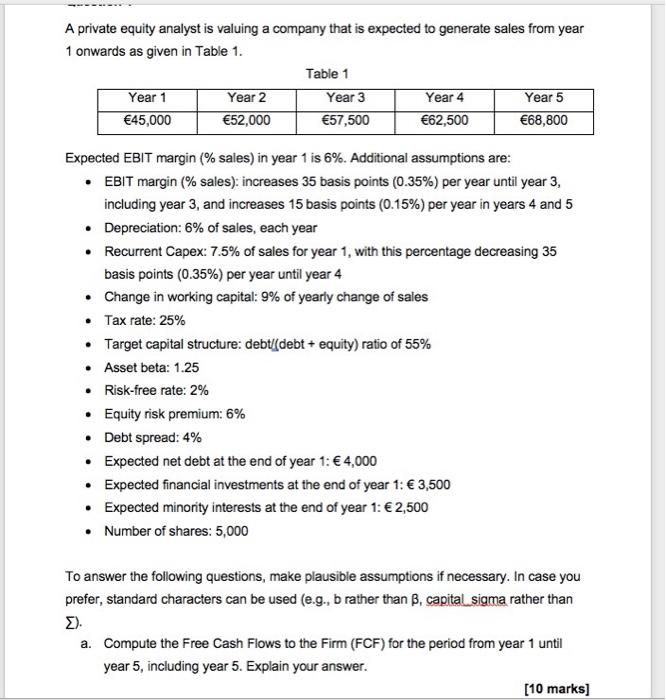

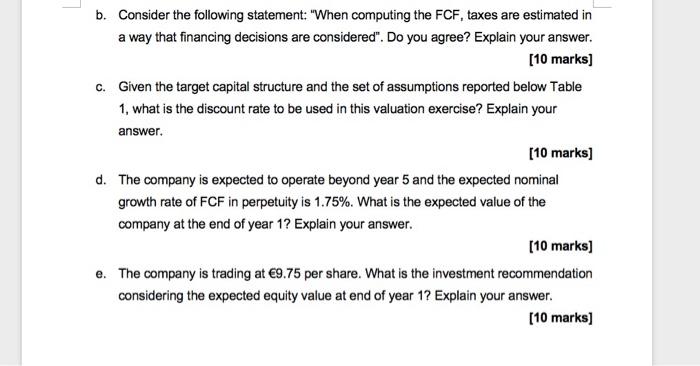

A private equity analyst is valuing a company that is expected to generate sales from year 1 onwards as given in Table 1. Table 1 Year 1 Year 2 Year 3 Year 4 Year 5 45,000 52,000 57,500 62,500 68,800 Expected EBIT margin (% sales) in year 1 is 6%. Additional assumptions are: EBIT margin (% sales): increases 35 basis points (0.35%) per year until year 3, including year 3, and increases 15 basis points (0.15%) per year in years 4 and 5 Depreciation: 6% of sales, each year Recurrent Capex: 7.5% of sales for year 1, with this percentage decreasing 35 basis points (0.35%) per year until year 4 Change in working capital: 9% of yearly change of sales Tax rate: 25% Target capital structure: debt (debt + equity) ratio of 55% Asset beta: 1.25 Risk-free rate: 2% Equity risk premium: 6% Debt spread: 4% Expected net debt at the end of year 1: 4,000 Expected financial investments at the end of year 1: 3,500 Expected minority interests at the end of year 1: 2,500 Number of shares: 5,000 To answer the following questions, make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.g., b rather than B, capital sigma rather than a. Compute the Free Cash Flows to the Firm (FCF) for the period from year 1 until year 5, including year 5. Explain your answer. [10 marks] b. Consider the following statement: "When computing the FCF, taxes are estimated in a way that financing decisions are considered". Do you agree? Explain your answer. [10 marks) C. Given the target capital structure and the set of assumptions reported below Table 1. what is the discount rate to be used in this valuation exercise? Explain your answer. [10 marks) d. The company is expected to operate beyond year 5 and the expected nominal growth rate of FCF in perpetuity is 1.75%. What is the expected value of the company at the end of year 1? Explain your answer. [10 marks] e. The company is trading at 9.75 per share. What is the investment recommendation considering the expected equity value at end of year 1? Explain your answer. [10 marks]