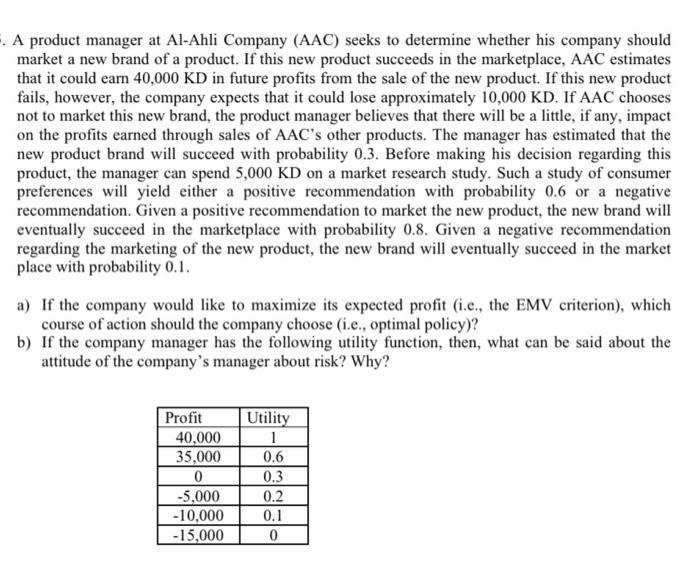

. A product manager at Al-Ahli Company (AAC) seeks to determine whether his company should market a new brand of a product. If this new product succeeds in the marketplace, AAC estimates that it could earn 40,000 KD in future profits from the sale of the new product. If this new product fails, however, the company expects that it could lose approximately 10,000 KD. If AAC chooses not to market this new brand, the product manager believes that there will be a little, if any, impact on the profits earned through sales of AAC's other products. The manager has estimated that the new product brand will succeed with probability 0.3. Before making his decision regarding this product, the manager can spend 5,000 KD on a market research study. Such a study of consumer preferences will yield either a positive recommendation with probability 0.6 or a negative recommendation. Given a positive recommendation to market the new product, the new brand will eventually succeed in the marketplace with probability 0.8. Given a negative recommendation regarding the marketing of the new product, the new brand will eventually succeed in the market place with probability 0.1. a) If the company would like to maximize its expected profit (i.e., the EMV criterion), which course of action should the company choose (i.e., optimal policy)? b) If the company manager has the following utility function, then, what can be said about the attitude of the company's manager about risk? Why? Profit 40,000 35,000 0 -5,000 -10,000 -15,000 Utility 1 0.6 0.3 0.2 0.1 0 . A product manager at Al-Ahli Company (AAC) seeks to determine whether his company should market a new brand of a product. If this new product succeeds in the marketplace, AAC estimates that it could earn 40,000 KD in future profits from the sale of the new product. If this new product fails, however, the company expects that it could lose approximately 10,000 KD. If AAC chooses not to market this new brand, the product manager believes that there will be a little, if any, impact on the profits earned through sales of AAC's other products. The manager has estimated that the new product brand will succeed with probability 0.3. Before making his decision regarding this product, the manager can spend 5,000 KD on a market research study. Such a study of consumer preferences will yield either a positive recommendation with probability 0.6 or a negative recommendation. Given a positive recommendation to market the new product, the new brand will eventually succeed in the marketplace with probability 0.8. Given a negative recommendation regarding the marketing of the new product, the new brand will eventually succeed in the market place with probability 0.1. a) If the company would like to maximize its expected profit (i.e., the EMV criterion), which course of action should the company choose (i.e., optimal policy)? b) If the company manager has the following utility function, then, what can be said about the attitude of the company's manager about risk? Why? Profit 40,000 35,000 0 -5,000 -10,000 -15,000 Utility 1 0.6 0.3 0.2 0.1 0