Question

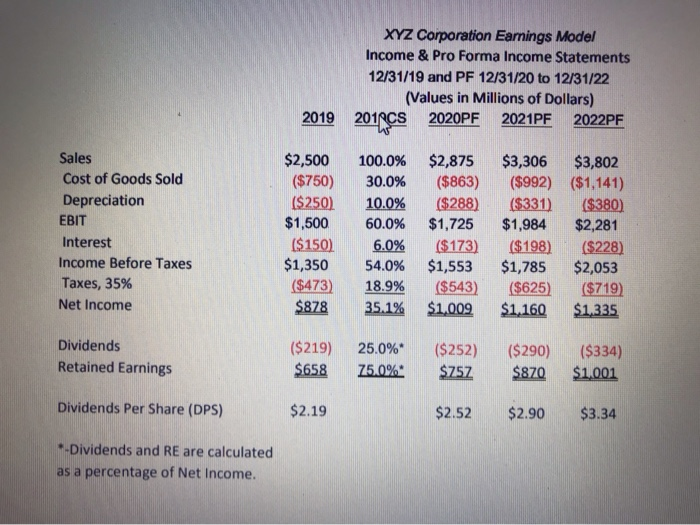

A pro forma Income Statement must be prepared in MS Excel, using a minimum projection of three years, as based on pro forma projections discussed

A pro forma Income Statement must be prepared in MS Excel, using a minimum projection of three years, as based on pro forma projections discussed in Chapter 18. You need to include the most recent income statement for your company that is part of the 10-K. This information can then be used to calculate the fair value of the companys stock price, as based on the stock valuation formulas discussed in Chapters 7 and 20. All assumptions and formulas used for the pro forma projections and the companys fair value must be included at the end of your model. Once a fair value is reached, this can be compared to a recent quote of the companys stock price to determine whether or not the company is fairly valued at its most recent trading price. A separate attachment provides an example of how this should be constructed.

Earnings Model Projections and Assumptions:

-Pro forma sales growth is 15% per year

-Common Size values are calculated as a percentage of sales, unless noted otherwise

-DPS is calculated as Dividends / 100 Million Shares Outstanding

-Dividends are expected to grow at a constant rate of 20% after pf2022

-The required return is 10%

-The value of this company is calculated as P0 = D1 / (1 + r) + D2 / (1 + r)^2 + D3 / (1 + r) ^3 +P3 / (1 + r) ^3 Where P3 = D3 / r - g

Using the Projections from XYZ Corporation's Earnings Model,

P0 = $2.52 / (1+0.10) + $2.90 / (1+0.10) ^2 + $3.34 / (1.10)^3 + $36.70 / (1.10) ^3 Where P3 = $3.34 / 0.20 - 0.10

P0 = $2.29 + $2.40 + $2.51 + $27.57 P0 = $34.77

-Once an estimated value is established, there are three possible valuation scenarios when it is compared to a recent quote, as follows:

Earnings Model Value XYZ Most Recent Quote (Three Scenarios)

P0 = $34.77 Scenario 1) $25, Undervalued

P0 = $34.77 Scenario 2) $50, Overvalued

P0 = $34.77 Scenario 3) $35, Fairly Valued

EVERYTHING NEEDED TO COMPLETE THE TASK IS BELOW (Including an example):

Here are the data of Qualcomm Inc. company to be used for the Pro Forma Statement projection for 3 years : (Values are in Millions except DPS)

Revenues/Sales: 9,824 Million Interest: 317 Million

Cost of Goods Sold: 4,367 Million Income before taxes: 1,366 Million

Depreciation: 698 Million Taxes: 2,088 Million

EBIT: 1,650 Million Net income: 1,731 Million

Dividends: 1,502 Million Retained earnings: 4,466 Million

Dividends per share (DPS): $0.62

Heres an example of whats expected from this task:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started