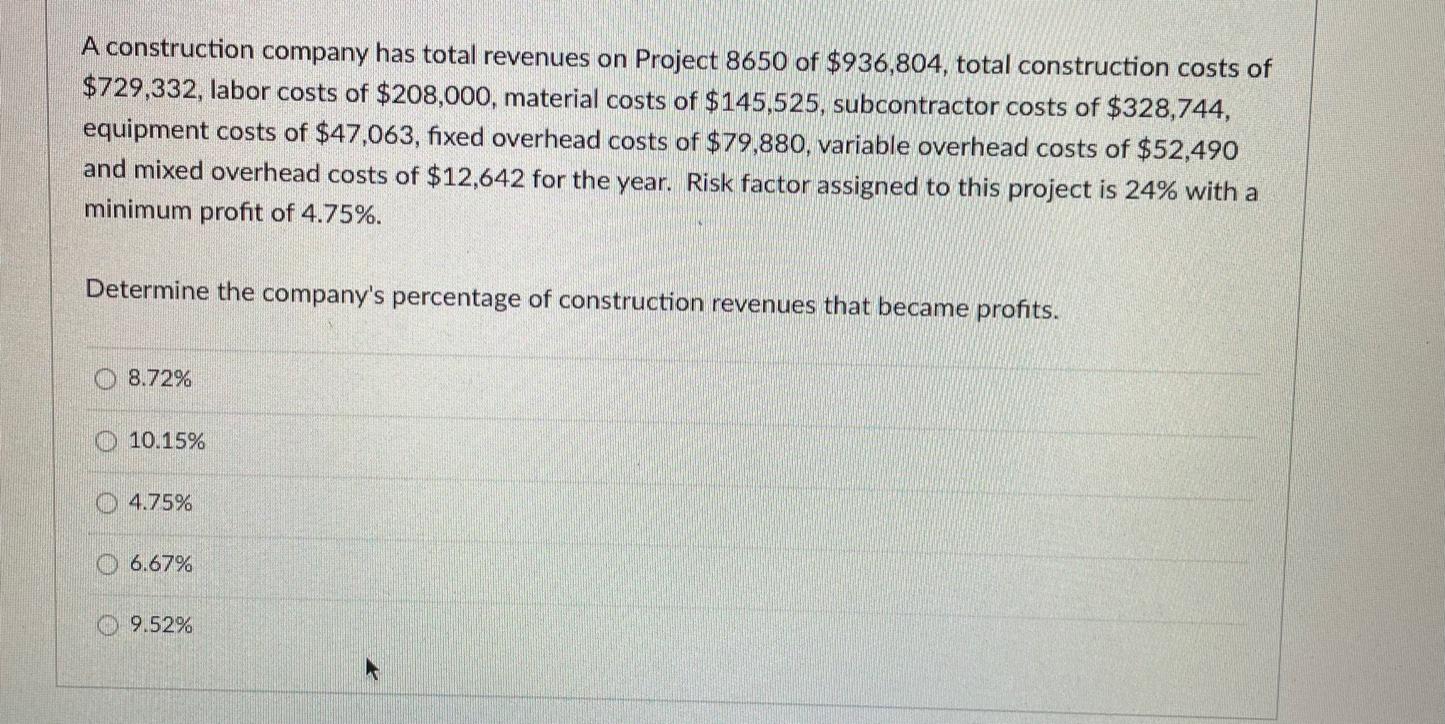

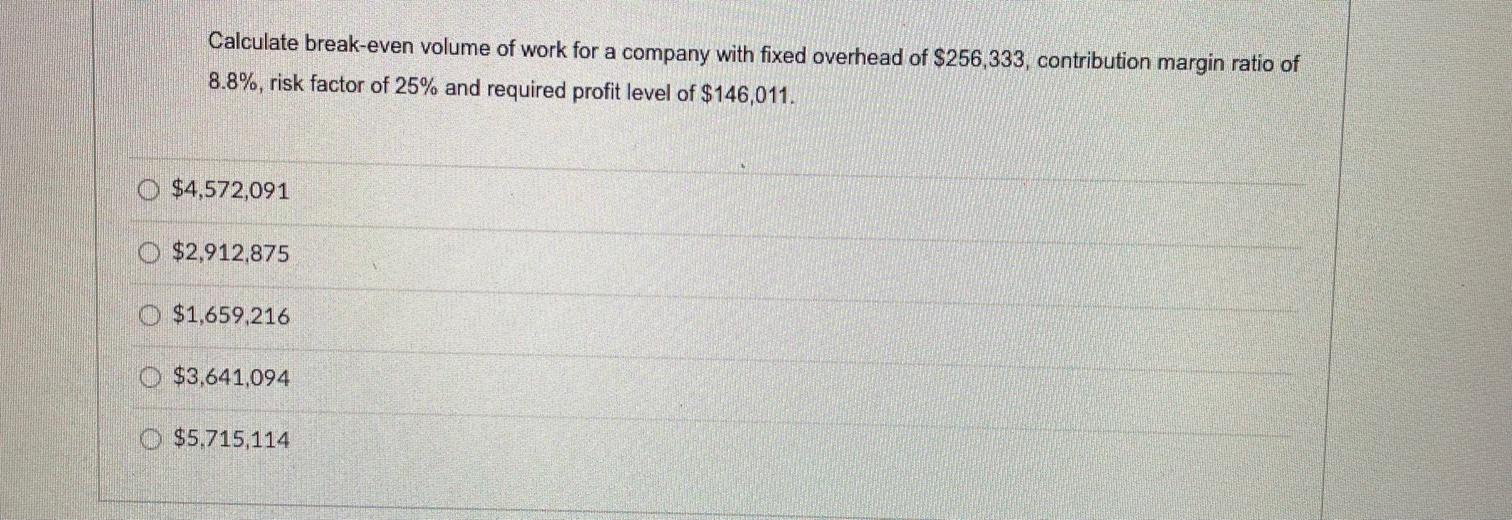

A project segment consists of three tasks. Task A is scheduled to begin at the start of Week 1 and finish at the end of Week 3. Task B is scheduled to begin at the start of Week 1 and finish at the end of Week 2. Task C is scheduled to begin at the start of Week 2 and end at the end of Week 3. Budgeted cost for Task A is $148,450, for Task B is $121,000, and for Task C is $93.900. A total of $86,000 is being carried for a contingency. This project has a very high level of risk, supporting a risk factor of 35% which equates to labor coverage of $71,649. Coincidentally, labor costs are running approximately 15% over budget due to project complexity. At the end of week two, Task A is 50% complete, Task B is 80% complete, and Task C is 45% complete. Actual cost of work for tasks A, B and C performed at the end of week two for project segment is $151,000 and none of your allocated risk factor funds have been used. Labor costs remain over budget but are not getting worse. Balance of your contingency fund remains strong with $47,800 of $86,000 remaining. 100 percent of unused contingency is returned to the project owner. Calculate cost performance index for project segment. Indicate project budget status based on calculated CPI index. O 1.4125: Under budget 1.1355; Over budget * 0.9522: Under budget O 0.9522: Over budget O 0.8685; Under budget A construction company has total revenues on Project 8650 of $936,804, total construction costs of $729,332, labor costs of $208,000, material costs of $145,525, subcontractor costs of $328,744, equipment costs of $47,063, fixed overhead costs of $79,880, variable overhead costs of $52,490 and mixed overhead costs of $12,642 for the year. Risk factor assigned to this project is 24% with a minimum profit of 4.75%. Determine the company's percentage of construction revenues that became profits. 8.72% O 10.15% 0 4.75% 6.67% 09.52% Calculate break-even volume of work for a company with fixed overhead of $256,333, contribution margin ratio of 8.8%, risk factor of 25% and required profit level of $146,011. O $4,572,091 O $2,912,875 $1,659,216 $3,641,094 $5.715,114 A project segment consists of three tasks. Task A is scheduled to begin at the start of Week 1 and finish at the end of Week 3. Task B is scheduled to begin at the start of Week 1 and finish at the end of Week 2. Task C is scheduled to begin at the start of Week 2 and end at the end of Week 3. Budgeted cost for Task A is $148,450, for Task B is $121,000, and for Task C is $93.900. A total of $86,000 is being carried for a contingency. This project has a very high level of risk, supporting a risk factor of 35% which equates to labor coverage of $71,649. Coincidentally, labor costs are running approximately 15% over budget due to project complexity. At the end of week two, Task A is 50% complete, Task B is 80% complete, and Task C is 45% complete. Actual cost of work for tasks A, B and C performed at the end of week two for project segment is $151,000 and none of your allocated risk factor funds have been used. Labor costs remain over budget but are not getting worse. Balance of your contingency fund remains strong with $47,800 of $86,000 remaining. 100 percent of unused contingency is returned to the project owner. Calculate cost performance index for project segment. Indicate project budget status based on calculated CPI index. O 1.4125: Under budget 1.1355; Over budget * 0.9522: Under budget O 0.9522: Over budget O 0.8685; Under budget A construction company has total revenues on Project 8650 of $936,804, total construction costs of $729,332, labor costs of $208,000, material costs of $145,525, subcontractor costs of $328,744, equipment costs of $47,063, fixed overhead costs of $79,880, variable overhead costs of $52,490 and mixed overhead costs of $12,642 for the year. Risk factor assigned to this project is 24% with a minimum profit of 4.75%. Determine the company's percentage of construction revenues that became profits. 8.72% O 10.15% 0 4.75% 6.67% 09.52% Calculate break-even volume of work for a company with fixed overhead of $256,333, contribution margin ratio of 8.8%, risk factor of 25% and required profit level of $146,011. O $4,572,091 O $2,912,875 $1,659,216 $3,641,094 $5.715,114