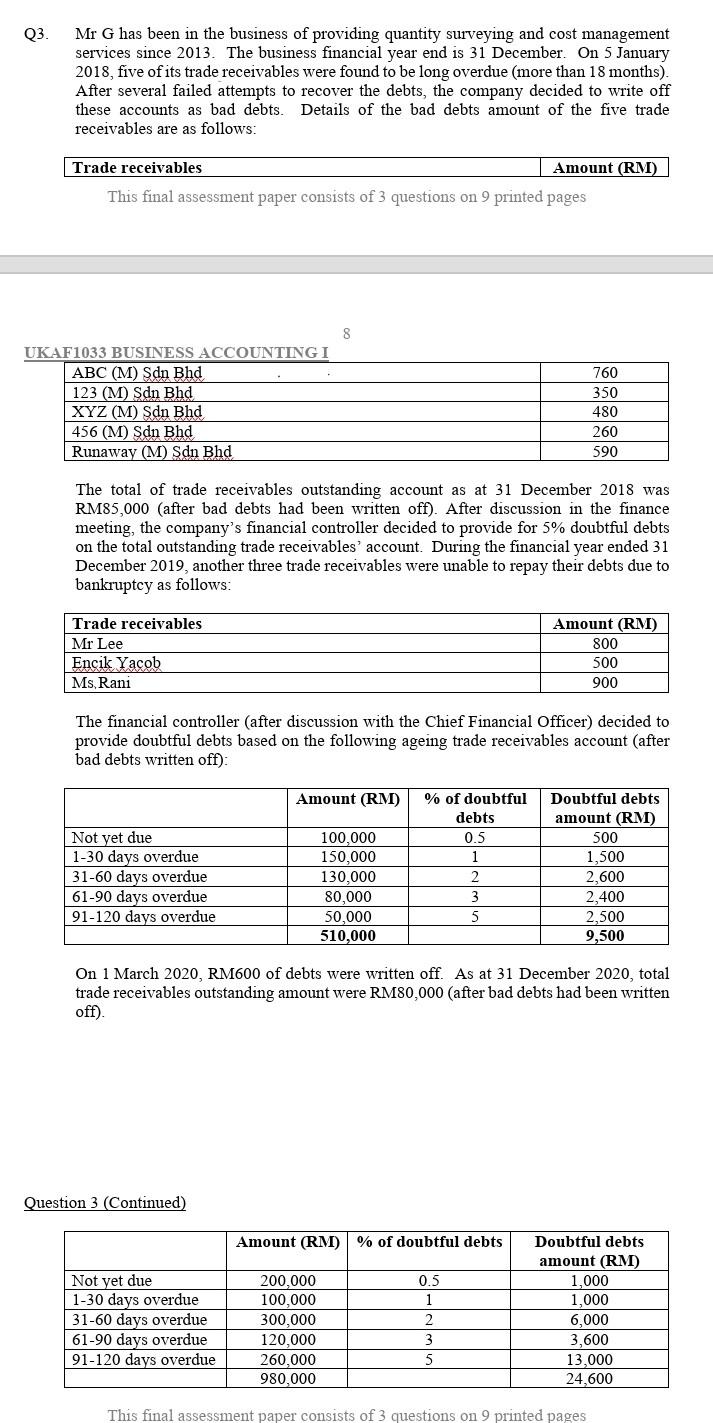

Q3. Mr G has been in the business of providing quantity surveying and cost management services since 2013. The business financial year end is 31 December. On 5 January 2018, five of its trade receivables were found to be long overdue (more than 18 months). After several failed attempts to recover the debts, the company decided to write off these accounts as bad debts. Details of the bad debts amount of the five trade receivables are as follows: Trade receivables Amount (RM) This final assessment paper consists of 3 questions on 9 printed pages 8 UKAF1033 BUSINESS ACCOUNTING I ABC (M) Sdn Bhd 123 (M) Sdn Bhd XYZ (M) Sdn Bhd 456 (M) Sdn Bhd Runaway (M) Sdn Bhd 760 350 480 260 590 The total of trade receivables outstanding account as at 31 December 2018 was RM85,000 (after bad debts had been written off). After discussion in the finance meeting, the company's financial controller decided to provide for 5% doubtful debts on the total outstanding trade receivables' account. During the financial year ended 31 December 2019, another three trade receivables were unable to repay their debts due to bankruptcy as follows: Trade receivables Mr Lee Encik Yacob Ms Rani Amount (RM) 800 500 900 The financial controller (after discussion with the Chief Financial Officer) decided to provide doubtful debts based on the following ageing trade receivables account (after bad debts written off): Amount (RM) Not yet due 1-30 days overdue 31-60 days overdue 61-90 days overdue 91-120 days overdue 100,000 150,000 130.000 80,000 50,000 510,000 % of doubtful debts 0.5 1 2 3 5 Doubtful debts amount (RM) 500 1,500 2,600 2,400 2.500 9,500 On 1 March 2020, RM600 of debts were written off. As at 31 December 2020, total trade receivables outstanding amount were RM80,000 (after bad debts had been written off) Question 3 Continued) Amount (RM)% of doubtful debts 0.5 Not yet due 1-30 days overdue 31-60 days overdue 61-90 days overdue 91-120 days overdue 200,000 100,000 300,000 120,000 260,000 980,000 1 2 3 5 Doubtful debts amount (RM) 1,000 1,000 6,000 3,600 13,000 24,600 This final assessment paper consists of 3 questions on 9 printed pages Q3. Mr G has been in the business of providing quantity surveying and cost management services since 2013. The business financial year end is 31 December. On 5 January 2018, five of its trade receivables were found to be long overdue (more than 18 months). After several failed attempts to recover the debts, the company decided to write off these accounts as bad debts. Details of the bad debts amount of the five trade receivables are as follows: Trade receivables Amount (RM) This final assessment paper consists of 3 questions on 9 printed pages 8 UKAF1033 BUSINESS ACCOUNTING I ABC (M) Sdn Bhd 123 (M) Sdn Bhd XYZ (M) Sdn Bhd 456 (M) Sdn Bhd Runaway (M) Sdn Bhd 760 350 480 260 590 The total of trade receivables outstanding account as at 31 December 2018 was RM85,000 (after bad debts had been written off). After discussion in the finance meeting, the company's financial controller decided to provide for 5% doubtful debts on the total outstanding trade receivables' account. During the financial year ended 31 December 2019, another three trade receivables were unable to repay their debts due to bankruptcy as follows: Trade receivables Mr Lee Encik Yacob Ms Rani Amount (RM) 800 500 900 The financial controller (after discussion with the Chief Financial Officer) decided to provide doubtful debts based on the following ageing trade receivables account (after bad debts written off): Amount (RM) Not yet due 1-30 days overdue 31-60 days overdue 61-90 days overdue 91-120 days overdue 100,000 150,000 130.000 80,000 50,000 510,000 % of doubtful debts 0.5 1 2 3 5 Doubtful debts amount (RM) 500 1,500 2,600 2,400 2.500 9,500 On 1 March 2020, RM600 of debts were written off. As at 31 December 2020, total trade receivables outstanding amount were RM80,000 (after bad debts had been written off) Question 3 Continued) Amount (RM)% of doubtful debts 0.5 Not yet due 1-30 days overdue 31-60 days overdue 61-90 days overdue 91-120 days overdue 200,000 100,000 300,000 120,000 260,000 980,000 1 2 3 5 Doubtful debts amount (RM) 1,000 1,000 6,000 3,600 13,000 24,600 This final assessment paper consists of 3 questions on 9 printed pagesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started