Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A private startup company has just gone public. It is not expected to pay any dividends for the first 2 years. It is then

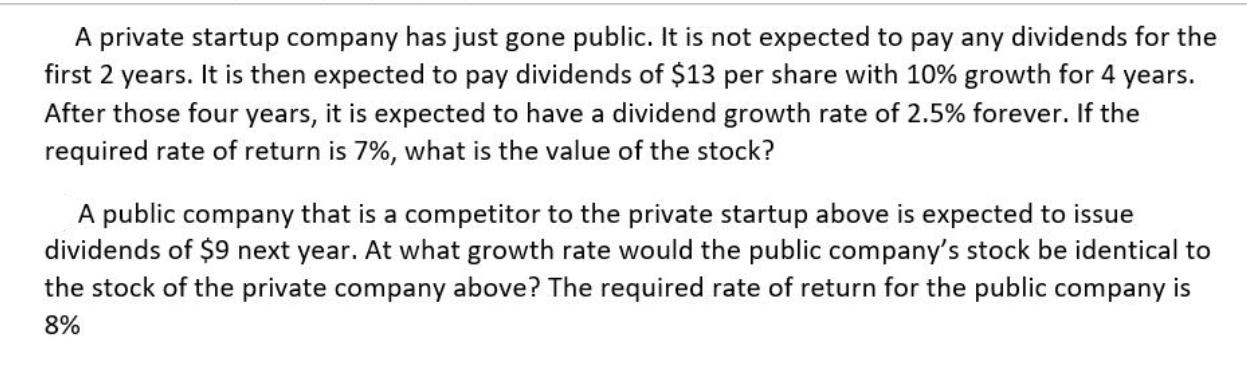

A private startup company has just gone public. It is not expected to pay any dividends for the first 2 years. It is then expected to pay dividends of $13 per share with 10% growth for 4 years. After those four years, it is expected to have a dividend growth rate of 2.5% forever. If the required rate of return is 7%, what is the value of the stock? A public company that is a competitor to the private startup above is expected to issue dividends of $9 next year. At what growth rate would the public company's stock be identical to the stock of the private company above? The required rate of return for the public company is 8%

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Valuation of the Private Startup We can use the Gordon Growth Model GGM to value the private startup Step 1 Calculate the terminal value TV Year 6 onwards Constant growth rate g 25 Dividend in year 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started