Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Prepare the journal entries to record the three investments b) Prepare the journal entry for the sale of the 3,390 Nirmala shares on May

a) Prepare the journal entries to record the three investments

b) Prepare the journal entry for the sale of the 3,390 Nirmala shares on May 20

c) Prepare the adjusting entry needed on December 31, 2023

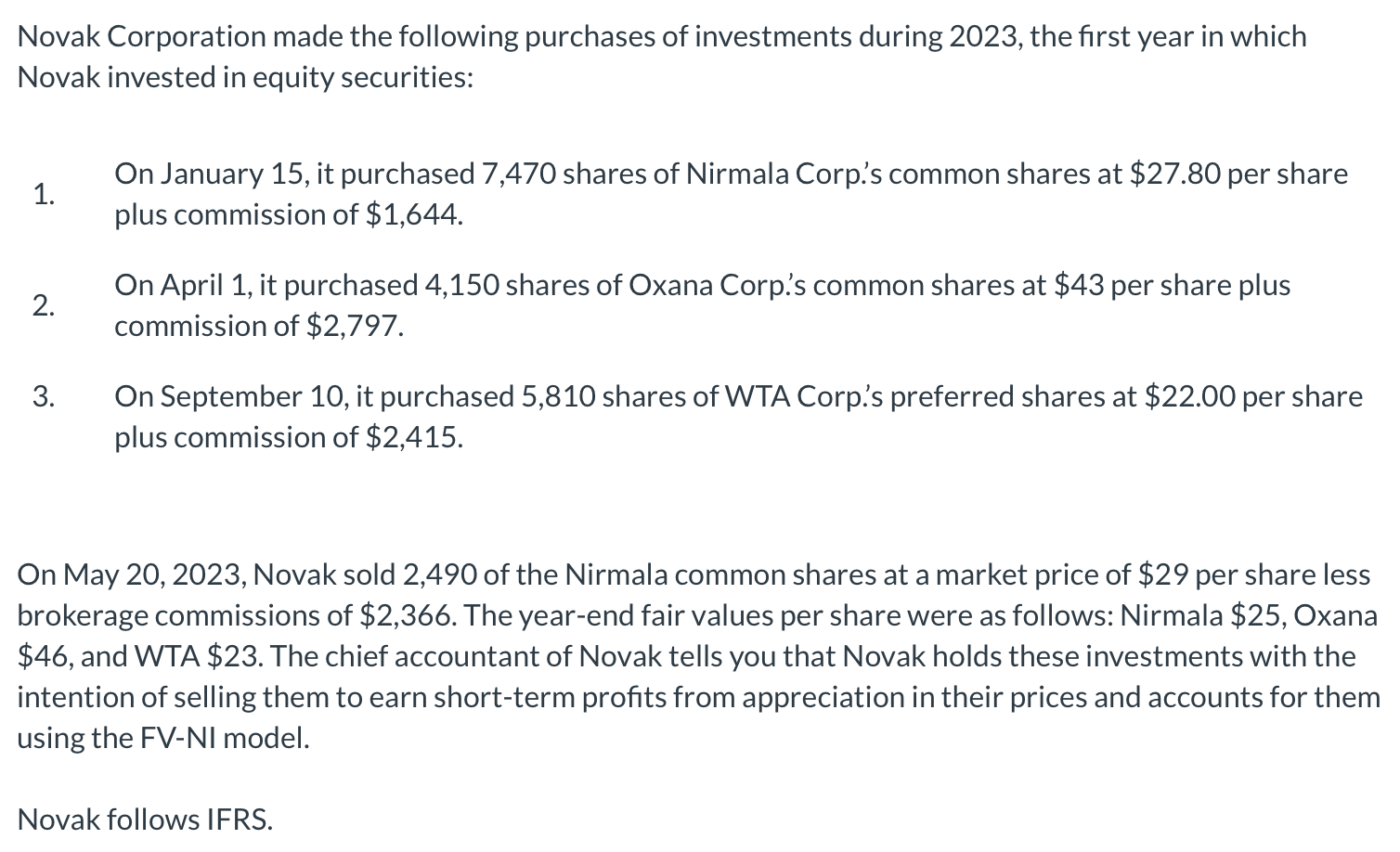

Novak Corporation made the following purchases of investments during 2023 , the first year in which Novak invested in equity securities: 1. On January 15 , it purchased 7,470 shares of Nirmala Corp.'s common shares at $27.80 per share plus commission of $1,644. 2. On April 1, it purchased 4,150 shares of Oxana Corp.'s common shares at $43 per share plus commission of $2,797. 3. On September 10, it purchased 5,810 shares of WTA Corp.'s preferred shares at $22.00 per share plus commission of $2,415. On May 20, 2023, Novak sold 2,490 of the Nirmala common shares at a market price of $29 per share less brokerage commissions of $2,366. The year-end fair values per share were as follows: Nirmala $25, Oxana $46, and WTA $23. The chief accountant of Novak tells you that Novak holds these investments with the intention of selling them to earn short-term profits from appreciation in their prices and accounts for them using the FV-NI model. Novak follows IFRS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started