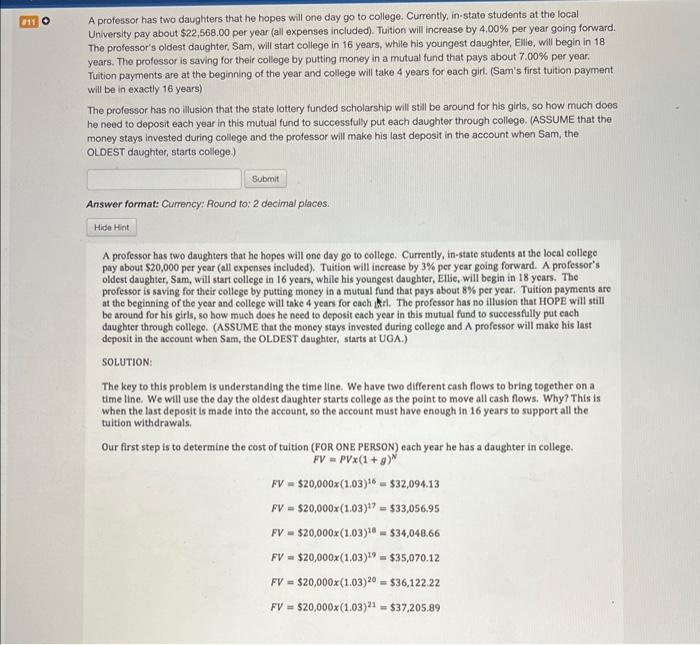

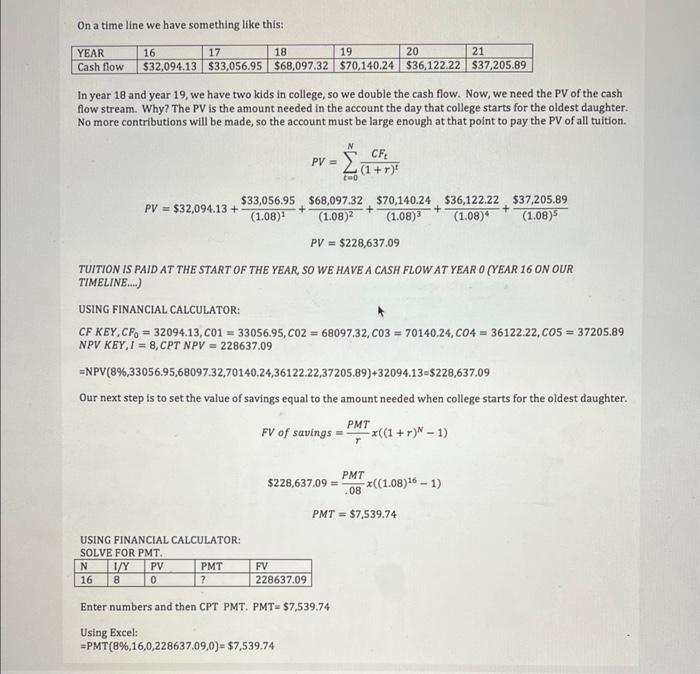

A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $22,568.00 per year (all expenses included). Tuition will increase by 4.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The profossor is saving for their college by putting money in a mutual fund that pays about 7.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST daughter, starts college) Answer format: Currency: Pound to: 2 decimal places. A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local college pay about $20,000 per year (all expenses included). Tuition will increase by 3% per year going forward. A professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 8% per year. Tuition payments are at the beginning of the year and college will take 4 years for each bil. The professor has no illusion that HOPE will still be around for his girls, so how much does he need to deposit cach year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and A professor will make his last deposit in the account when Sam, the OLDEST daughter, starts at UGA.) SOLUTION: The key to this problem is understanding the time line. We have two different cash flows to bring together on a time line. We will use the day the oldest daughter starts college as the point to move all cash flows. Why? This is when the last deposit is made into the account, so the account must have enough in 16 years to support all the tultion withdrawals. Our first step is to determine the cost of tuition (FOR ONE PERSON) each year he has a daughter in college. FV=PVx(1+g)NFV=$20,000x(1.03)16=$32,094.13FV=$20,000x(1.03)17=$33,056.95FV=$20,000x(1.03)18=$34,048.66FV=$20,000x(1.03)19=$35,070.12FV=$20,000x(1.03)20=$36,122.22FV=$20,000x(1.03)21=$37,205.89 On a time line we have something like this: In year 18 and year 19, we have two kids in college, so we double the cash flow. Now, we need the PV of the cash flow stream. Why? The PV is the amount needed in the account the day that college starts for the oldest daughter. No more contributions will be made, so the account must be large enough at that point to pay the PV of all tuition. PV=t=0N(1+r)tCFtPV=$32,094.13+(1.08)1$33,056.95+(1.08)2$68,097.32+(1.08)3$70,140.24+(1.08)4$36,122.22+(1.08)5$37,205.89PV=$228,637.09 TUITION IS PAID AT THE START OF THE YEAR, SO WE HAVE A CASH FLOW AT YEAR O YEAR 16 ON OUR TIMELINE...) USING FINANCIAL CALCULATOR: CF KEY,CF0=32094.13,C01=33056.95,C02=68097.32,C03=70140.24,C04=36122.22,CO5=37205.89 NPV KEY,I=8,CPTNPV=228637.09 =NPV(8%,33056.95,68097.32,70140.24,36122.22,37205.89)+32094.13=$228,637.09 Our next step is to set the value of savings equal to the amount needed when college starts for the oldest daughter. FVofsavings=rPMTx((1+r)N1) $228,637.09=.08PMTx((1.08)PMT=$7,539.74 USING FINANCIAL CALCULATOR: SOLVE FOR PMT. Enter numbers and then CPT PMT. PMT =$7,539.74 Using Excel: =PMT(8%,16,0,228637.09,0)=$7,539.74