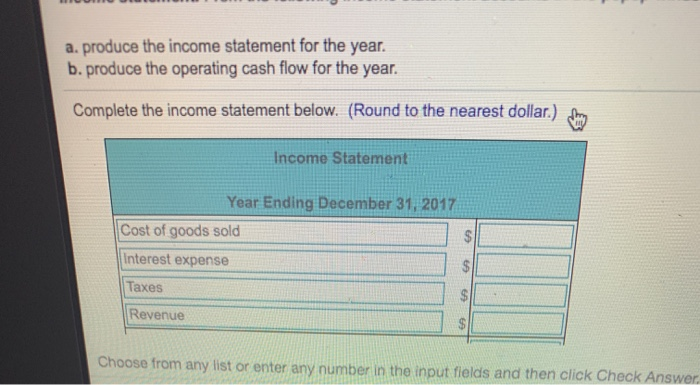

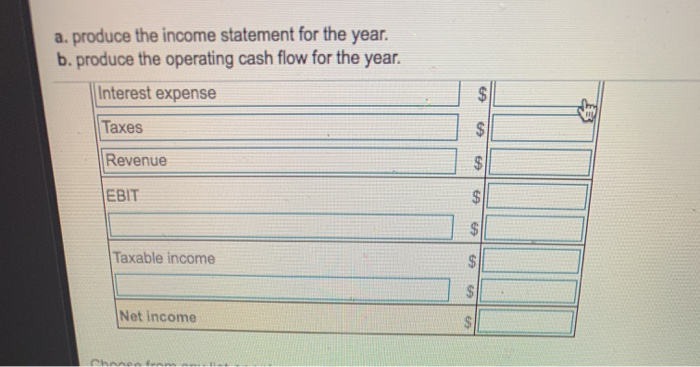

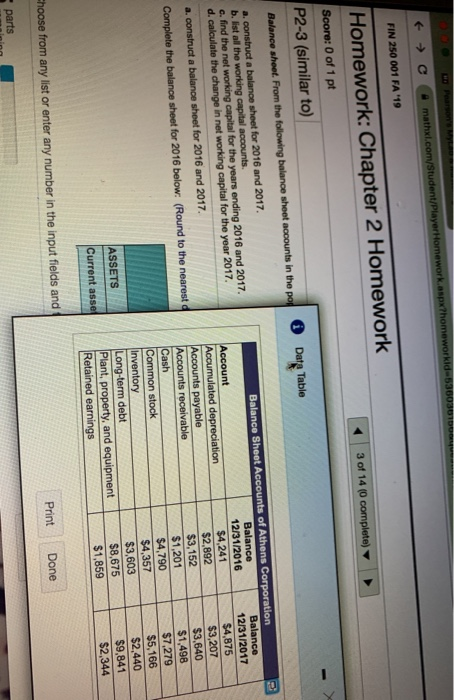

a. produce the income statement for the year. b. produce the operating cash flow for the year. Complete the income statement below. (Round to the nearest dollar.) fing Income Statement Year Ending December 31, 2017 Cost of goods sold Interest expense Taxes Revenue Choose from any list or enter any number in the input fields and then click Check Answer a. produce the income statement for the year. b. produce the operating cash flow for the year. Interest expense Taxes Revenue EBIT Taxable income Net income Chun OP C mathx.com/Student/Player Homework.aspx homeworklo 53000 3 of 14 (0 complete) FIN 250 001 FA '19 Homework: Chapter 2 Homework Score: 0 of 1 pt P2-3 (similar to) Balance sheet. From the following balance sheet accounts in the pog Date Table a. construct a balance sheet for 2016 and 2017 b. list all the working capital accounts. c. find the networking capital for the years ending 2016 and 2017. d. calculate the change in net working capital for the year 2017 a. construct a balance sheet for 2016 and 2017. Complete the balance sheet for 2016 below. (Round to the nearest Balance Sheet Accounts of Athens Corporation Balance Balance 12/31/2016 12/31/2017 Account $4,875 $4,241 Accumulated depreciation $2,892 $3,207 Accounts payable $3,152 $3,640 Accounts receivable $1,498 $1,201 Cash $7.279 $4,790 Common stock $5,166 $4,357 Inventory $2,440 $3,603 Long-term debt $8,675 $9,841 Plant, property, and equipment $1,859 $2,344 Retained earnings ASSETS Current asse Print Done Choose from any list or enter any number in the input fields and parts a. produce the income statement for the year. b. produce the operating cash flow for the year. Complete the income statement below. (Round to the nearest dollar.) fing Income Statement Year Ending December 31, 2017 Cost of goods sold Interest expense Taxes Revenue Choose from any list or enter any number in the input fields and then click Check Answer a. produce the income statement for the year. b. produce the operating cash flow for the year. Interest expense Taxes Revenue EBIT Taxable income Net income Chun OP C mathx.com/Student/Player Homework.aspx homeworklo 53000 3 of 14 (0 complete) FIN 250 001 FA '19 Homework: Chapter 2 Homework Score: 0 of 1 pt P2-3 (similar to) Balance sheet. From the following balance sheet accounts in the pog Date Table a. construct a balance sheet for 2016 and 2017 b. list all the working capital accounts. c. find the networking capital for the years ending 2016 and 2017. d. calculate the change in net working capital for the year 2017 a. construct a balance sheet for 2016 and 2017. Complete the balance sheet for 2016 below. (Round to the nearest Balance Sheet Accounts of Athens Corporation Balance Balance 12/31/2016 12/31/2017 Account $4,875 $4,241 Accumulated depreciation $2,892 $3,207 Accounts payable $3,152 $3,640 Accounts receivable $1,498 $1,201 Cash $7.279 $4,790 Common stock $5,166 $4,357 Inventory $2,440 $3,603 Long-term debt $8,675 $9,841 Plant, property, and equipment $1,859 $2,344 Retained earnings ASSETS Current asse Print Done Choose from any list or enter any number in the input fields and parts