Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A private equity fund calls you regarding its interest in Active Dreamz SA, a French video games company. Active Dreamz SA conducts two businesses:

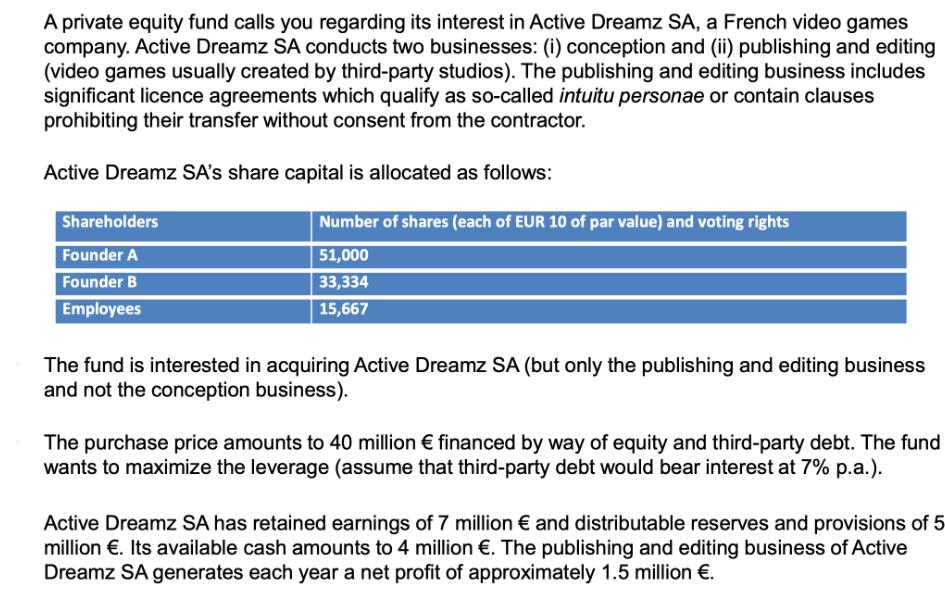

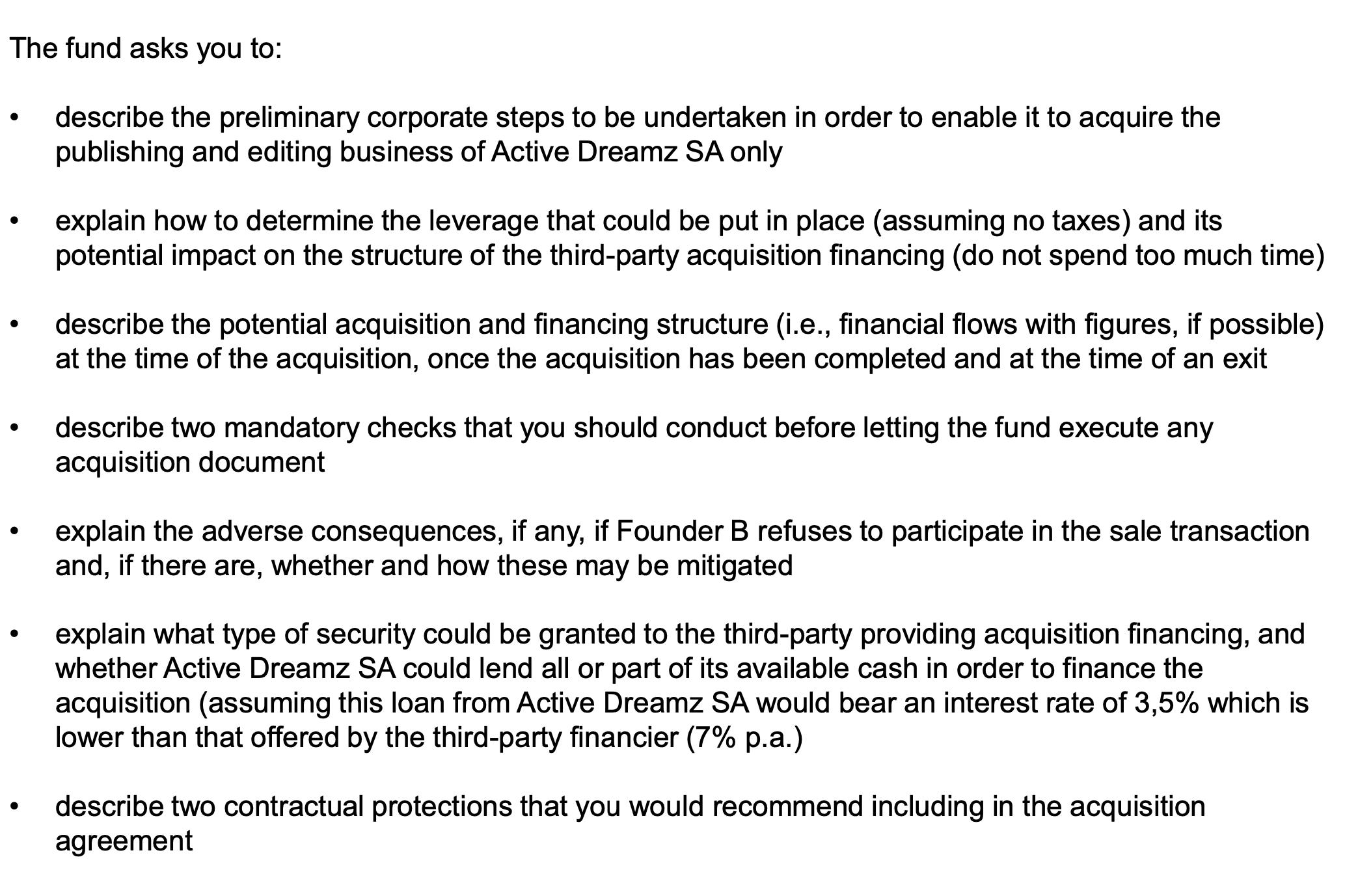

A private equity fund calls you regarding its interest in Active Dreamz SA, a French video games company. Active Dreamz SA conducts two businesses: (i) conception and (ii) publishing and editing (video games usually created by third-party studios). The publishing and editing business includes significant licence agreements which qualify as so-called intuitu personae or contain clauses prohibiting their transfer without consent from the contractor. Active Dreamz SA's share capital is allocated as follows: Shareholders Founder A Founder B Employees Number of shares (each of EUR 10 of par value) and voting rights 51,000 33,334 15,667 The fund is interested in acquiring Active Dreamz SA (but only the publishing and editing business and not the conception business). The purchase price amounts to 40 million financed by way of equity and third-party debt. The fund wants to maximize the leverage (assume that third-party debt would bear interest at 7% p.a.). Active Dreamz SA has retained earnings of 7 million and distributable reserves and provisions of 5 million . Its available cash amounts to 4 million . The publishing and editing business of Active Dreamz SA generates each year a net profit of approximately 1.5 million . The fund asks you to: describe the preliminary corporate steps to be undertaken in order to enable it to acquire the publishing and editing business of Active Dreamz SA only explain how to determine the leverage that could be put in place (assuming no taxes) and its potential impact on the structure of the third-party acquisition financing (do not spend too much time) describe the potential acquisition and financing structure (i.e., financial flows with figures, if possible) at the time of the acquisition, once the acquisition has been completed and at the time of an exit describe two mandatory checks that you should conduct before letting the fund execute any acquisition document explain the adverse consequences, if any, if Founder B refuses to participate in the sale transaction and, if there are, whether and how these may be mitigated explain what type of security could be granted to the third-party providing acquisition financing, and whether Active Dreamz SA could lend all or part of its available cash in order to finance the acquisition (assuming this loan from Active Dreamz SA would bear an interest rate of 3,5% which is lower than that offered by the third-party financier (7% p.a.) describe two contractual protections that you would recommend including in the acquisition agreement

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Acquisition of Active Dreamz SAs Publishing Editing Business 1 Preliminary Corporate Steps Spinoff of the publishing editing business Separate the bus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started