Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Prices, coupon rates (paid semi-annually) and maturity dates of three comparable Treasury bonds, as of March 16, 2018, are listed below: All bonds have

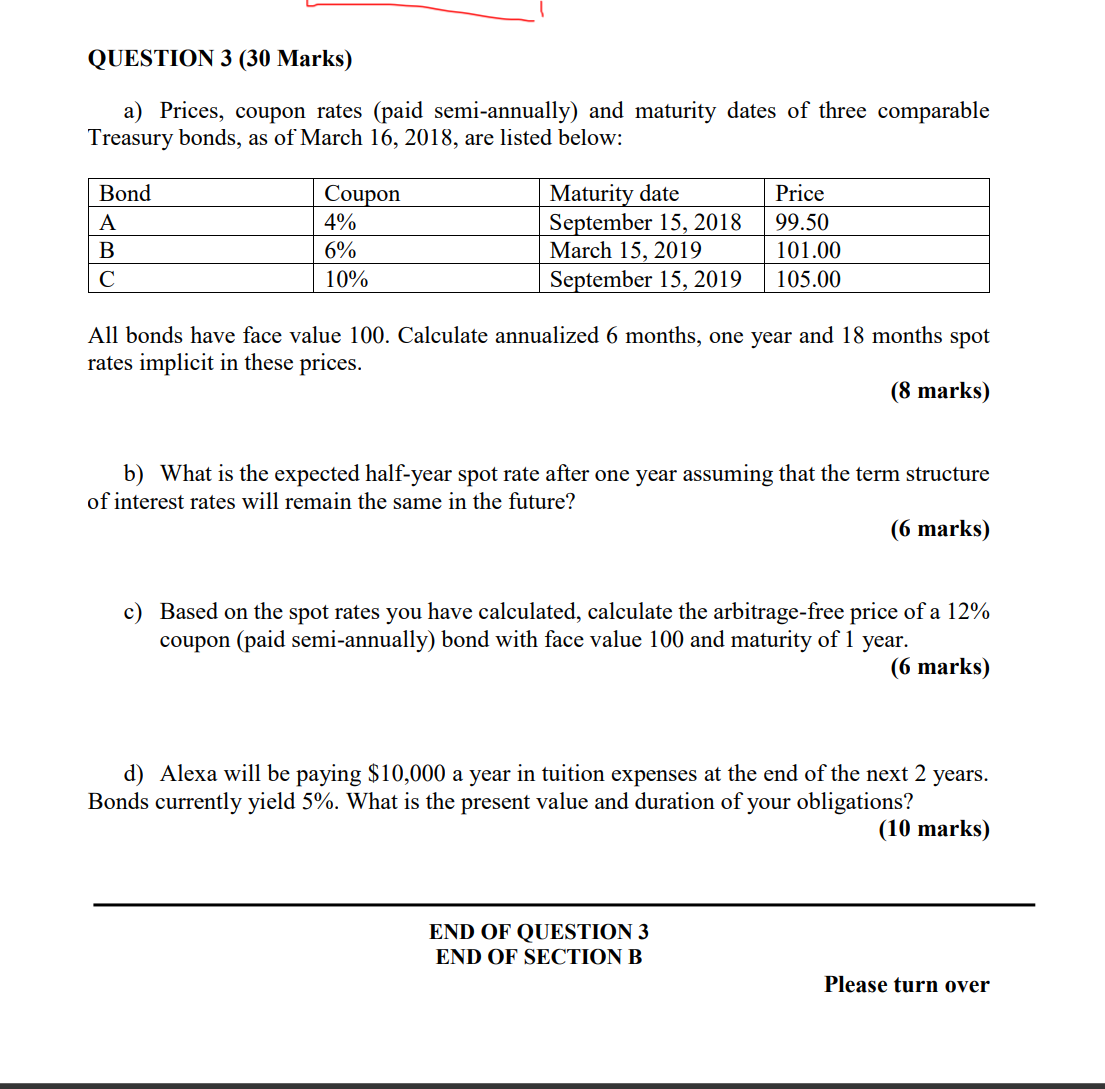

a) Prices, coupon rates (paid semi-annually) and maturity dates of three comparable Treasury bonds, as of March 16, 2018, are listed below: All bonds have face value 100. Calculate annualized 6 months, one year and 18 months spot rates implicit in these prices. (8 marks) b) What is the expected half-year spot rate after one year assuming that the term structure of interest rates will remain the same in the future? (6 marks) c) Based on the spot rates you have calculated, calculate the arbitrage-free price of a 12% coupon (paid semi-annually) bond with face value 100 and maturity of 1 year. (6 marks) d) Alexa will be paying $10,000 a year in tuition expenses at the end of the next 2 years. Bonds currently yield 5%. What is the present value and duration of your obligations? (10 marks)

a) Prices, coupon rates (paid semi-annually) and maturity dates of three comparable Treasury bonds, as of March 16, 2018, are listed below: All bonds have face value 100. Calculate annualized 6 months, one year and 18 months spot rates implicit in these prices. (8 marks) b) What is the expected half-year spot rate after one year assuming that the term structure of interest rates will remain the same in the future? (6 marks) c) Based on the spot rates you have calculated, calculate the arbitrage-free price of a 12% coupon (paid semi-annually) bond with face value 100 and maturity of 1 year. (6 marks) d) Alexa will be paying $10,000 a year in tuition expenses at the end of the next 2 years. Bonds currently yield 5%. What is the present value and duration of your obligations? (10 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started