Question

A product producing plans to purchase for $100,000 a new piece of equipment having an expected useful life of 5 years. Based on past experience

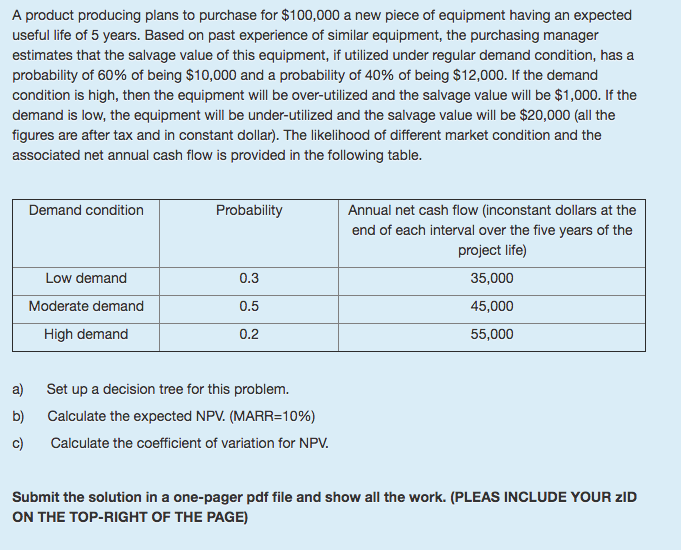

A product producing plans to purchase for $100,000 a new piece of equipment having an expected useful life of 5 years. Based on past experience of similar equipment, the purchasing manager estimates that the salvage value of this equipment, if utilized under regular demand condition, has a probability of 60% of being $10,000 and a probability of 40% of being $12,000. If the demand condition is high, then the equipment will be over-utilized and the salvage value will be $1,000. If the demand is low, the equipment will be under-utilized and the salvage value will be $20,000 (all the figures are after tax and in constant dollar). The likelihood of different market condition and the associated net annual cash flow is provided in the following table.

| Demand condition | Probability | Annual net cash flow (inconstant dollars at the end of each interval over the five years of the project life) |

| Low demand | 0.3 | 35,000 |

| Moderate demand | 0.5 | 45,000 |

| High demand | 0.2 | 55,000 |

a) Set up a decision tree for this problem.

b) Calculate the expected NPV. (MARR=10%)

c) Calculate the coefficient of variation for NPV.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started