Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The cost of equity is 18% and loan can be obtained at 12%. The leverage factor is 0.7. Inflation rate is projected to be 5%

The cost of equity is 18% and loan can be obtained at 12%. The leverage factor is 0.7. Inflation rate is projected to be 5% over the appraisal life of the project.

Compute the RDR and calculate the Expected NPV for the project.

Compute the Std. Dev. of the NPV and interpret the result.

Compute the CV and interpret the result.

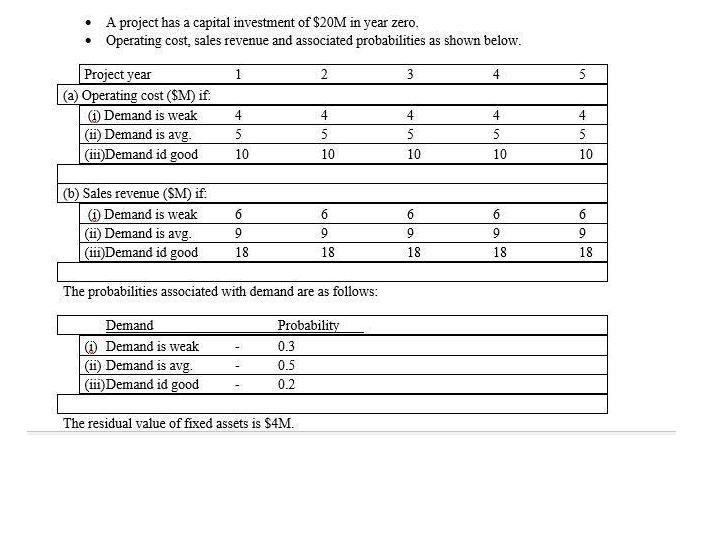

A project has a capital investment of $20M in year zero. Operating cost, sales revenue and associated probabilities as shown below. 1 2 4 Project year (a) Operating cost ($M) if: (1) Demand is weak (ii) Demand is avg. (iii)Demand id good (b) Sales revenue (SM) if: (1) Demand is weak (ii) Demand is avg. (iii)Demand id good 4 5 10 6 9 18 4 5 10 6 9 18 The probabilities associated with demand are as follows: Demand (1) Demand is weak (ii) Demand is avg. (iii)Demand id good The residual value of fixed assets is $4M. Probability 0.3 0.5 0.2 3 4 5 10 6 9 18. 4 5 10 6 9 18 5 4 5 10 6 9 18

Step by Step Solution

★★★★★

3.54 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the Required Rate of Return RDR for the project we can use the formula RDR Cost of Equity x Equity Weight Cost of Debt x Debt Weight x 1 Tax Rate Since the leverage factor is 07 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started