Answered step by step

Verified Expert Solution

Question

1 Approved Answer

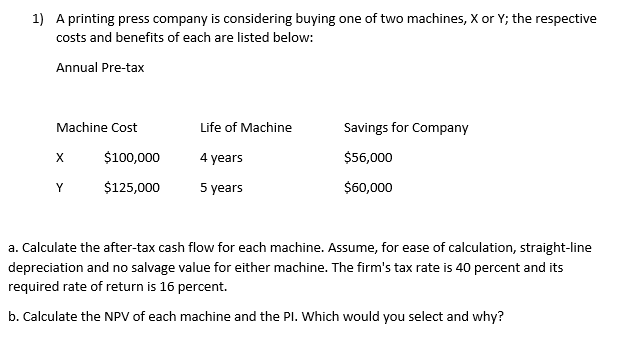

A printing press company is considering buying one of two machines, X or Y; the respective costs and benefits of each are listed below: Annual

- A printing press company is considering buying one of two machines, X or Y; the respective costs and benefits of each are listed below:

Annual Pre-tax

Machine Cost Life of Machine Savings for Company

X $100,000 4 years $56,000

Y $125,000 5 years $60,000

a. Calculate the after-tax cash flow for each machine. Assume, for ease of calculation, straight-line depreciation and no salvage value for either machine. The firm's tax rate is 40 percent and its required rate of return is 16 percent.

b. Calculate the NPV of each machine and the PI. Which would you select and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started