Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Prepare the necessary entries to adjust and close the books of ITV Company (b) Prepare the entries to record the investments of ITV Co

(a) Prepare the necessary entries to adjust and close the books of ITV Company

(b) Prepare the entries to record the investments of ITV Co and YSL in the new partnership books

(c) Prepare a statement of financial position for the partnership if ITV Co and YSL on December 1, 2021

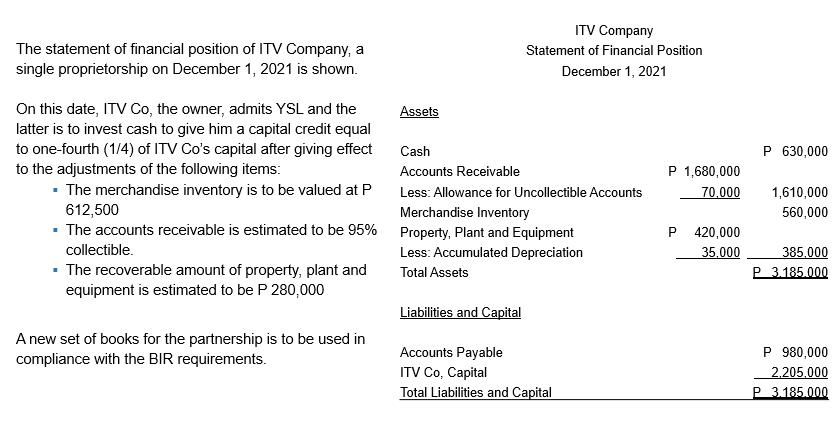

ITV Company The statement of financial position of ITV Company, a Statement of Financial Position single proprietorship on December 1, 2021 is shown. December 1, 2021 On this date, ITV Co, the owner, admits YSL and the latter is to invest cash to give him a capital credit equal to one-fourth (1/4) of ITV Co's capital after giving effect to the adjustments of the following items: The merchandise inventory is to be valued at P Assets Cash P 630,000 P 1,680,000 70.000 Accounts Receivable Less: Allowance for Uncollectible Accounts 1,610,000 612,500 The accounts receivable is estimated to be 95% Merchandise Inventory Property, Plant and Equipment 560,000 420,000 collectible. Less: Accumulated Depreciation 35,000 385.000 The recoverable amount of property, plant and equipment is estimated to be P 280,000 Total Assets P 3.185.000 Liabilities and Capital A new set of books for the partnership is to be used in compliance with the BIR requirements. P 980,000 Accounts Payable ITV Co, Capital Total Liabilities and Capital 2.205.000 P 3.185.000

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a NECESSARY ENTRIES IN THE BOOKS OF ITV COMPANY TO ADJUST AND CLOSE THE BOOKS DEBIT AMOUNT CREDIT AMOUNT IN P IN P Accumulated Depreciation Account 35...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started