Question

A Project Director is looking to implement a project internally within the company. The project is classified as medium importance regarding the companys organisation strategy.

A Project Director is looking to implement a project internally within the company.

The project is classified as medium importance regarding the company’s organisation strategy.

The project has a four-year financial net cash flow forecast of €25,000, €50,000, €60,000 and €65,000 in the next four years. It will cost €189,000 to implement the project and the project will have no residual value at the end of the four years.

The Project Director has asked that rate of return for a project be set at 2% percent, in line with current inflation. Please undertaken a discounted cash flow calculation to determine the Net Present Value (NPV) for this project.

What would happen to the NPV of the above question 1(a) project, if the inflation rate increased from 2% to 5% for years 3 and 4 only?

Calculate the profitability index for Question 1(a) and Questions 1(b).

Please provide comments on the profitability index and your views on the proposed project implementation for the company.

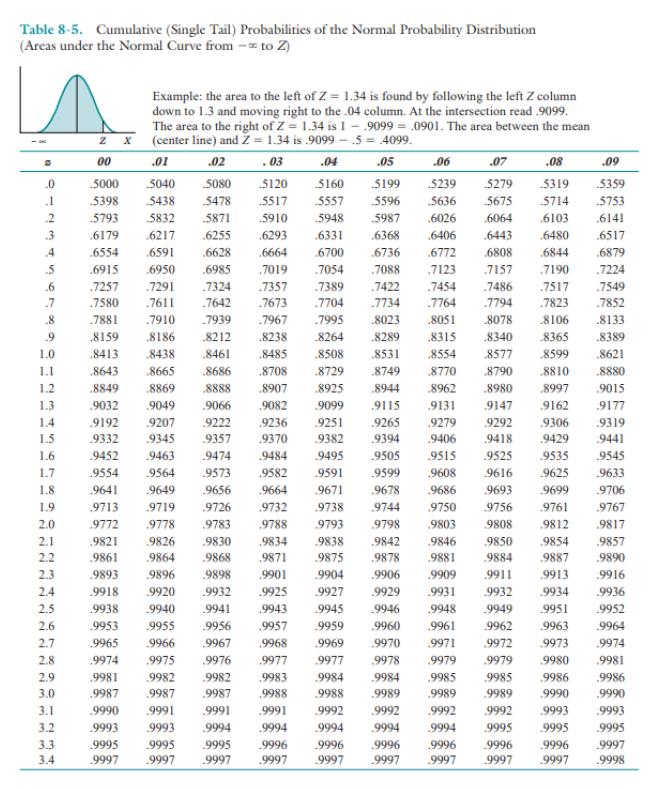

Table 8-5. Cumulative (Single Tail) Probabilities of the Normal Probability Distribution (Areas under the Normal Curve from * to Z) 15 .0 .1 .2 3 4 5 6 7 .8 .9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.8 2.9 3.0 3.1 3.2 3.3 3.4 2 00 5000 5398 .5793 .6179 .6554 .6915 7257 Example: the area to the left of Z = 1.34 is found by following the left Z column down to 1.3 and moving right to the .04 column. At the intersection read .9099. The area to the right of Z= 1.34 is 1.9099 0901. The area between the mean (center line) and Z = 1.34 is 9099.5 = 4099. .01 .02 .03 .04 .05 5040 5080 5120 5160 $199 5438 5478 5517 5557 5596 5832 5871 .5910 5987 .6217 .6255 .6293 .6591 .6628 .6664 6950 .6985 .7019 .7291 7324 .7611 7642 .7910 .8186 .8212 .8438 .8461 .8686 .8708 .8665 8869 .8888 .8907 .8925 .8944 .9082 9099 9115 9049 9066 .9131 9207 9222 9236 9251 9265 .9279 9345 9357 9370 9382 .9394 .9406 9418 9463 9525 9535 9616 9625 9484 9495 .9505 9515 .9582 9591 .9599 .9608 .9686 .9750 9756 .9761 9693 9699 9808 7357 .7673 .7939 .7967 9474 9564 9573 .9649 9656 9719 9726 9778 9783 .7580 7881 .8159 .8413 .8643 .8849 .9032 9192 9332 9452 9554 .9641 9713 .9772 9788 9821 9826 9830 9834 9861 9864 .9868 .9871 9893 9896 9898 .9901 .9918 9920 .9932 9925 9927 9929 .9938 9940 .9941 9943 9945 .9946 .9953 9955 9956 .9957 9959 .9960 9965 .9966 9967 .9968 9969 .9970 .9974 .9975 .9976 .9977 9977 9978 .9979 .9981 9982 .9982 .9983 .9984 .9984 9985 9987 9987 9987 .9988 9988 9989 9989 9990 9991 9991 .9991 9992 9992 .9992 .9994 5948 .6331 .6700 .7054 7389 7704 .7995 .08 .09 5319 .5359 5714 .5753 .6026 .6103 .6141 .6368 .6406 .6443 .6480 .6517 .6736 .6772 .6808 .6844 .6879 .7088 .7123 .7157 .7190 7224 7422 7454 7486 .7549 7734 7764 7794 7852 .8023 .8051 8078 .8289 .8315 .8340 .8531 .8554 8577 .8729 .8749 .8770 8790 .8962 .8980 .9993 9993 9994 .9994 .9995 9995 .9995 .9996 9997 9997 9997 .9997 .06 5239 5636 .8238 .8264 .8485 8508 .9664 9671 9678 9732 9738 .9744 9793 9798 9838 9842 9875 9878 .9904 .9906 .07 5279 5675 6064 .8133 .8389 .8621 .8880 .9015 9177 .9319 9441 .9545 .9633 9706 .9767 9803 9812 .9817 .9846 9850 9854 9857 .9881 9884 9887 .9890 .9909 9911 .9913 .9916 9931 9932 9934 .9936 .9948 9949 .9951 .9952 .9961 9962 9963 9964 9971 9972 .9973 .9974 9979 9980 .9981 9985 .9986 9989 .9990 9992 .9993 .9993 9995 9995 .9995 9994 9994 9996 9996 .9996 9996 9997 .9997 .9997 9997 9997 9996 .9997 .9998 7517 .7823 8106 .8365 .8599 8810 .8997 9147 9162 9292 .9306 9429 9986 9990

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started