Answered step by step

Verified Expert Solution

Question

1 Approved Answer

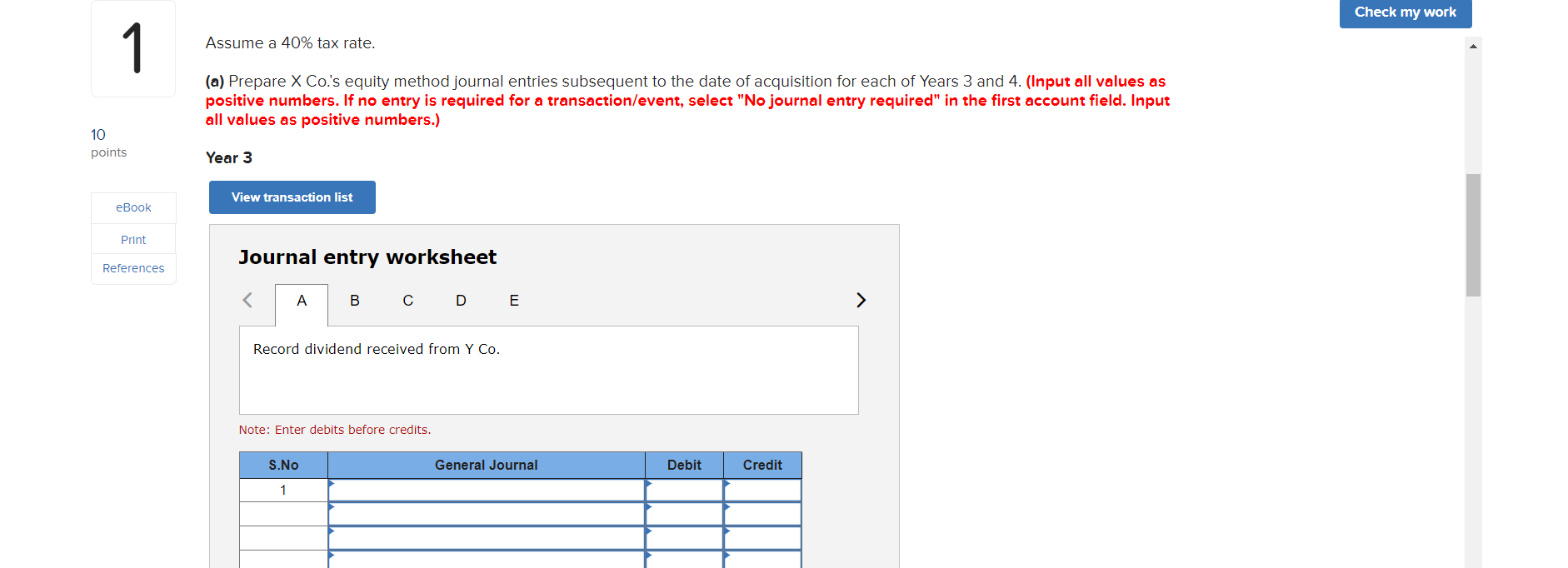

(a) Prepare X Co.'s equity method journal entries subsequent to the date of acquisition for each of Years 3 and 4. (Input all values as

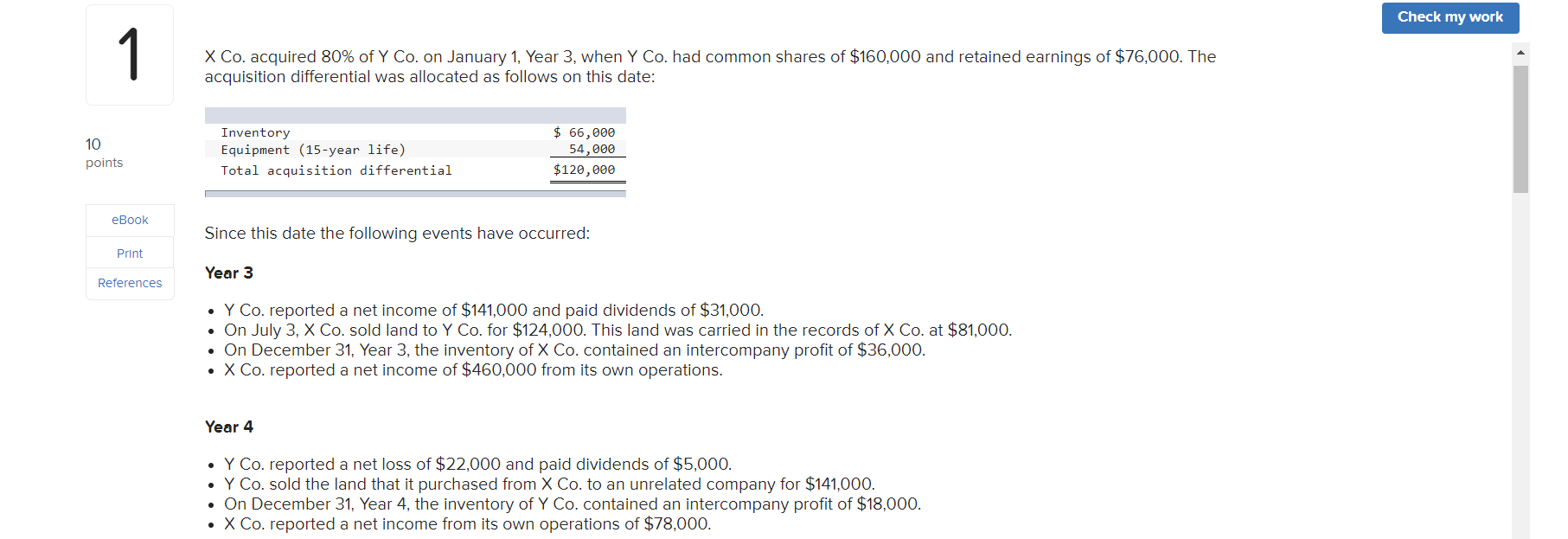

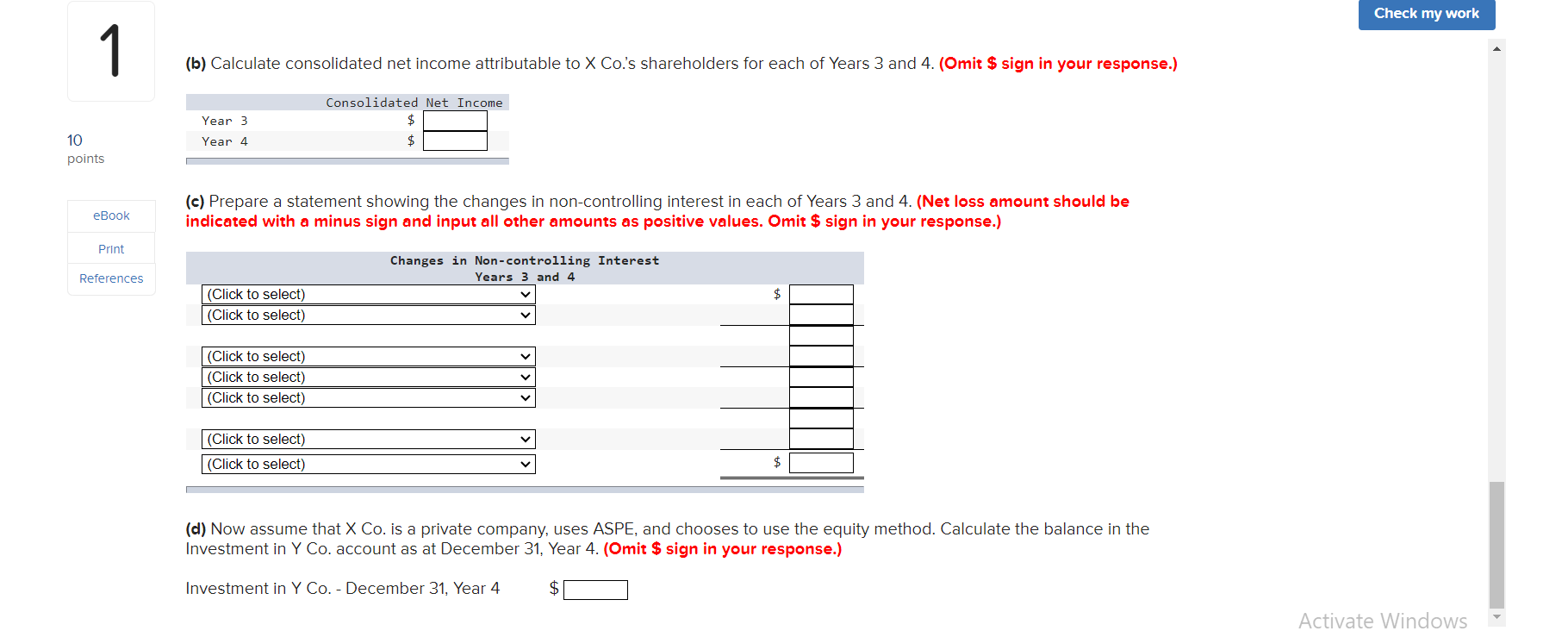

(a) Prepare X Co.'s equity method journal entries subsequent to the date of acquisition for each of Years 3 and 4. (Input all values as positive numbers. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Input all values as positive numbers.) Year 3 (c) Prepare a statement showing the changes in non-controlling interest in each of Years 3 and 4. (Net loss amount should be indicated with a minus sign and input all other amounts as positive values. Omit $ sign in your response.) (d) Now assume that X Co. is a private company, uses ASPE, and chooses to use the equity method. Calculate the balance in the Investment in Y Co. account as at December 31, Year 4. (Omit \$ sign in your response.) Investment in Y Co. - December 31, Year 4 $ X Co. acquired 80% of Y Co. on January 1, Year 3, when Y Co. had common shares of $160,000 and retained earnings of $76,000. The acquisition differential was allocated as follows on this date: Since this date the following events have occurred: Year 3 - Y Co. reported a net income of $141,000 and paid dividends of $31,000. - On July 3,X Co. sold land to Y Co. for $124,000. This land was carried in the records of X Co. at $81,000. - On December 31, Year 3, the inventory of X Co. contained an intercompany profit of $36,000. - X Co. reported a net income of $460,000 from its own operations. Year 4 - Y Co. reported a net loss of $22,000 and paid dividends of $5,000. - Y Co. sold the land that it purchased from X Co. to an unrelated company for $141,000. - On December 31, Year 4, the inventory of Y Co. contained an intercompany profit of $18,000. - X Co. reported a net income from its own operations of $78,000

(a) Prepare X Co.'s equity method journal entries subsequent to the date of acquisition for each of Years 3 and 4. (Input all values as positive numbers. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Input all values as positive numbers.) Year 3 (c) Prepare a statement showing the changes in non-controlling interest in each of Years 3 and 4. (Net loss amount should be indicated with a minus sign and input all other amounts as positive values. Omit $ sign in your response.) (d) Now assume that X Co. is a private company, uses ASPE, and chooses to use the equity method. Calculate the balance in the Investment in Y Co. account as at December 31, Year 4. (Omit \$ sign in your response.) Investment in Y Co. - December 31, Year 4 $ X Co. acquired 80% of Y Co. on January 1, Year 3, when Y Co. had common shares of $160,000 and retained earnings of $76,000. The acquisition differential was allocated as follows on this date: Since this date the following events have occurred: Year 3 - Y Co. reported a net income of $141,000 and paid dividends of $31,000. - On July 3,X Co. sold land to Y Co. for $124,000. This land was carried in the records of X Co. at $81,000. - On December 31, Year 3, the inventory of X Co. contained an intercompany profit of $36,000. - X Co. reported a net income of $460,000 from its own operations. Year 4 - Y Co. reported a net loss of $22,000 and paid dividends of $5,000. - Y Co. sold the land that it purchased from X Co. to an unrelated company for $141,000. - On December 31, Year 4, the inventory of Y Co. contained an intercompany profit of $18,000. - X Co. reported a net income from its own operations of $78,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started