Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Price a down-and-in call option with final payoff as follows: Payoff (T) = [max(ST - K,0); TH 0: S, 0: S 2 H)

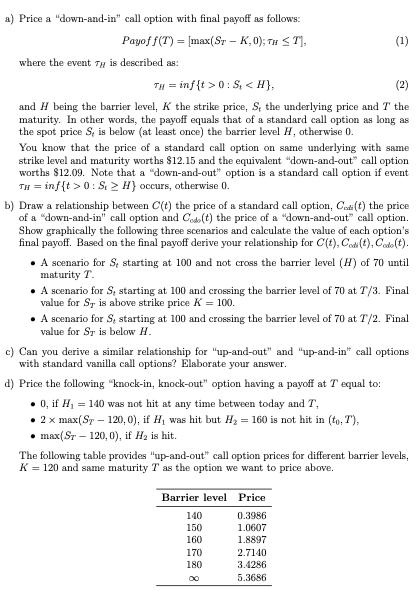

a) Price a "down-and-in" call option with final payoff as follows: Payoff (T) = [max(ST - K,0); TH 0: S, 0: S 2 H) occurs, otherwise 0. b) Draw a relationship between C(t) the price of a standard call option, Co(t) the price of a "down-and-in" call option and Code(t) the price of a "down-and-out" call option. Show graphically the following three scenarios and calculate the value of each option's final payoff. Based on the final payoff derive your relationship for C(t), Codi(t), Codo(t). A scenario for S, starting at 100 and not cross the barrier level (H) of 70 until maturity T. A scenario for S, starting at 100 and crossing the barrier level of 70 at T/3. Final value for ST is above strike price K = 100. . A scenario for S, starting at 100 and crossing the barrier level of 70 at T/2. Final value for Sr is below H. c) Can you derive a similar relationship for "up-and-out" and "up-and-in" call options with standard vanilla call options? Elaborate your answer. d) Price the following "knock-in, knock-out" option having a payoff at T equal to: 0, if H = 140 was not hit at any time between today and T, 2 x max(ST - 120, 0), if H was hit but H = 160 is not hit in (to, T), max(ST 120, 0), if H is hit. The following table provides "up-and-out" call option prices for different barrier levels, K = 120 and same maturity T as the option we want to price above. Barrier level Price 140 0.3986 150 1.0607 160 1.8897 170 2.7140 180 3.4286 00 5.3686

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DownandIn Call Option Pricing and Relationships a b c a DownandIn Call Option Price Unfortunately due to the path dependency of the downandin option a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started